Suite of digital tools offers

prevention-first approach to workers comp

By Christopher W. Cook

Combing through the fine details, workers compensation can be a complicated topic. One of my first exposures to the concept was the classic season seven episode of The Simpsons, “King-Size Homer.” After a co-worker is injured at the Springfield Nuclear Power Plant and is granted permission to work from home through work comp, Homer attempts to get injured himself to have the same luxury. After all attempts fail, he learns that employees who weigh over 300 pounds qualify as being “disabled,” so he intentionally and rapidly gains over 60 pounds.

Hilarious episode. (Who can forget Homer trying to find the “any” key on his computer’s keyboard when prompted to “press any key”?) But again, a complicated topic in real life.

To bring simplification to work comp, this is where a father-and-son team created tech platforms to help agents and brokers make the topic make sense for their clients.

Desiring to move beyond the “bid and quote” model of selling insurance, Emerge Apps was founded in 2015 by Randy and Dustin Boss, who both work at Ottawa Kent Insurance (now part of HIGHSTREET Insurance Partners) in Jenison, Michigan. Dustin, who serves as Emerge Apps’ chief executive officer, is a self-taught computer developer who blends technology with his work as a business insurance and risk advisor; his father, Randy, who serves as chief financial officer, has 45-plus years of experience working with employers to build safer, healthier workplaces. Both remain active in the agency’s work, ensuring that every tool they create is practical, relevant, and tested in the real world.

“Originally, the apps were designed for our own use as practical tools to help us engage with employers, prevent risks, improve compliance, and protect employees,” says Dustin Boss. “After experiencing great success in using these tools to build relationships and win insurance business, we began licensing them to other agents who wanted the same results.”

The Emerge Apps catalog began with OSHAlogs, a solution for simplifying OSHA recordkeeping, and expanded from there. Wellness401k, which automates employee wellness programming, and AutomateSafety, which automates the distribution of safety training messages, were added in 2018 and 2019, respectively. The following year, ComplianceCheck, compliance and audit tools for HR and safety, was integrated after an acquisition.

In 2024, ModSure, an experience mod analysis and sales strategy tool for agents was developed with the Institute of WorkComp Professionals (IWCP). This year, LightDutyWorks, a turnkey return-to-work program for employers, launched alongside the Mod Performance Suite, which combines ModSure and LightDutyWorks, and includes additional sales support from Emerge Apps’s Chief Experience Mod Officer Kevin Ring—a long-time educator and the driving force behind the IWCP’s expertise on experience mods.

Dustin’s brother, Josh Boss, serves as chief implementation officer, ensuring that agencies who adopt the platform experience measurable results through effective rollout and ongoing support.

“What started as a local solution for two agents has evolved into a national insurtech platform, giving agents across the country new ways to win business while helping employers safeguard their employees,” Dustin says.

The Mod Performance Suite

With its mission to “give agents practical, prevention-first tools that open doors with employers, spark meaningful conversations, and ultimately win business,” Emerge Apps built its Mod Performance Suite to achieve this.

“All of our tools are designed to uncover pain points, deliver quick solutions, and provide immediate value around safety, compliance, and workplace health—issues that shape the performance of the experience mod,” Dustin explains.

“[W]e didn’t just want to build another mod analysis tool; we wanted to reimagine what mod software could be. That meant adding innovation, usability, and real-world coaching that goes beyond graphs and reports.”

—Dustin Boss

Co-founder and Chief Executive Officer

Emerge Apps

“With ModSure, we can show employers the financial story in a way that clicks. And with LightDutyWorks alongside it, we can deliver a program that improves outcomes by keeping employees at work and protecting the mod.”

—Zander Galloway

President

Peoples First Insurance

“When we polled our user community, agents made it clear: They wanted a modern alternative to the legacy mod platforms on the market. But we didn’t just want to build another mod analysis tool; we wanted to reimagine what mod software could be. That meant adding innovation, usability, and real-world coaching that goes beyond graphs and reports.”

At its core, the Mod Performance Suite brings together three critical pieces:

- The analysis to make the mod simple and clear

- The tools and strategies to improve the key drivers of the mod (such as safety and return-to-work)

- The coaching and support that allows agents to bring their own chief experience mod officer (CXO)-level expertise into every client conversation

“The Mod Performance Suite was created to give agents a complete set of tools to analyze, strengthen, and communicate the financial impact of the experience mod, while also providing the coaching and strategies needed to help employers put those insights into action,” Dustin says. “Instead of stopping at analysis, the suite provides agents with actionable tools that connect employers to the day-to-day factors driving the mod—claims handling, return-to-work, and safety practices—so they can see and control their impact.

“This matters because the experience mod is the single largest factor in determining workers compensation premiums, and it can cause major swings in cost regardless of the carrier or agent. Yet many employers don’t realize they have influence over it. In many ways, the mod functions like a tax: driven by losses but ultimately shaped by how effectively those claims are managed.”

