PRACTITIONERS SHARE INTERNAL, EXTERNAL MARKETING CHALLENGES

First-ever IMCA CMO Council “State of Insurance Marketing” research findings revealed

By Kevin Jenné

Worthy marketers always look to research customers, prospects or competitors before investing in strategies and tactics.

The Insurance Marketing & Communications Association (IMCA) CMO Council used the same approach in understanding the hopes and concerns of insurance marketers themselves as it launched the first-ever national research study, “The State of Insurance Marketing 2021.”

Sponsored by Applied Systems, the quantitative research project polled marketers at independent agencies, program administrators, wholesalers, MGAs and MGUs, carriers and reinsurers. The IMCA sought feedback from all career levels of insurance marketing and communications professionals—from entry level to chief marketing officer.

Some of the topics the study explored:

- How do you market to, and listen to your primary audience?

- What are the skills gaps in insurance marketing talent today? What skills will your next hire have?

- What are the barriers to marketing and communications success that you’re trying to overcome? Where do you go to solve those challenges?

- Where have you increased or reduced your spending in the last two years?

- What marketing technologies are you using?

- How has the pandemic changed your strategy and tactics?

- How do you evaluate your marketing success?

The IMCA CMO Council will use the survey results for webcast and conference discussion, to develop solutions, and to share best practices to help insurance marketers, according to Peter van Aartrijk, IMCA board member.

“We know that marketing is the engine that moves brands,” van Aartrijk says. “When done well, it drives relationships, business development, sales and renewals.

“Our issue in the insurance industry is that even the word ‘marketing’ can get tangled,” van Aartrijk adds. “We see ‘marketing directors’ who position a piece of new or renewal business with underwriters. That’s a necessary and noble task.

“But prospect and customer marketing, led by well-designed strategy, is a whole different kettle of fish,” he says. “The CMO Council seeks to highlight and elevate the critical role of these marketers.”

About half of the IMCA survey respondents work for carriers; over half target agents and brokers as their target audience, while a third primarily communicate directly to policyholders and prospects.

Top challenge: ROI

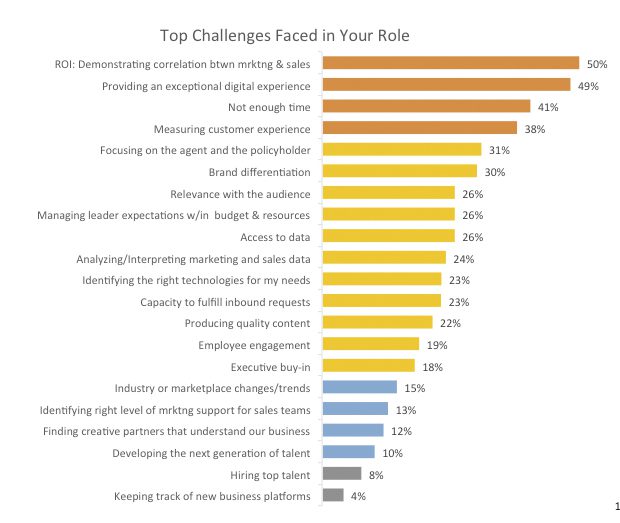

Out of 21 challenges IMCA listed—all of which are faced by some participants—the top challenge was in demonstrating the link between marketing investments and the sales they’re intended to generate.

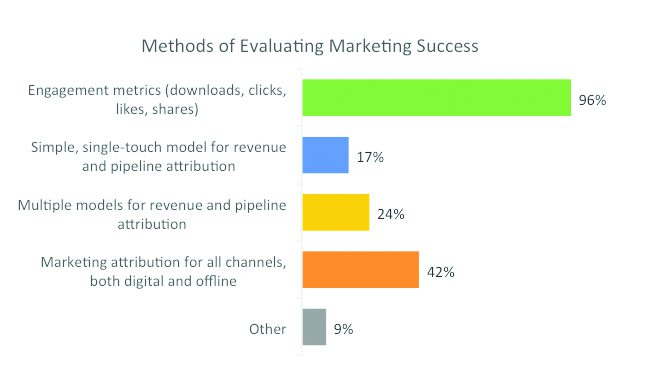

Measuring and evaluating the effectiveness of marketing efforts is challenging. One quarter of these marketing professionals say they currently have no programs or methods in place to evaluate their marketing success at all.

Measuring and evaluating the effectiveness of marketing efforts is challenging. One quarter of these marketing professionals say they currently have no programs or methods in place to evaluate their marketing success at all.

Of those who are trying to measure, fewer than half have methods in place to gauge marketing attribution for all channels, both digital and offline. This makes it more difficult to show the business any meaningful return on investment.

“We’ve seen independent agency leaders struggle with a commitment to marketing,” van Aartrijk says. “They tend to gravitate to short-term, silver-bullet solutions.”

