Coverholders & Risk Takers

By Frank Huver

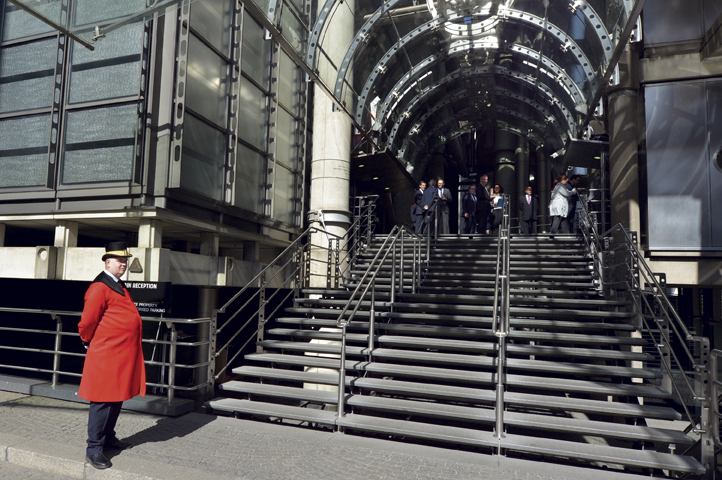

LLOYD’S OF LONDON—OPEN FOR BUSINESS

“Future at Lloyd’s” program helps transition firm to a virtual operating environment

For many of us, the sheer scale of the COVID-19 crisis will forever change our lives. It has already fundamentally altered the way we work, play, travel, and interact with others. New phrases like “shelter in place” and “social distancing” are now a common part of our shared lexicon. At this stage, it is impossible to predict the ultimate long-term impact.

Our industry will certainly not be immune to COVID-19’s aftermath. John Neal, CEO of Lloyd’s of London, has suggested that the current pandemic is likely to be the most expensive event in insurance history, comparable to disasters like Hurricane Katrina and the 9/11 terror attacks. He went on to predict that losses of tens of billions, if not hundreds of billions, will be discussed over time.

[O]n March I9 … Lloyd’s turned the page on its centuries-old tradition by closing the underwriting floors of its office building.

This view is also shared by the domestic markets. Evan Greenberg, CEO of Chubb, predicted that COVID-19 will be “the largest event in insurance history.” He added that “we are in an unprecedented moment of historic proportions. None of us living today has experienced an event of this nature or magnitude. It is at once surreal and catastrophic. As a country, we will manage through and heal both our society and economy, and it will take time.”

Insurance agencies are on the front lines during this crisis, responding to their customers’ issues and concerns. As many of our colleagues already know, this is not an easy task. “Many of our small and mid-sized business clients are feeling overwhelmed,” says Glenn Clark, president of Rockwood Programs. “The economic impact of the pandemic is putting the ongoing financial viability of their companies at risk. Now, in addition to the stress of making payroll and other operational expenses, they need to determine if any of the exposures they’re facing are covered by insurance.”

(For help understanding insurance-related implications of COVID-19, Wilson Elser, an internationally recognized law firm and Rockwood Programs partner, has established an online Coronavirus Resource Center. Visit it at bit.ly/WECOVID19.)

The pandemic has presented some unique challenges to the world’s oldest and most recognized insurance market. Throughout most of its 334-year history, the normal course of doing business was reminiscent of the way things were done in Edward Lloyd’s coffee house: parties relying on verbal communications and paper contracts to negotiate, quote, and bind risks.

All of that changed on March 19, when Lloyd’s turned the page on its centuries-old tradition by closing the underwriting floors of its office building. Syndicates, brokers, and other industry groups were required to make the move to working remotely.

