For outsized growth in this

For outsized growth in this

industry, M&As are critical

The talent and relationships gained through

quality acquisitions could take decades to develop organically.

By James Graham, CVA

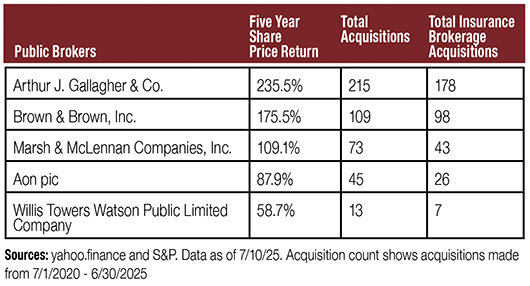

The increasing volume of insurance broker transactions is a direct result of the success of highly acquisitive strategic platforms’ ability to acquire turn-key insurance brokerages at accretive prices. Consider the chart below: Over the past five years, Arthur J. Gallagher & Co. (AJG) has acquired significantly more firms than its peers, resulting in outsized returns for shareholders.

This isn’t to suggest that mergers and acquisitions (M&A) are the only or single most important factor in creating outsized shareholder value. MarshBerry strongly believes that a successful M&A strategy stems from building a great business capable of supporting the constant change that comes with integrating new partners.

While private equity (PE) returns cannot be shown due to the private nature of their equity, anecdotal evidence suggests that insurance brokerage firms with a consistent, strong acquisition strategy have, on average, outperformed their peers. There doesn’t appear to be any serial acquirer with a multi-year track record that hasn’t delivered a positive return to its financial sponsors.

However, rising interest rates have slowed some acquirers, leading to increased discipline in acquisition strategies. Despite the reduction in buyers following the sale of NFP to AON plc; AssuredPartners to AJG; McGriff Insurance Services, LLC to Marsh & McLennan Companies, Inc.; and Accession to Brown & Brown, Inc., demand remains at elevated levels and new platforms are continuing to form.

The key takeaway for insurance brokerage CEOs is that M&A is critical for outsized growth in this industry. The talent and relationships gained through quality acquisitions could take decades to develop organically. Moreover, if your share price returns lag behind those of publicly traded firms or the average returns of private equity firms, the capital trapped in your business is underperforming its potential.

Given the high demand for M&A, a clearly defined go-to-market strategy is crucial for maximizing value for the seller. Valuation outcomes can vary significantly, and a skilled advisor can work to help secure top dollar while educating the seller to ensure informed decision-making.

The author

James Graham joined MarshBerry in 2015 and is a director on MarshBerry’s Financial Advisory team in its Dana Point, California, office. His expertise includes merger and acquisition advisory, capital raising, business valuation, perpetuation and succession planning, and strategic planning. James provides his clients with customized financial and capital strategies to help them accomplish their goals. He also is a facilitator for MarshBerry’s Connect Network and actively publishes articles relevant to the insurance distribution marketplace.

Prior to joining MarshBerry, James was a senior consultant with Deloitte Consulting LLP.

James currently maintains the FINRA Securities Industry Essentials (SIE®) Exam in addition to the Series 62, 79 and 63 FINRA Registrations through MarshBerry Capital, LLC, the affiliated FINRA-registered broker-dealer of Marsh, Berry & Co., LLC. He earned a Bachelor of Science in Finance from Azusa Pacific University and a Master’s in Business Administration (MBA) from George Mason University. He is also a Certified Valuation Analyst (CVA). Contact him at James.Graham@MarshBerry.com or (949) 272-0351.

M&A MARKET UPDATE

As of June 30, 2025, there were 310 announced M&A transactions in the United States. This activity is up 2.3 % compared to this time last year, which saw 303 transactions announced through June.

Private capital-backed buyers have accounted for 220 (71.0%) of the 310 transactions this year. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 51 deals so far in 2025, representing 16.5% of the market. There have been four announced transactions by bank buyers. Deals involving specialty distributors as targets accounted for 46 transactions, or 15.2% of the total acquisitions so far this year. This percentage share is in line compared to the 15% in 2024, continuing the trend of a low supply of specialty firm sellers.

Deal activity from the top ten buyers accounted for 49.0% of all announced transactions, while the top three (BroadStreet Partners, Hub International, and World Insurance) account for 24.6% of the 310 total transactions.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., LLC. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122; (440) 354-3230. Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. Statistics are preliminary and may change in future publications. Please send any announcements to M&A@MarshBerry.com. Source: S&P Global Market Intelligence and other publicly available sources.