Founded in 1925, the Merrill Insurance team acknowledges

its “century of service” outside its office in Eustis, Florida.

Florida agency celebrates a century

in business thanks to hard work and faith in God

By Dennis H. Pillsbury

Photography by Arturo Paulino

It was a time to celebrate at Merrill Insurance in Eustis, Florida. It was the year before the agency would turn 100 and the next generation was assuming leadership roles. Brett Merrill completed the purchase of the agency on July 17, 2024, from his father, Kent, who had led it since he purchased it in 1986 from the family of one of the founders. The agency traces its roots back to 1925 when it was founded by Simpson and Waite. It became Merrill Insurance in 1988.

“Dad didn’t have to sell me the business, but I wanted to buy it while Dad was still here,” Brett says, “so I could continue to learn from him and build on the legacy of trust and fair-dealing that he had established throughout his 44 years in the business. And I was really looking forward to assuming responsibility for leading the agency forward. We had done stuff along the way to protect that legacy by adding a claims advocate and in-house loss control so that we had value-added services unique for agencies of our size. We were entering our 100th year ready to achieve our goal of reaching $15 million in revenue by continuing to add resources that better serve our clientele with a resultant increase in the many referrals that we receive.

“In the lead-up to my purchase of the agency (about seven years ago), Dad’s suggestion to me on what was needed for the future was ‘you’ve got to get younger.’ I knew he didn’t mean me personally. He was looking for me to build a management team from young people who could learn from our veterans.

“I immediately started to search for good people to become part of a younger management team by going to clients and friends and asking them if they knew of talented young people who would like to take a chance on a growing agency and help lead it to the next level,” Brett notes.

Florida agency

celebrates

a century in business

Thanks to hard work

and faith in God

Young management team

“By the time we entered 2025, we had a management team with an average age of 34,” Brett continues. “Every one of them came from recommendations from clients and friends with the exception of Alex Hurst, who reached out to us and came on as a producer. He is now our sales manager.

“One of our management team members came from a client and my first mentor, who recommended Katy Cintron for her talent, strong work ethic, and ability to learn. She came on as an account manager but within a few years grew into the chief operating officer position.”

“We’re not a call center or a faceless agency. We’re a second-generation family business

deeply rooted in Southern values and driven by our faith.”

—Kent Merrill

Chairman

“I was working at an insurance company and wasn’t looking for anything different,” Katy remembers. “But the agency was close to home and I was driving an hour each way to get to work at the company. So, I called Brett and [his wife] Katlin just to talk. When that was over, I was really considering it. My job at the company was one that I knew I could keep for a long time, but I could see a future with Merrill and knew I could bring value there. It was a tough decision, but God told me to go.”

The team is tested

Brett notes with a chuckle that “I was now an indentured servant to the agency with the pressure squarely on me. So, in January of this year, I made certain that I put my house in order by going through an estate planning process. I was a healthy 39-year-old, but it seemed prudent to do it. On February 12th, I got to experience a truly surreal moment. The estate planning paperwork had just arrived for me to pick up that morning and later that day, at a doctor’s visit, I was diagnosed with cancer that needed aggressive treatment. For the next four to five months, I went through hell. That’s my part of the story.

“But the people at the agency are the real story,” Brett says proudly. “The leadership team was being asked to run the agency not knowing what was going to happen to its owner. Everyone stayed even though things were uncertain. They really showed that they all were part of a legacy of caring, that they saw their job as protecting our clients and our company partners. I couldn’t be prouder of them. This team cared enough to put in the extra hours and use the knowledge they had gleaned during their career.

Agency leaders with the “giant blue chair” at Grantham Pointe, located at the nearby Port of Mount Dora. From left: Alex Hurst, Sales Manager; Tammy Marcelino, Commercial Lines Team Lead; Katy Cintron, Chief Operating Officer; Lindsey Fenlon, Brand Manager and Personal Lines Team Lead; Kent Merrill; Brett Merrill

“The leadership team was being asked to run the agency not knowing what was going to happen to its owner. … They really showed that they all were part of a legacy of caring, that they saw their job as

protecting our clients and our company partners.”

