Members of the First MainStreet Executive team. From left:

Duane Smith, Chairman: Randy Rings, Chief Legal Officer and Secretary:

Dru Bridges, Executive Vice President; and Dan Driscoll, Director, Strategic Expansion.

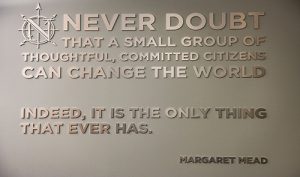

SMALL-TOWN VALUES, BIG-TIME VIABILITY

Providing a platform for independent agencies to stay local and create a legacy

By Maura C. Ciccarelli

Creating a legacy business is a challenging task in any era, but even more so today, when economic pressures from all sides are pushing smaller firms—independent agencies included—to merge, sell, or simply close up shop if no one is ready to take over the business.

when economic pressures from all sides are pushing smaller firms—independent agencies included—to merge, sell, or simply close up shop if no one is ready to take over the business.

First MainStreet Insurance offers a different path. Founded in 2017 as an affiliated business unit of TrueNorth Companies, L.C., of Cedar Rapids, Iowa, the new platform helps independent agency owners preserve their legacy, keep their operations viable in their community, and grow their business, with the help of shared resources and experiences of a larger enterprise, access to broader market opportunities, and the vision and training to create a way forward and maintain a legacy business. TrueNorth was featured in June 2005 as the Rough Notes Marketing Agency of the Month.

“We appreciate the independent agency model,” says First MainStreet Insurance (FMSI) Executive Vice President Dru Bridges. “We believe that it needs to be alive and well.” Like the other members of the FMSI leadership team, she hails from a small town—in her case, Reinbeck, Iowa, population 2,500. She grew up knowing the residents and business owners of Reinbeck, who shared small-town values like neighbors helping neighbors and a business’s commitment to supporting the community.

“As an agency owner, you provided jobs at the local level,” she observes. “You provided a level of service and care for customers at the community level that was so critical.”

Adds Chief Legal Officer and Secretary Randy Rings, “We’re really focused on continuing that individualized, local community asset, and First MainStreet is the platform that lets that happen.” Rings grew up in Colusa, Illinois (pop. 61), just 10 miles across the Mississippi River from the southeast corner of Iowa. “That town is just now starting to slowly dry up and blow away in the dust,” he notes. “If I can help other places avoid that fate, I sure would like to.”

Starting a family of small agencies

By 2018, First MainStreet Insurance had five affiliated agencies with 35 employees and $5.8 million in revenue. As of this summer, 28 FMSI agencies span 37 locations, with 144 employees generating almost $25 million in revenue. All of the agencies are in Iowa, except for one in the suburbs of Nashville, Tennessee.

“If you were to split First MainStreet out on its own, it would rank inside of the top 80 or 85 agencies in America as far as pure size,” notes Dan Driscoll, director strategic expansion, who grew up in Marion, Iowa (pop. 26,000), right next to Cedar Rapids.

Duane Smith, FMSI chairman, started the entrepreneurial project when he retired from being CEO of TrueNorth, which he calls an urban-focused business. His own roots go back to his days as an independent agent in Lamont, Iowa, (pop. 500). He’d started his career at the bank his father worked for but changed course when the early 1980s recession hit his small community hard.

“We believe in the small-town values. We believe in the legacy that these entrepreneurs have built.”

—Duane Smith

Chairman

First MainStreet Insurance

“I said, ‘Dad, I think I’m going to get my insurance license instead of foreclosing on my friends,’” Smith remembers. He became the second employee of a small agency his dad had bought for the bank from the local barbershop.

“When you deliver that check or show up on the doorstep after a devastating fire or event, and you’re able to console those clients and help them get their feet back on the ground, that’s what it’s all about,” Smith says.

To understand the First MainStreet focus, it helps to know where TrueNorth’s own values came from, Smith adds. After selling the original bank-based agency, he created another by partnering with his former high school football coach, Larry Bergdale. That agency merged in the early 2000s with two others to become TrueNorth, a large privately owned independent agency.