Fortunately, the timely execution of plans initially developed nearly a decade ago has allowed Lloyd’s to weather the transition to a virtual operational environment. Work that began in 2011 has led to the Future at Lloyd’s project, which was introduced last year. This initiative aimed to “build the most advanced insurance marketplace in the world.” The first iteration—called Blueprint One—outlined six innovations for improving workflow, taking advantage of technology and becoming more efficient. One of these integrated solutions was an electronic trading platform called the Placing Platform Ltd. (PPL).

PPL was viewed as a way to bring the market into the digital age. The results seen to date have been encouraging; by the end of 2019, Lloyd’s syndicates were placing more than 70% of their risks electronically. From a purely transactional perspective, this translates to more than 100,000 risks placed across the markets and about 200,000 endorsements to existing accounts finalized. The end result is a more efficient use of time and resources for London brokers and syndicates. We expect these figures to increase significantly as the majority of business continues to be done virtually.

The economic and operational challenges posed by COVID-19 have caused London to reprioritize its automation planning for the remainder of 2020. The focus will be directed toward the delivery of components from the Future at Lloyd’s strategy that will deliver the most benefit and value to participants. These include:

- The complex risk platform—A central e-placing platform that enables brokers and insurers to quote, negotiate, bind, and endorse business digitally. Automation will make the process more efficient, mitigating the need for paper and creating a digital information flow/audit trail.

- Lloyd’s risk exchange—An initiative designed to support agencies with delegated underwriting authorities (coverholders). It is designed to enable easier access to the market.

- Improved claims solution—Focused claims process improvements will have an immediate impact on the market this year. It also will lay the foundation for future enhancements and technological innovation.

The bottom line is that the London market is open for business. Hank Watkins, president of Lloyd’s North America, says: “As we move into the second month of remote working around the world, much of the Lloyd’s market has made the transition to electronic trading and all syndicates are responding to requests for premium payment extensions, adapting their positions on cancellation and non-renewal, making adjustments for reduced/changed exposures, etc., based on guidance from Lloyd’s.”

While Lloyd’s is open for business, don’t expect it to be business as usual. Here are some common-sense tips to keep in mind as we operate in the “new normal”:

- Don’t expect COVID-19-specific insurance to be available anytime soon. Enough said.

- Get your submissions in early. With so many broker and syndicate personnel working remotely, expect overall response time to be slower than before. Prepare for this issue by submitting applications as far in advance of the account’s expiration date as possible.

- Make sure submissions are complete. Invest a little extra time to verify that you are providing a complete application—including the necessary supporting documentation—to the underwriters from the outset. This will mitigate the need for subsequent “data chasing” and will allow the market to offer terms more quickly.

- Be realistic regarding new business. Diminished capacity and the syndicates’ desire to focus on existing clients and accounts will combine to make the placement of new business more difficult. You should expect the process of finding a home for these risks to take more time than usual. This impediment may ease as pandemic conditions improve.

- Set the proper expectations with your clients. Make sure your customers understand that the delivery of quotes, binders, endorsements, etc., may be delayed due to current business conditions. Clients should also be made aware—in advance—about the potential unavailability of or restrictions on such coverages as business interruption, event cancellation, employment practices liability, etc.

Don’t be afraid to ask for help during these turbulent times. The CHART Exchange can serve as a resource for helping specialist insurance agencies launch new programs or products within the U.S./London marketplace. CHART’s approach puts us in the position to advocate for the business submissions seeking placement through Lloyd’s. We have a number of tools at our disposal, including brokerage capabilities, an extensive vendor network, and the capacity to “incubate” programs.

For more information, view the CHART website (www.chart-exchange.com) or submit any questions to info@chart-exchange.com.

The author

Coverholders and Risk Takers is a periodic column written by principals or “early adopters” of the CHART Exchange (chart-exchange.com). The group’s core mission is to facilitate more U.S./London commerce via personal interaction, education, and technology. Francis J. “Frank” Huver is senior vice president and chief financial officer at Claymont, Delaware-based Rockwood Programs, a Lloyd’s Coverholder for more than 15 years and a CHART Exchange early adopter.