BROKEN GLASS

FAMILY MATTERS

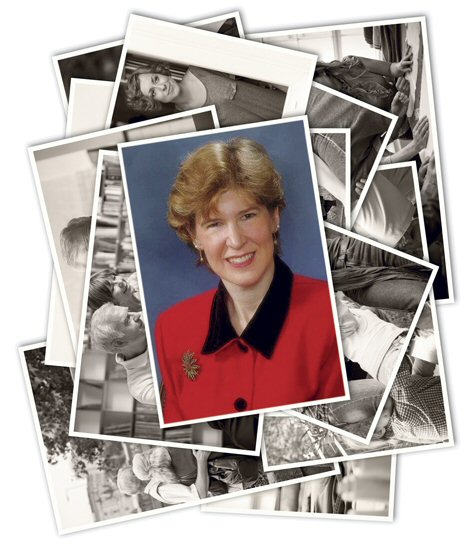

She didn’t plan a career in insurance (who does?), but this agent is happy at the helm of the firm her parents founded

By Elisabeth Boone, CPCU

“Habla español?”

If your name is Kathryn Soderberg, the answer is a resounding “Si!” As president of the agency her parents, Douglas and Frances, established in 1959, she spearheads an initiative to reach out to the growing population of Hispanics in Lynnfield and surrounding communities just north of Boston. Soderberg is fluent in Spanish, as are four other members of the agency’s nine-member team, and she has deep respect and affection for the family-focused Hispanic culture. “We have a diverse, multicultural clientele,” Soderberg says. “We operate mostly in the Boston area and are also licensed in Maine and New Hampshire. Like a lot of agencies, we serve families and small to medium-sized businesses. We have a strong niche in the Hispanic community, and the fact that we’re family owned makes us attractive to those clients.”

Soderberg Insurance represents some 40 carriers, and its property/casualty premium volume is about 70% personal lines and 30% commercial. “Our mix of business is gradually shifting toward the commercial side, mainly because many of our Hispanic clients are business owners and contractors,” Soderberg explains.

When it comes to the children of family-owned agencies, it’s even money whether they’ll follow their parents into the business or pursue other opportunities. “I considered insurance as a possible career, but I wanted to explore other avenues,” Soderberg says. “I was good at languages, so I thought of a career as a teacher or a translator. When I was in graduate school I realized that with fluency in only two languages, my options were fairly restricted.”

Soderberg helped out in the agency when her parents were traveling but didn’t see herself running the business. “Ironically, my older brother majored in insurance and computer science at the Wharton School and would have been the ideal candidate to take over the agency, but he chose to go in a different direction,” Soderberg recalls. “Over time I began to realize, first, that insurance offered attractive opportunities and, second, that I could be successful if I joined the family agency. In fact, it seemed to me like I’d be a fool not to pursue it.”

Soderberg has been running the agency since earning the CPCU designation in 2000; her father, a CPCU and CLU, has retired from active management and serves as an advisor.

No war stories

Joining a family-owned agency, Soderberg was always supported and encouraged as she learned the business; and, as she says with a chuckle, she doesn’t have any war stories to share about having been the target of gender-based discrimination. “My parents were excellent role models,” she remarks. “My father took a leadership role, not necessarily because he was a man but because it suited his temperament and personality. For the same reason, my mother was comfortable in a support role. As the only other producer in the agency besides my father, when I attended agent meetings or company sales meetings I saw mostly men because they far outnumbered women as agency principals. I see a change taking place, and I tell young women when they join the agency that we offer great career opportunities and also provide flexibility for working parents.”

Soderberg isn’t shy about pointing out instances of what she perceives to be less than equal treatment of women. She tells a story about her experience with a major insurer in her state.

“I think it would be great if other agencies took the initiative to make internships available to college students. We all should make an effort to recruit young blood to our field!”

—Kathryn Soderberg, CPCU

President

Soderberg Insurance Services, Inc.

“This was the biggest carrier in Massachusetts, and it was the only company I ever bought stock in individually. As an agent I had knowledge of the company and thought it was extremely well run. It was bought by a Spanish conglomerate about 10 years ago. The board of the conglomerate had about 15 members, and not a single director was a woman. I wrote a letter to the CEO in which I pointed out that its customer base was about 50% women and that women comprised the majority of its workforce, and I asked: ‘Aren’t you able to find at least one qualified woman to sit on your board?’

“To his credit, he wrote back to me and said he was aware of the issue and was addressing it, and since then several women have joined the board,” Soderberg says with satisfaction.

Asked what unique qualities she thinks women bring to leadership positions in agencies, Soderberg talks about her mother, who died in 2017: “She was a great role model. She had a high degree of emotional intelligence and had excellent listening and communication skills. She always focused on people’s positive traits, and her sincere concern and empathy went a long way toward helping our agency achieve a high retention rate as well as attract and retain a strong staff. Those are important qualities that I think allow many women to build successful careers while at the same time contributing to the growth of their agencies.

“Finding and keeping talented employees is our biggest challenge,” Soderberg observes, “and I think it’s the same for most agencies, especially with the unemployment rate so low. We’re facing a lot of competition for qualified people, just as we must compete for new business.

Education is key

One way that her agency identifies and nurtures young talent, Soderberg says, is through a robust educational program for college undergraduates.

“For many years Soderberg Insurance Services has provided internships for undergrads with the goal of introducing them to insurance as a possible career path,” she explains. “We have sponsored internships with my alma mater, Colby College, for many years. More recently we have provided intern- ships for students at a nearby liberal arts college, Endicott College, in Beverly.

“The brilliant young people who intern at our agency have helped us with our marketing efforts mostly in the area of social media, where they excel, and they also have assisted with other daily activities of our busy agency,” Soderberg continues. “They receive one-on-one training. They are regularly included in staff meetings, appointments, and company meetings. By the time they finish their internship, they have an excellent understanding of insurance. We have had both young men and young women serve as interns, and I believe they have enjoyed the experience tremendously. After all, how many of us actually thought as young people that we would be working in insurance or even one day have our own agency?

“I think it would be great if other agencies took the initiative to make internships available to college students. We all should make an effort to recruit young blood to our field!”

Do you know a female independent agency leader we should feature? If so, please email details about her as well as contact information to Elisabeth Boone, CPCU, senior features editor (elis.boone@icloud.com). We’ll take it from there.