Let’s dive deeper into the three critical pieces of the suite.

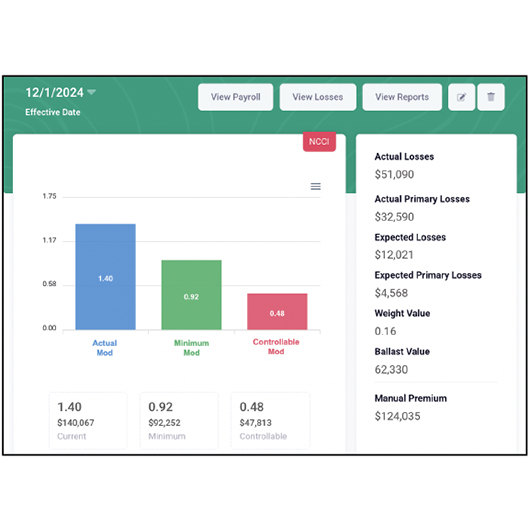

- ModSure. This delivers mod analysis designed specifically for agents to share with clients and prospects—making the complex experience mod easy to explain, understand, and is directly tied to financial impact. Agents can quickly show the true dollar impact of the mod, uncover hidden financial opportunities in claims data, and position themselves as trusted advisors.

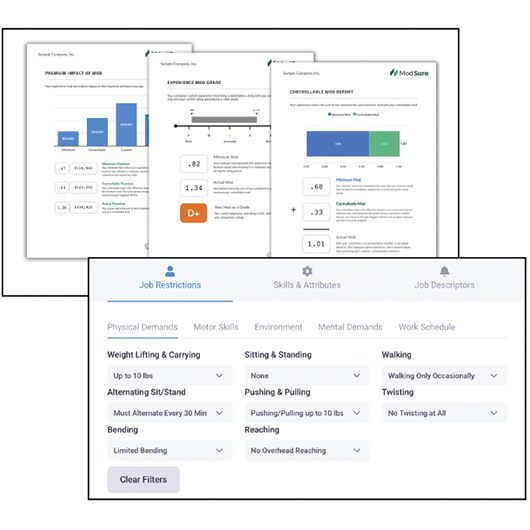

ModSure reframes the mod in ways employers can actually grasp by breaking up mod reports into minimum and controllable components, showing the controllable portion as an avoidable “tax” that results from how losses and claims are managed. ModSure also assigns employers a letter grade, providing an intuitive benchmark to spark meaningful conversations about performance.

Claim-by-claim analysis highlights the financial impact of each loss and even models how alternative claim handling could have changed outcomes—spotlighting the cost differential.

- LightDuty Works. A strong return-to-work program is one of the most effective ways employers can control workers compensation costs. Bringing injured employees back to modified duty quickly helps keep claims classified as “medical only.” In many states, those claims receive a 70% discount in the experience mod formula. Without a return-to-work option, claims often escalate into lost-time cases—eliminating the discount and driving the mod higher for years. Beyond the financial impact, return-to-work programs keep employees connected, productive, and engaged, benefiting both the worker and the business.

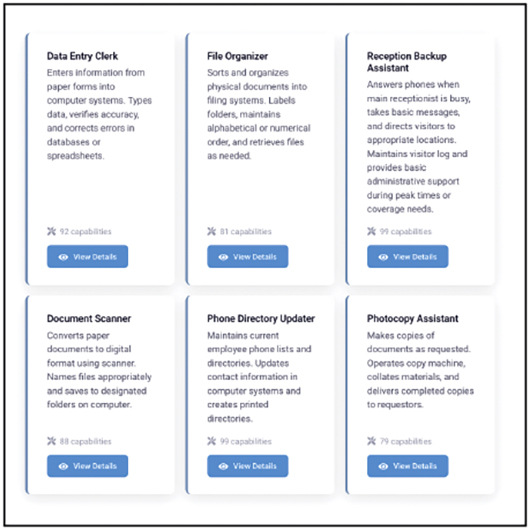

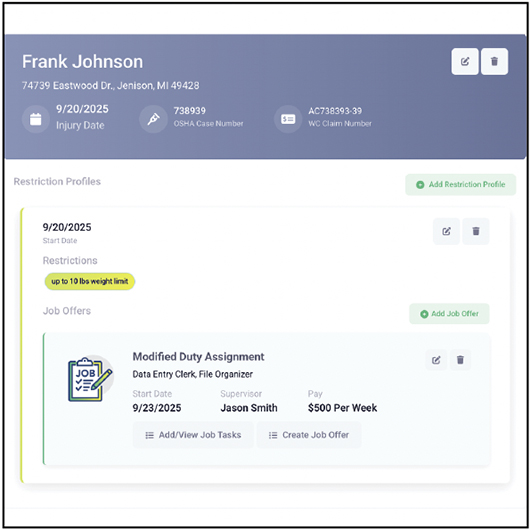

With LightDutyWorks, agents can provide employers with their own log-in to the platform, giving them direct access to a comprehensive, turnkey program. Once inside, employers can tap into a large job bank of modified duty tasks (ensuring there are no more excuses for sending injured employees home), generate compliant job offers with pre-built templates, and access supervisor instructions and physician communication tools.

