Insurance Marketing & Communications Association

research finds that marketers struggle between tactics and strategic needs

By Peter van Aartrijk

A recent study of insurance marketing and communications professionals unveils deep organizational issues that are holding back these teams. In short, the systemic issues mean marketers are focused on tactics versus strategic needs. The research was conducted for the Insurance Marketing & Communications Association (IMCA) by insurance branding firm Aartrijk.

In the study, we found that insurance marketing and communications professionals are focused on the greater organizational issues and don’t have the time or luxury to focus on strategy and important marketing functions. “We are stretched too thin to think strategically,” one respondent commented.

Over the years, many IMCA members have said they struggle with getting the attention of leadership. Even the term “marketing” gets twisted around in this industry in that it typically refers to an agent or broker “marketing” a customer to an MGA or carrier. But the focus of professional marketers is on strategy, messaging and a deep understanding of what drives customers and business partners.

Ultimately, to be successful, marketing requires a seat at the C-suite table. Marketing must be aligned closely with business strategy, business development and sales. But it’s not always that way in insurance organizations, the research found.

Survey respondents’ frustration with resources is interesting, given the tenure of most of them. Some 48% have more than 20 years of marketing experience, with another 29% having 11 to 20 years. And 28% of respondents are in the C-suite or have EVP or SVP titles, 48% are department heads or team leaders, and 23% are individual contributors.

The top challenges (in descending order of importance) cited by insurance marketers are structural:

- Lack of time and bandwidth

- Struggles to prove return on investment

- Limited access to data

- Difficulty managing business leader expectations

- Poor cross-departmental collaboration

- Inability to bring on strategic partners to round out staff capabilities

And what’s the obvious outcome when marketers have to wrestle with tactical barriers? The good work they do produce is not valued as much as it should be. The marketing efforts are diluted by organizational misalignment, which is frustrating.

Then, it sometimes leads to a state of complacency. “There’s a major disconnect between marketing and the rest of the organization,” one respondent said.

In the research, marketing leaders say they focus on four areas, to the extent they can: internal training, internal recruitment, external recruitment, and cross-department acumen. Under-investing in external training due to budget constraints creates the recycling of outdated methods instead of driving innovation.

Many marketers are operating in small teams or working solo. “It’s just me doing all of it—there’s no time to think about development,” one respondent said. Some 42% of respondents have four or fewer members in their teams. Another 27% have five to 10 members. Is management investing adequately in marketing? Time will tell as artificial intelligence likely will impact marketers’ head counts.

Customer experience insights missing

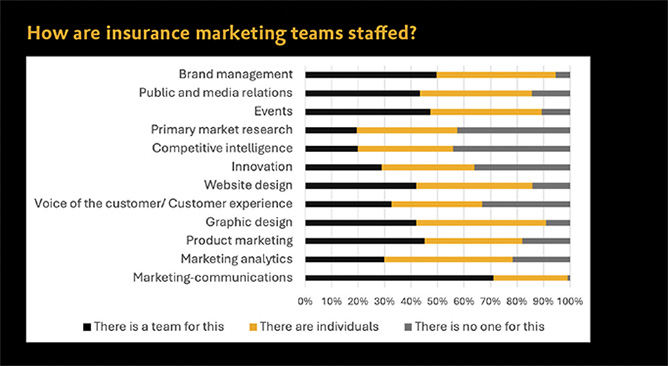

The research found that marketers’ creative strengths and execution are high. Common capabilities include graphic, visual and web design, as well as brand and communication management. On the other hand, these professionals are lagging in data analytics and integration as well as customer experience research such as customer journey-mapping and personalization. This means that the teams aren’t able to deliver modern marketing programs.

In terms of customer experience programs, we asked marketers, “How do you listen to your primary audience?” Some 41% cited surveys or calls (in house), followed by advisory boards or panels, 23%; social media comments, 22%; and focus groups, 14%. Clearly, what is missing here are external research and interviews, post-engagement surveys, and data analysis.

The marketers said they lack customer insights, and yet budget dollars aren’t being directed adequately to understand the customer. Surveys alone are a static activity; customer reviews generally are emotion-based without deeper context and follow-up action. And neither help with strategic initiatives based on the voice of customers. “We do a great job with branding, but we lack real customer insight,” one respondent said.

How do insurance marketers keep an eye on competitors? Their top tools include:

- Web/digital reports

- Social media research

- SWOT analysis

- Human intelligence

The tools used the least include: win-loss analysis, benchmarking, market intelligence portals, and pricing research.

Role of AI

To be sure, artificial intelligence tools and data are rocking the world of marketing. This is the time for marketers to be curious and experiment to learn what tasks can be shifted to AI tools. Insurance marketing departments have limited use of AI to date, our research found.

Instead, most marketers say they’re using AI on an individual basis—a leading reason is corporate security concerns about AI use on the job. “Today, we do not have an official policy or tool we can use,” one respondent said. “Instead, I use ChatGPT outside of work since we aren’t allowed inside work.”

Nearly a third of insurance marketers said they are self-learning how to use AI. Primary tools include ChatGPT, Jasper and GA4. Marketing team adoption is very fragmented; in fact, fewer than 10% have an AI tool department wide. Note that marketers outside the insurance business are in a different place here: 43% leverage AI as a team, and 75% individually.

When asked, “How are you using AI?”, respondents said:

- Open-source AI—50%

- We don’t use now, but will—35%

- Closed proprietary model—12%

- We have no plans to use—3%

Marketing must be aligned closely with business strategy, business

development and sales. But it’s not always that way in insurance organizations … .

The future

So, what now for insurance marketers? They have an opportunity to change the direction in the areas where they are weak. Immediate and long-term actions to improve outcomes, provide efficiency, and grow value and ROI include the following.

Advocate for strategic enablement:

- Clarify marketing’s strategic role beyond execution

- Define shared ROI metrics and data-access strategy

- Build alignment with cross-functional partners

Expand capabilities in customer experience, data and personalization:

- Audit team skills against modern marketing requirements

- Upskill customer journey mapping, segmentation and experience

- Use external partners to close gaps and gain deeper insights

- Experiment with AI tools

Invest in people, especially in solo teams:

- Create formal individual development paths

- Recruit talent outside the insurance industry

- Build fresh ideas through collaboration networks and shared services

The author

Peter van Aartrijk (peter@Aartrijk.com) is EVP of insurance marketing firm Aartrijk. Throughout his career he has worked on research, branding and marketing for agents, brokers, carriers, tech firms and other business partners to the independent agency channel. He serves on the boards of Insurance Marketing & Communications Association, InvestProgram.org and the Risk & Insurance Education Alliance.

The Insurance Marketing & Communications Association’s membership comprises professionals from carriers, brokers, wholesalers, program administrators, technology firms and other business partners to the insurance industry. Networking and professional education are top benefits of the IMCA.