Are they simpler than commercial lines?

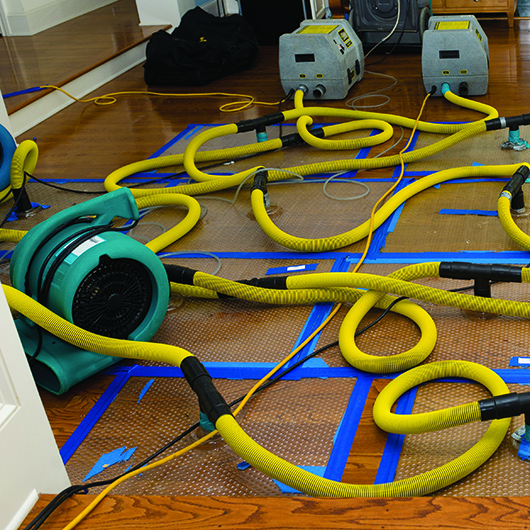

[U]rge your clients not to skimp on the water backup

limit of insurance, as restoration contractors

can quickly eat away that limit as part of

the drying out process.

By Marc McNulty, CIC, CRM

Our last “Mind the Gap” explored water-related exclusionary language, carve-backs, and endorsements for the commercial lines Special Form and Businessowners Coverage Form. Should we believe that topic is any simpler in personal lines?

Of course not!

As we did in that column, let’s start off by examining the exclusionary language in the HO 00 05 03 22 (Homeowners 5 – Comprehensive Form). That form contains the following verbiage under Section I – Exclusions:

- Water

This means:

- Flood, surface water, waves, including tidal wave and tsunami, tides, tidal water, overflow of any body of water, or spray from any of these, all whether or not driven by wind, including storm surge;

- Water which:

(1) Backs up through sewers or drains; or

(2) Overflows or is otherwise discharged from a sump, sump pump or related equipment;

- Water below the surface of the ground, including water which exerts pressure on, or seeps, leaks or flows through a building, sidewalk, driveway, patio, foundation, swimming pool or other structure; or

- Waterborne material carried or otherwise moved by any of the water referred to in A.3.a. through A.3.c. of this exclusion.

This Exclusion A.3. applies regardless of whether any of the above, in A.3.a. through A.3.d., is caused by an act of nature or is otherwise caused.

This language is similar to what we saw in the commercial lines Special Form, although you might notice that the perils of mudslide and mudflow are notably missing. (The Homeowners 5 – Comprehensive Form still excludes these; they are simply listed under the Earth Movement exclusion.)

The exclusion continues by clarifying the “escape, overflow or discharge, for any reason, of water or waterborne material from a dam, levee, seawall or any other boundary or containment system” are not covered but that “direct loss by fire, explosion or theft resulting from any of the above, in A.3.a. through A.3.d., is covered.”

Finally, the form clarifies how this exclusion applies to Coverage C. In short, the exclusion applies if the Coverage C is on a premises owned by, rented, or occupied by an “insured,” but if the Coverage C is away from such premises, the exclusion does not apply.

You may recall that the CP 10 30 and BP 00 03 forms gave back coverage for “water damage.” The HO 00 05 does this as well in the form of a carve-back that is found in Section I – Perils Insured Against:

Unless the loss is otherwise excluded, we cover loss to property covered under Coverage A, B or C resulting from an accidental discharge or overflow of water or steam from within a:

(i) Storm drain, or water, steam or sewer pipe, off the “residence premises”; or

(ii) Plumbing, heating, air conditioning or automatic fire protective sprinkler system or household appliance on the “residence premises”. This includes the cost to tear out and replace any part of a building, or other structure, on the “residence premises”, but only when necessary to repair the system or appliance. However, such tear out and replacement coverage only applies to other structures if the water or steam causes actual damage to a building on the “residence premises”.

We do not cover loss to the system or appliance from which this water or steam escaped.

For purposes of this provision, a plumbing system or household appliance does not include a sump, sump pump or related equipment or a roof drain, gutter, downspout or similar fixtures or equipment.

This wording is slightly different from what we saw in the BP 00 03 since the homeowners form references other structures.

It should also be noted that the accidental discharge or overflow of water or steam is a named peril under the Landlord’s Furnishings section of the HO 00 05. That provision provides up to $3,000 for appliances, carpeting, and other household furnishings on the “residence premises” regularly rented or held for rental should a covered cause of loss—including water-related ones—apply.

Now, knowing what we know about the water-related language in the HO 00 05, will the most common types of homeowners water-related claims be covered?

Maybe.

Let’s say you have a client who left their house for several hours to run errands and turned their dishwasher on before leaving. The dishwasher broke, which caused a massive amount of water-related floor damage, and now they’ve called you for help.

The language we just reviewed above should put your client at ease since the loss stems from a broken household appliance (although the dishwasher itself won’t be covered).

However, if that same client goes into their basement and discovers standing water, then we might have a problem. It all depends on the cause of loss.

If the water was determined to have come from a burst pipe, then the damage should be covered. However, if the water came from a sump pump failure or water below the surface of the ground (hydrostatic pressure), then we have an issue and will need a separate water back-up endorsement to provide coverage.

Surprisingly, ISO offers a number of water back-up endorsements, as many states have their own variations. For the purposes of this exercise, we will start with the HO 04 95 03 22 (Limited Water Back-Up and Sump Discharge or Overflow Coverage). This endorsement provides coverage up to the specified limit within the form (chosen by the insured) for water or waterborne material which:

- Originates from within the dwelling where you reside and backs up through sewers or drains; or

- Overflows or is discharged from a:

- Sump, sump pump; or

- Related equipment; even if such overflow or discharge results from mechanical breakdown or power failure. This coverage does not apply to direct physical loss of the sump pump, or related equipment, which is caused by mechanical breakdown or power failure.

In addition, ISO offers the HO 06 95 03 22 (Broadened Water Back-Up and Sump Discharge or Overflow Coverage) as an option, which is designed to be a slightly broader coverage form. This version states that the policy will pay for direct physical loss caused by water or waterborne material which:

- Backs up through sewers or drains; or

- Overflows or is discharged from a:

- Sump, sump pump; or

- Related equipment; even if such overflow or discharge results from mechanical breakdown or power failure.

Notice the key difference? The HO 06 95 doesn’t state that the water must originate from within the dwelling! I have seen this firsthand where a drainpipe outside my insured’s home became clogged after a storm and water began to back up through their basement shower as a result.

Language like this is certainly something to consider when looking to provide your clients with water-related coverage outside of the base policy form.

Notice what else neither endorsement offers? Coverage for water below the surface of the ground.

In complete transparency, many carriers do not offer hydrostatic pressure coverage, so you may find that you don’t have an option for this. However, it will be to your advantage to read through your carriers’ proprietary water-related endorsements to see if any of them include language like this as part of a limited water damage endorsement:

(1) “We” will pay for “physical loss” to covered property caused by or resulting from water or waterborne material:

(c) Below the surface of the ground, including water or waterborne materials which exerts pressure on or seeps or leaks through a building, sidewalk, driveway, foundation, swimming pool or other structure.

Another suggestion is to urge your clients not to skimp on the water backup limit of insurance, as restoration contractors can quickly eat away that limit as part of the drying out process. Your insureds will need to still have some limit left to replace what has been damaged after the fans are turned off and everything has been dried out.

The author

Marc McNulty, CIC, CRM, is a principal at The Uhl Agency in Dayton, Ohio, and has been with the agency since 2001. He divides his time among sales, marketing, technology and operational duties. You can reach Marc at marcmcnulty@uhlagency.com.