At its core is the Case Manager, which employers can use to track restrictions, assign safe tasks, and generate offers. Each case becomes a centralized hub, storing restrictions, job offers, and updates over time—eliminating confusing paperwork and keeping compliance intact.

- Chief Experience Mod Officer (CXO) expertise. One of the nation’s foremost authorities on the workers compensation mod, Kevin Ring, provides direct support to agents through reviews, coaching calls, and strategy sessions. This ensures that agents aren’t just running reports—they’re learning how to use them to educate prospects, lead with value, and close deals.

The CXO program was designed so that agents can present Kevin as part of their own team. The software and service plan make it possible to bring Kevin directly into prospect and client conversations, positioning him as your agency’s CXO.

Agent perspective

With a chance to stand out in the industry when it comes to workers comp, a number of Emerge Apps’ partners have been around since the firm’s earlier platforms.

For example, Zander Galloway, president of Peoples First Insurance in Rock Hill, South Carolina, first discovered the OSHAlogs platform. “We saw how practical it was, particularly compared to some of the other tools out there that were not as user-friendly,” he says. “We had tried other mod software before, but it was clunky and overly technical.

“ModSure is straightforward, intuitive, and powerful. It connects seamlessly with the other EmergeApps tools we use, like OSHAlogs and AutomateSafety, so everything ties together. And with their LightDutyWorks program, we can deliver a solution to the client that improves and protects the mod by putting an effective return-to-work program in place. The integration of all these tools makes life easier for us and the client.”

Zander finds that the product is more effective due to its founders’ background in the industry. “I have always felt that Dustin’s background as an agent, along with an eye for simplicity and good design, has been what has made these tools so useful. The team is approachable, responsive, and they truly understand the challenges we face because they’ve lived it themselves. When we need help, we aren’t calling a faceless organization. We’ve even had them create AutomateSafety training topics that a client needed.”

According to Zander, the tools have helped Peoples First stand out when it comes to workers comp. “They show our sophistication to our clients, and they support our strategic insurance and risk management approach,” he says. “With ModSure, we can show employers the financial story in a way that clicks. And with LightDutyWorks alongside it, we can deliver a program that improves outcomes by keeping employees at work and protecting the mod.

“Add in the support from Dustin and his team, and you’ve got a solution that’s easy to use, agent-focused, and powerful in front of prospects,” he concludes.

John Basten, president of The Mid-State Group in Lynchburg, Virginia, met Dustin through a mutual insurance network and developed a working relationship with him and Randy. “We’ve stayed connected as agents, focused on growing and sharing ideas,” John says. “We started working with Dustin when they launched their first product, OSHAlogs, and were very excited when they developed the ModSure software, which takes a complex topic and makes it simple.

“The reports are clear, easy for employers to understand, and they spark the right conversations. We use it to show clients and prospects the financial impact of their claims and their mod, and to highlight why having an agent who can explain this makes us the right partner for them.”

John says the product has helped “open doors and win new business by giving us something unique to bring to the table, and it supports our broader risk management sales process. For existing clients, it reinforces our value by showing them strategies tied directly to cost savings. It also helps us connect the dots between safety, risk management, and how those areas impact them financially.”

He adds: “The software gives you a completely different conversation with employers, and the support from Dustin and his team makes it easy to get results quickly.

“The [Emerge Apps] team is responsive, down-to-earth,

and always focused on helping us succeed. They treat our

clients like their own, and because

they’re agents themselves, they understand the

nuances of those relationships. That matters.”

—John Basten

President

The Mid-State Group

“Working with Emerge Apps feels more like a partnership than a vendor relationship. The team is responsive, down-to-earth, and always focused on helping us succeed. They treat our clients like their own, and because they’re agents themselves, they understand the nuances of those relationships. That matters,” he concludes.

Getting started

After purchasing the suite of products, new clients begin with a 60-day onboarding sequence. “This includes software training tutorials, strategy ‘how-tos’, thought leadership content, and more,” Dustin says. “We also onboard an agency’s top five clients on their behalf, ensuring that their employers are quickly up and running on OSHAlogs, AutomateSafety, and LightDutyWorks.”

Agents also gain access to a library of hundreds of marketing and thought leadership pieces, fully branded to their agency, to spark interest and curiosity with clients and prospects. Access to in-depth success playbooks and quarterly CXO masterminds—along with proven ways to integrate the software into everyday sales conversations—are also included, along with ongoing customer support.

“Our support isn’t just a ticket system; it’s a team of real people who know your agency and position themselves as part of it. We work alongside you, answering questions, troubleshooting issues, and helping you maximize the tools to deliver measurable value for your clients,” Dustin concludes.

For more information:

Emerge Apps

emergeapps.com