He said marketing that ultimately generates sales results requires a commitment to:

- A long-term investment rather than a one-off tactical approach

- A research-based strategy, where messages are developed to resonate with the target audience sets

- Understanding how relevant data can support marketing; otherwise, it’s a guess

- Relevant metrics to measure success, including non-financial (e.g., quotes, calls, inquiries) as well as financial (increased policies in force or policies per customer)

Misperception of marketing function

Misperception of marketing function

The difficulty in demonstrating are liable link between marketing investment and sales leads to the widespread perception of marketing functions as cost centers rather than revenue drivers, the IMCA survey found.

As marketers improve their collaboration with internal and external partners with data analysis capabilities, they should be able to up their game to earn a seat at the senior-executive table within a data-driven industry to show their contribution to the businesses they support.

That’s a seat they don’t have today. Of the senior marketing leaders who took the survey (41% of the total), only one quarter report to the CEO. Yes, it’s difficult for marketers to drive new business acquisition strategy with this distance from the head table.

Among the many barriers to success that marketing professionals are working hard to overcome, the top three appear closely related:

- Differentiation in the marketplace

- Making insurance itself about more than commodity or price

- Breaking through with messages

Whether the audience is agents or policyholders, marketers have a tough time getting across their organizations’ unique selling propositions. There’s a huge amount of money being spent by the biggest players beating the price drum across all media, with GEICO and Progressive each spending over $1 billion. It is difficult to break through all that clutter if you want to talk about coverage or service.

Even without the ability to show their actuarially minded colleagues solid ROI data, marketing functions are still seeing priority for staffing resources. Since the beginning of 2020, 42% of marketing teams increased in size, and 41% stayed the same. Only 17% decreased in size, even while the industry struggled with the impacts of the pandemic.

Top talent gaps

Marketers identified their top talent gaps, with “insurance knowledge” heading the list (51%). This was followed by “understanding the customer” and “technology, data and analysis skills.”

Fortunately, the knowledge avail-able to help with these is accessible to marketing professionals, often within their own organizations and certainly from outside partners. Investing the time to build relationships with product and distribution colleagues can help many marketers improve their insurance knowledge. Market research departments and agencies can help marketers tune in to their customers’ and prospects’ perspectives. And there’s tremendous data analysis capability within most insurance organizations that marketers can leverage to help them understand and apply their data more effectively.

Knowing the customer is vital

If any insurance organization is struggling with where to refresh or launch a marketing effort, van Aartrijk recommends starting with customers. Regular communications outside of premium notices are critical, he says. “We tend to put people on the books and forget about them. We do that at our own peril.”

Beyond the top three challenges mentioned earlier, rounding out the top five were “measuring customer experience” and “focusing on the agent and the policyholder.” Many of the insurance marketers who participated in this survey consider both agents and policyholders as customers, and often do so without a clear understanding of their particular needs, or how well their organizations meet those needs. For those who partner with agents and brokers to distribute their products, understanding the agent’s perspective is clearly vital. While a marketer may have an intuitive awareness that pricing, ease of doing business, and claims service are important, this may not be enough to plan a relevant, focused communication strategy.

Carrier marketers need clear measurement of what matters to their appointed agents—the customer for 55%of our survey respondents—and beyond that, how well they meet these needs. Knowing the areas in which they have competitive advantages as well as opportunities enables the marketer to craft messaging to the agent audience that rings true and conveys their unique selling proposition in a way that drives new business in the near term, and true partnership in the long run. If a carrier knows that its appointed agents place strong emphasis on the fact that claims responsiveness is important, knowing whether it’s particularly strong or weak in that area helps it choose whether to emphasize this point in its communications and field rep conversations.

Many carriers have the benefit of an internal research function; others may need to rely on outside agencies to access expertise in qualitative and quantitative methods to build this understanding. In either case, research experts can help reduce the guesswork and reliance on anecdotal feedback to not only make better-informed decisions, but also to measure the effects of those decisions over time. Which would a marketing professional rather have?

- “Our agents seem to like us fine, but I’m hearing complaints about premiums.”

- “Our overall satisfaction with agents is at 68%, on par with our main competitors and trending slightly upward. We have a 10-point advantage over competitors in our field rep relationships, we’re on par with them on commercial line pricing, but we’re underperforming by six percentage points on our underwriting appetite, which was an advantage for us last year.”

Certainly, one of these scenarios enables a marketer to make more reliable decisions, to employ them in communications strategies, and to validate the effectiveness of those strategies in moving the needle. The carrier marketing professional who chooses to pursue the second scenario will build the opportunity to engage more closely with agents and leapfrog the competitors whose research happens at the golf course.

Note: The study was conducted by Channel Harvest Research on behalf of IMCA.

For more information:

Insurance Marketing & Communications Association

www.imcanet.com

The author

Kevin Jenné is research director at Channel Harvest Research and previously was director of agent and consumer research at a leading omnichannel property and casualty carrier. He can be reached at kevin@Aartrijk.com.