Texas agency finds new ways to take care of clients

Bigham-Kliewer-Chapman-Watts,now doing business as BKCW Insurance, Risk Management & Benefits, Killeen, Texas, traces its roots back to 1952 when William S. Bigham of Waco was asked by a friend to recommend an agent in Killeen. He couldn’t. So he became one, starting out in life insurance and then forming a partnership in 1958 and opening his first agency.

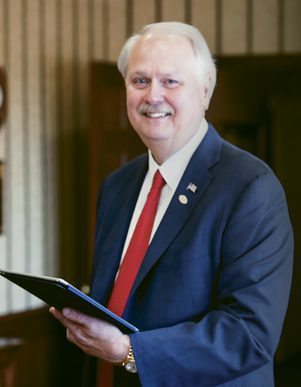

-Bill Kliewer

Chairman

When the current chairman, Bill Kliewer, joined the agency in 1977, it was a sole proprietorship with about $500,000 in premium volume. By then, the agency had abandoned its life insurance roots and was strictly focused on property/casualty business. But that didn’t last. Ken Chapman joined in 1983 to provide expertise in life and benefits. In 1987, BKCW merged with Hilliard Insurance to gain expertise in commercial insurance. “One of my best friends was a partner in that agency,” Bill says. “We helped him buy out his partner.” There were a couple of other small acquisitions, but most of the firm’s growth has been organic.

Managing Partner Tyler L. Spears joined the agency in 2009 as chief financial officer after graduating from the University of Texas at Austin, McCombs School of Business. He points out that, today, the agency has two additional locations—Austin and Copperas Cove—with a total of 45 employees responsible for some $10 million in revenue, with commercial lines accounting for 50% of that; personal lines 20%; employee benefits 20%; and contingencies 10%.

The leap forward

“It was about six years ago that we began to talk seriously about finding a way to take care of clients differently,” Bill remembers. “Most agencies worked on price and, while that is important, we wanted to focus on value-added services that would help clients achieve their risk management goals and reduce their overall cost of risk through careful risk management practices that eliminated or mitigated underlying risks. We were putting our own program together when we ran into Scott Addis and his Beyond Insurance process. It was exactly what we were looking for and probably saved us several years of work creating our own program.

“The process allows us to establish a completely different kind of relationship with our clients than we previously enjoyed,” Bill continues. “We’re viewed as partners involved in protecting their bottom line, rather than simply purveyors of insurance.”

Tyler notes that the process is available to clients that generate $5,000 or more in commission income. “Our commercial lines sweet spot is $50,000 to $100,000 in revenue, although we do have several clients providing revenue in the high six figures.” He adds that this floor includes revenue generated by commercial lines, personal lines and benefits business. “We’ve adopted a holistic approach whereby we try to respond to all the client’s insurance and risk management needs.”

-Tyler L. Spears

Managing Partner

Client for life

“The approach involves developing a thorough understanding of, and appreciation for, the operations and risk management programs of every client or prospect,” Bill says. “We often work with a client or prospect for eight or nine months before we institute a comprehensive risk management service plan.

“It starts with an initial meeting where we explain what we are going to do and what we expect from the client,” he continues. “The objective is to develop a long-lasting relationship where the client is working with us to create a risk management plan and then implement the safety and risk mitigation programs that we have agreed on.

“The most important aspect is listening,” Bill explains. “We learn from them where they are, what they want to accomplish and where they are heading. Then we find out what they currently have in place in terms of risk management and review current insurance policies to determine if there are any gaps in coverage.

“As we go through this process, we try to deal with all levels of management and employees,” he adds. “Naturally, we talk to the CEO, CFO and safety people, but we also talk to other managers and employees so we can thoroughly understand the business and obtain their buy-in to the process by pointing out how, over the long term, it will bring down their overall cost of risk.”

Months later, they implement a plan that is designed for the client’s unique circumstances, and also recommend any new coverages that may be needed to fill in gaps. As the plan is implemented, agency professionals monitor the process throughout the year and tweak any areas where they see new needs or where things aren’t working as planned.

“And then,” Bill says, with a smile, “we do the whole process all over again, constantly updating the process to reflect what we have learned. Because of the ongoing nature of the process and our regular engagement with the client, we now have clients for life who see the value of what we bring to the table on a daily basis.”