Smith says the six original principals wanted to create a unique business vision: to build a legacy company within an entrepreneurial platform to attract, develop and coordinate high-performing talent.

After Smith retired from TrueNorth—or graduated from it, as he likes to say—he saw a void in the marketplace for perpetuating small independent agencies. “We believe in the small-town values,” he says. “We believe in the legacy that these entrepreneurs have built.”

“[What] was very appealing to us was that we would be able to

The connection of all First MainStreet independent agency partners creates a unique power in local communities and beyond.

maintain our community involvement, maintain our presence, and maintain

the name of the agency, because you become the face of insurance in your community.”

—Chris Vens

Owner, Retired

Core-Vens Insurance

Drawing on the expertise of TrueNorth, Smith’s First MainStreet leadership team included Bridges, TrueNorth’s former chief operating officer, along with Rings and Driscoll. Bridges explains, “Based on our experience with TrueNorth, we spent time thinking about how could we build a model or a platform that can attract small, independent agencies, allow them to maintain the legacy that they built so diligently, maintain jobs, help them provide services beyond what they were capable of for their clients, and help them remain a viable part of the community. “We didn’t want to be an aggregator, so we built a model that provides services beyond just the market and the carrier,” she adds. “We based that on feedback from the independent agencies: What did they not like to do? What was a necessary part of owning an agency and what could we do more efficiently and more cost effectively for them?”

Driscoll notes that the model has resonated with so many small agencies that the growth has been very grass- roots. “As of this summer, we haven’t done one marketing piece, other than good old word-of-mouth or me driving down the interstate or having a carrier rep saying, ‘Hey, maybe you should call this person.’” he says.

“Our goal, because we are passion-ate about the model, is to launch this platform in another state by the end of 2023,” says Bridges. So far, active conversations are happening with small-town agencies in Illinois, Missouri, South Dakota, and Wisconsin.

“[W]e come up with unique solutions depending on the needs of the agency partner … .

We can do discovery on each individual location [including] the

back-room type of stuff the clients don’t see.”

—Dru Bridges

Executive Vice President

First MainStreet Insurance.

How the model works

For each new agency, Rings says, First MainStreet creates a new limited liability company using the agency’s own name. “They have an opportunity to retain ownership locally of five to 25 percent if they want to,” he notes. “It varies across the board. It’s one of the things that makes us unique, because we can tailor that solution to fit the needs of the agency and the communities.”

Arrangements vary, depending on the goals of the agency owners, Rings adds. Sometimes, the current owner wants to stay and grow it further. Other times, the owners want to leave but want to support the next generation with more partners and tools for when they take over ownership. Sometimes it’s a family member, so the owner wants to make sure the agency has longevity in the community.

A local independent insurance agency is a community asset, like the local bank, the local post office and the local courthouse.

“And as long as those things are viable, the community has a much better chance of long-term success,” he adds. “So we want to stay there and operate as a community asset. That’s why that local ownership opportunity is there.”

It also offers an attractive and flexible alternative to simply selling the agency and moving jobs away from the small town.

“We want to try to maintain and grow the legacy,” Rings says.

Core-Vens Insurance

Over the years, Chris Vens, former owner of Core-Vens Insurance in Clinton, Iowa, had been approached with offers to buy his enterprise. But, nothing seemed to offer the right fit. Then, after his brother, Mike, affiliated his own agency with FMSI, Vens looked into the possibility for Core-Vens in 2020.

In particular, Vens had been spending a lot of time on the day-to-day running of the agency, while he really wanted to focus on being a producer. The affiliation allowed him to do just that until he finally retired on July 1 of this year.

“Once we made our affiliation with First MainStreet, they provided all of the agency management resources,” he says. “They took care of all the HR, the accounting. All of those responsibilities are, basically, taken off your plate, so you concentrate on selling.”

“If you were to split First MainStreet out on its own, it would rank inside of the top 80 or 85 agencies in America as far as pure size.”

