“We ask staff what we should keep doing,

what we should stop doing.

We even tell interviewees that if they want micromanagement, they’ve come to the wrong place,

but if they want autonomy, come on in.”

—Chris Ball

CEO

FROM ZERO TO $20 MILLION

Reliance Group boasts seven companies at its headquarters in Burnaby, British Columbia

By Dennis H. Pillsbury Photography by Melanie Maganias Nashan

“The people you meet when we make our proposal are the people who will handle your account for as long as you’re with us,” says Chris Ball, CEO of the Reliance Insurance Group of Companies, Burnaby, British Columbia, Canada, in explaining why his agency is able to “beat the pants off the big brokers.”

And Chris knows from the inside who he is competing against.

Although he started his career with Reliance in 1995 as an account manager, he left in 1998 to join some of the large brokers and find out about the complex risk management needs of Fortune 1000 accounts, working for both Willis and Marsh in Vancouver, New York City, and San Francisco.

“I left New York for a position Marsh offered me in San Francisco and, after a year, found that my entrepreneurial spirit clashed with the culture,” Chris recalls, “So in 2005, I talked to my dad, Jim, who built Reliance virtually from scratch, about rejoining the agency.

“I came on board as vice president, but was really a producer. We had about 20 people working at the agency and some $3 million in revenue at the time,” Chris explains. “But my timing proved to be propitious as we were growing in the commercial arena.

“That was where I really had an opportunity to shine,” he adds, “thanks to my experience with the accounts I saw—especially during my time in New York City, where you can specialize in anything, and where the accounts often come with a lot more zeroes at the end of the premium.

“But the approach to landing those accounts was the same: You needed to understand their risk management needs and provide outstanding service.”

“Now, I don’t know what I would

do if Dad wasn’t here. He is 82

and he still comes in every day;

he is a grounding presence to the

culture of the organization. He

is one of the reasons we have so

many long-time employees. We have

built our agency by listening to people and he has led that effort.”

—Chris Ball

Starting with nothing

When Jim Ball started working as an agent in 1982, he had a desk and a phone book and the entrepreneurial spirit that he apparently passed along to his son. Prior to striking out on his own, Jim began his insurance career as a bodily injury claims adjuster for CNA in Cleveland, Ohio, close to where this Canadian native had attended college.

After a few years there, he moved to a company position in Toronto, which then moved him west until he reached the Vancouver area and satisfied his itch to run his own business. “I left the company on Friday and on Monday, I was a broker with no clients,” Jim points out, with tongue firmly in cheek.

Only a year later, Jim had an opportunity to take over an existing firm, Reliance Insurance Agencies, Ltd., that had been founded by a friend who had a car auction company and hoped to realize some downstream revenue from the agency. “It hadn’t worked out as well as he’d hoped,” Jim recalls, “and he asked me to come and run the company.

“He promised to sell it to me after a few years if I wanted to buy it—and two years later, he did just that,” he says. “Not only that, but he also guaranteed the loan I needed to buy the company when we found out that banks were not accepting goodwill as collateral at that time.

“By the way,” Jim points out, “he is still a friend and client of the agency.”

This resilience by Jim comes as no surprise to retired insurance executive Brian Wills, who has known him for 44 years and worked with him at an insurer; Brian also has worked with him and Chris as a marketing executive with an insurer Reliance used. “Jim’s philosophy has always been that ‘every knock’s a boost.’ In fact, I expect to see that on his tombstone, which won’t be happening soon,” Brian says.

“I’ve been retired for 11 years now,” he adds, “and Jim just keeps on going and getting stronger. He and Chris were great ambassadors for my insurer and continue to be great friends.”

Acquisitions part of growth

Acquisitions have played a key part in the agency’s growth, along with organic growth. This happened as the agency’s necessary focus on personal lines at its inception moved to commercial lines, where its focus on risk management expertise could play a key role. Over the 40-plus years of its life, the agency has made 17 acquisitions that have allowed it to bring in important expertise, as well as opportunities to expand into new insurance markets.

One acquisition shows the combination of tenacity and focus that has allowed this agency to grow into one of the largest and most respected in British Columbia and other areas of Canada in which it operates. That acquisition (of another agency) also quickly pointed to the differences that existed between father and son, differences that caused minor problems at first but resulted in a strong relationship and dependence that have made the agency even stronger and better prepared for the future.

Chris remembers: “It was a fairly sizable acquisition of an agency with more than 40 employees. The deal went wrong so many times, and towards the end we were kicked out of the discussion when our offer was considered too low.

“But you don’t give up,” he adds. “We went back with our best offer—not just monetarily, but pointing out that we offered an opportunity for the acquired agency and its people to remain entrepreneurial while our competition did not offer that.

“Our competition was a big broker that paid a lot (when acquiring) but also had a reputation for doing a lot of damage once it took over,”

Chris notes. “And that was it—our final offer—and they accepted it. All we needed then was $13 million.

“The banks had said no, but an insurer agreed to finance the deal. That was until they pulled out 24 hours before the deadline.

“A buddy at Intact Insurance agreed to help out if we sent him all our info within less than an hour,” Chris explains. “We put all the info on a USB stick and went to Dad for his half of the info, when we found out it was all on paper. A very busy scanner and a rush trip across town and the deal went through.