—Brett Merrill

“They made sure that our people were paid, that our clients’ claims were handled efficiently and effectively and that their questions were answered promptly and courteously, that people followed up with referrals that came in, that producers continued to make cold calls, that our company partners were informed about what was happening and that the relationships we had established with them remained strong, assuring them that they would continue to provide them with the type of business they wanted.

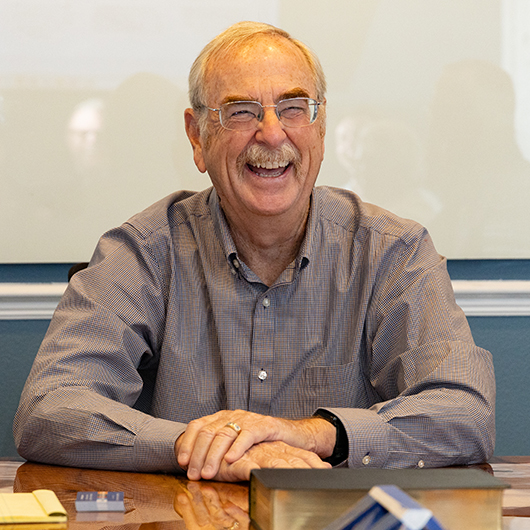

Kent Merrill visit Charles Marcussen (Chief Financial Officer) and

Dr. Sam Smith (President) at the Mount Dora Christian Academy

“[D]ad’s suggestion to me on what was needed for the future was ‘you’ve got to get younger.’ I knew he didn’t mean me personally. He was looking for me to build a management team from young people who could learn from our veterans.”

—Brett Merrill

Chief Executive Officer

In late June, I returned with a cancer-free diagnosis to find out that the agency had grown while I was gone. Everyone had stepped up and made certain not just that we prospered but that our reputation for faith-driven service remained strong.”

Middle-market agency

“We are a true middle-market agency. Commercial lines represents about 70% of our revenue; the balance comes from personal lines,” Brett points out. “Our niches include artisan contractors, large commercial properties, and various other lines. In personal lines, we write multiple lines with each policyholder. Although, we are mainly writing in Florida, our plans include expanding into the rest of the Southeastern United States and [we] are actively looking for good agencies in that area who might be interested in joining us in that endeavor through merger or acquisition.

“Most of our business comes to us through referrals but our producers are in the field every day. In fact, we are getting ready to hire more outside producers.”

Kent Merrill, Brett’s father and the agency’s chairman, says the agency has “a strong partnership with each of our carriers, each of which has been cherry-picked to make certain that they reflect our values. We don’t cut corners and they know that.”

Remaining independent

Kent continues that the agency “is committed to remaining independent. We have an excellent cadre of people, many of whom refer their personal friends and family members. It is a strong testament to our caring environment that people like working here enough that they recommend us as a good place to work to their family members and hopefully soon, their children and grandchildren as second and third generation team members.”

“It is somewhat ironic that we currently are working on establishing a robust perpetuation plan as part of our goal to remain independent into the foreseeable future,” Brett says, pointing out that “I was the perpetuation plan, but my unfortunate diagnosis made it clear how important it is to have a wider plan.

“We are looking at ways to make more growth opportunities available to our people as a way of rewarding them for their hard work and loyalty,” Brett continues. “That will ensure that our legacy will remain in independent hands of people who cherish it.”

Kent concludes: “At Merrill Insurance, our mission is rooted in something bigger than business. Guided by God’s loving care, we exist to uplift the lives of our team, clients, and community. We carry forward a century-long legacy of service by pouring into the people we serve, helping them protect what matters most, and making decisions with clarity and confidence.

“We’re not a call center or a faceless agency. We’re a second-generation family business deeply rooted in Southern values and driven by our faith. Since 1925, we’ve served our clients with the same care and commitment we bring to our team, families, and community. We believe people should leave us better than they arrived—more informed, more protected, and more confident in their decisions.”

Rough Notes is proud to recognize Merrill Insurance as our Agency of the Month. They not only emphasize the importance of perpetuation in order to continue to be independent but have given us a graphic display as to why.

The author

Dennis Pillsbury is a Virginia-based freelance insurance writer.