Tyler admits that “not every producer likes the long lead time involved before bringing in an account, but they are starting to see the upside in terms of retention and the stronger client relationships the consultative approach develops. Like most producers, they are very protective of their clients and are seeing how this process enhances that relationship. It also didn’t hurt that one of our new young producers recently landed a huge account thanks to our risk management process.”

Tyler continues that, to acquire the expertise needed to support the risk management process, producers are encouraged to develop niches where they can gain a strong understanding of the risk management needs of that particular niche and be better able to listen to the client’s needs with that understanding as a backdrop. “Especially important these days is our growing expertise in employee benefits,” he adds. “That’s where a lot of industries are feeling the greatest pain, and it’s where we can provide the most valuable service through support of wellness programs and other benefit risk management protocols.”

-Meredith Kliewer Spears, JD

Vice President and Partner

Great morale booster

Vice President and Partner Meredith Kliewer Spears, JD, points out how beneficial the new process is to all employees. “Everybody loves being able to engage with clients,” she says. “They like this enhanced relationship, where clients come to us not just to report a claim, but to seek our expertise or just to talk about some work we are doing in the community. You can feel the energy inside the agency. People are excited to be involved in an organization that is helping clients succeed.

“That’s one of the reasons we’ve been voted by our employees as the best agency to work for in the Southwest,” Meredith points out. “Of course, it’s not just the care we put into our relationships with our clients that makes this such an attractive place to work; it’s also the care we put into internal relationships with our people.”

“Our people police themselves,” Tyler adds. “We have flex time, and thanks to our Vertafore management system, we can support off-site workers. In fact, we have three remote employees who work outside of Texas. Our ‘files’ are 100% in the cloud, and our employees can access client information wherever they are.”

Bill says the agency employs a number of military spouses because of the agency’s proximity to Fort Hood. “These people often have to change locations, and we’ve been able to accommodate that. Our people see that and realize that they have a job for life, even if they have to move elsewhere.”

Second row from left: Heather Michalek; Jason Pfaltzgraff, Risk Manager; Amber Garza, Account Manager-Commercial Lines; Cindy McFall, CIC, ACSR, CISR, Account Manager-Commercial Lines; Lisa Nelis, CIC, CISR, Systems Information Specialist.

Third row from left: Percy Chang, CWCA, Assistant Vice President and Commercial Lines Director; Shala Sturgeon; Todd Allison, Marketing Coordinator; Tyler Spears; Theresa Johnson, Receptionist-Killeen; Bill Kliewer, Chairman; Mark Livingston, CIC, CWCA, Risk Manager.

A good corporate citizen

“Not surprisingly,” Meredith notes, “our people are heavily involved in supporting the communities in which we operate. We encourage those efforts by giving people time off to work on charitable projects and through corporate giving.

“This is a tradition that goes back to the start of the agency,” she says. “Mr. Bigham was well known as a steward of the community, and Bill and Tyler both have followed in his footsteps.” (So has Meredith, through her active involvement with at least a dozen community organizations.)

Recently Bill headed up an economic development effort in Killeen designed to supplement the city’s efforts in that regard or, depending on the political vagaries of the city council makeup, the lack of effort. “Economic development funds often are earmarked to come from a percentage of sales taxes,” he explains, “but politicians don’t always adhere to that and may see that money as a nice place to raid to achieve other political promises.

“This happened in Killeen recently, so the business community decided to take matters into its own hands and raise $2 million over five years,” Bill notes. “We are nearly 90% there and will easily exceed our goal at the end of this five-year period. It’s been very exciting. Small and medium-sized businesses have donated as much as $100,000 to the effort.

“We’re blessed to be in a rapidly growing community that is able to support the local businesses and keep this a thriving and enjoyable place to live,” he continues. “It’s a great area in which to do business, and we all want to keep it that way. Economic development benefits everyone in the community, and I am certain that it will return to being a public/private effort as politicians begin to understand that fact.”

Rough Notes is proud to recognize BKCW Insurance, Risk Management & Benefits as our Agency of the Month. The agency’s ability to change in response to client, employee and community needs makes the honor well deserved.

The author

Dennis H. Pillsbury retired in 2016 as executive editor of Rough Notes magazine.