The experience, he notes, “pointed out how important it was for all of us to become adept at technology. And to be honest, Dad has championed our efforts to adopt whatever technology is necessary for us to achieve our goals of interacting with customers however they want and to reach new potential customers through the internet.

“In fact,” Chris says, “one of our companies, Safe Harbour Insurance Services, Ltd., sells pleasure craft insurance via the internet to customers in Ontario, Quebec and British Columbia.”

He goes on to point out that “when I first came on board, I wasn’t sure this (arrangement) would work. Dad and I are different in many ways, but as time went on, it became clear that we are very much the same where it counts: We want our agency and its affiliates to succeed, primarily so that the more than 100 people we now employ can come to a place where they enjoy what they are doing and are proud to work for a company that takes care of its customers and its community.

“Now, I don’t know what I would do if Dad wasn’t here,” Chris says. “He is 82 and he still comes in every day; he is a grounding presence to the culture of the organization. He is one of the reasons we have so many long-time employees. We have built our agency by listening to people and he has led that effort.

“We ask staff what we should keep doing, what we should stop doing,” he explains. “We even tell interviewees that if they want micromanagement, they’ve come to the wrong place, but if they want autonomy, come on in.

“I love working here and I see that they do, too.”

Giving back

The first community to which Reliance gives back its time and talent is the industry that has allowed them to succeed. The Insurance Brokers Association of British Columbia’s Executive Director Chuck Byrne says, “Reliance has been a member forever. Jim and Chris are both volunteers and served on our board and have been great assets to the association. Jim has served as our president and as president of the national association.

“What I have seen as key to that agency is the hands-on nurturing of top talent,” he adds, “resulting in a quality staff that is second to none. They have key relationships with Lloyd’s and local underwriters and ‘walk the walk’ on all classes of business.

We give people the opportunity to speak their mind and we are starting to reward the right people with equity,” Chris says. “The group of people we have here, the team of people, is the reason that we have reached $20 million in revenue and why we will reach our goal of doubling that in five years.

Their support for community encompasses a wide range of programs, including building housing in Nicaragua and contributing time and money to PALS Adult Services Society, which provides daily programs and independent housing for adults with autism spectrum disorder, allowing their members to live vibrant, meaningful lives.

Unfortunately, we don’t have space for all the other organizations that Jim, Chris and members of their staff have helped. We still need to tell you who the members of the Reliance Group are:

Reliance Insurance Agencies Ltd. is a P-C retail brokerage. “And in addition to contributing to the industry,” Chuck adds, “they are first-class people who give back to the community.”

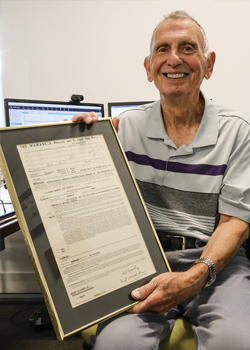

Paul Towriss, senior vice president of

commercial insurance, holds a framed

Dwelling and Contents policy that he

had written in 1952, insuring a dwelling

for $3,500.

“[K] ey to the agency is the hands-on nurturing

of the top talent, resulting in a quality staff that is

second to none. … [T] hey are first-class people

who give back to the community.”

-Chuck Byrne

Executive Director

Insurance Brokers Association of British Columbia

Their support for community encompasses a wide range of programs, including building housing in Nicaragua and contributing time and money to PALS Adult Services Society, which provides daily programs and independent housing for adults with autism spectrum disorder, allowing their members to live vibrant, meaningful lives.

Their support for community encompasses a wide range of programs, including building housing in Nicaragua and contributing time and money to PALS Adult Services Society, which provides daily programs and independent housing for adults with autism spectrum disorder, allowing their members to live vibrant, meaningful lives.

Unfortunately, we don’t have space for all the other organizations that Jim, Chris and members of their staff have helped. We still need to tell you who the members of the Reliance Group are:

Reliance Insurance Agencies Ltd. is a P-C retail brokerage.

Pacific Marine Underwriting Managers Ltd. was founded in 2002 and sells pleasure craft insurance through a network of about 700 brokers in all the Canadian provinces except the maritime provinces. Its offices in Burnaby; London, Ontario; and Laval, Quebec are shared by Safe Harbour.

Safe Harbour Insurance Services Ltd., the internet market mentioned above, was acquired as Harbour Insurance Services in 2007 and rebranded with its current name in 2020.

Pro-Form Insurance Services (B.C.) Inc. sells insurance brokers’ E&O in British Columbia.

PMU Specialty Underwriting Managers Ltd., founded in 2022, is an MGA that sells liability insurance through a growing network of about 30 brokers in British Columbia, Alberta, Saskatchewan, Manitoba and Ontario.

Premium Pay Inc. is a premium finance company founded in 2009 that finances premiums under $10,000 for Reliance customers.

James M. Pate Ltd. is a real estate company that purchased the agency’s headquarters building at 4853 Hastings Street in 2013, which was renovated in 2014 and 2015. All companies operate out of this 16,000 square foot L-shaped building.

Rough Notes is proud to recognize Reliance as our Agency of the Month. Its history of sticking to its core values through all the “knocks” it experienced to enjoy the “boosts” that saw it grow to one of the largest brokers in British Columbia offers a roadmap to others with tenacity and drive.

The author

Dennis Pillsbury is a Virginia-based freelance insurance writer.