—Dan Driscoll

Director, Strategic Expansion

First MainStreet Insurance

With a focus that spans commercial and personal lines, Core-Vens was able to expand its P-C carriers from 15 to 200 contracts after joining FMSI. “The resources were great,” Vens explains. “The technology that they brought to us allowed us to operate from anyplace in the world if we had an internet connection and a PC.” Most important to him, though, was what would happen to his agency’s staff. “One of the things that we were concerned with and wanted to make sure of was that our employees were retained and had the opportunity to continue their insurance careers,” Vens says. “Once the transaction took place, literally nothing changed as far as our personnel was concerned. Everybody was retained and they still are, two years after the sale occurred.

“[First MainStreet] simply gave us better tools, more markets, and the technology,” he adds. “And other than that, the people are identical. It’s the same people who had been doing it for years.

“One of the things that was very appealing to us was that we would be able to maintain our community involvement, maintain our presence, and maintain the name of the agency because you become the face of insurance in your community,” he says. “As an agent owner, you only get to make this transaction once. We are very happy we chose First MainStreet.”

People first

Echoing those priorities, Rings says, “The difference, I think, between us and some aggregators or private equity is that we really do start with our first goal, [which] is to retain all the employees. They were there as part of the asset.”

He adds, “Our step one is, ‘How can we retain all the employees?’ We think most folks buying agencies today lead with ‘synergy,’ which we just think is a code word for ‘fire everybody.’ And so we start in a completely different place.

Driscoll says that when he opens conversations with an agency, he’s hoping for two things: “That there’s going to be a local owner post transaction, and that every single person is going to be on that bus. That’s our goal, and we’ll figure it out from there. I’m proud of that because that’s the opposite of what many others are doing.”

Another feature of the model is the importance of local ownership. Driscoll says almost 85% of First MainStreet locations have local owners, including many from family-run agencies. That means the agency’s future doesn’t have to depend on just one owner.

Too often in agencies, when that person retires, the foundation crumbles. “We restore the foundation so the agency as a whole can continue on and thrive in the community, and it doesn’t have to be tied to just one person,” Rings says. “Now, we have a succession plan and a legacy plan for it to be there for the foreseeable future.”

Growth and best practices training

Bridges notes that the FMSI team focuses a great deal on talking with the agency’s staff and understanding who wants to develop and who wants to just do what they do, day in and day out.

“What’s unique about First MainStreet is that we come up with unique solutions depending on the needs of the agency partner, unlike what we’ve seen in the market, [which is] kind of a one size fits all,” she says. “We can do discovery on each individual location [including] the backroom type of stuff the clients don’t see. That’s where we can really buckle on to them and provide them the efficiency that they need.”

The FMSI Dream Team—aka folks from agencies who are focused on heavy growth—meets weekly, Bridges says, sharing their expertise and experience as well as role playing to tackle challenges.

-Randy Rings

Chief Legal Officer and Secretary

First MainStreet Insurance

“They’re really trying to help each other, and we have been just the facilitator for that process,” she explains. “Success has come because we have people that culturally want to engage in and want to help the success of the agency and/or the platform. And as a result, they’re willing to give up [time] once a week in order to collaborate and share their wins and their losses and how can we learn together? That’s been fun to watch.”

Live online training brings agency producers, account managers, and leaders together and in their own tracks to give affiliated agency staff the chance to learn best practices for growing the business.

Roger Sitkins, a Rough Notes columnist and owner of the Sitkins Group training organization, says he’s seen firsthand the sense of freedom First MainStreet people feel. “These agencies and owners are caught in traps,” he explains. “They know there’s a better way that’s less stressful. They know there’s a way to get back to having fun again. They just don’t know what it is.”

While some producers may be happy to continue their legacy business, others want to grow, he says. “I’m seeing some real excitement in them because when they’re going through our training, they’re getting a road map that says here’s exactly what you have to do. You don’t have to reinvent the wheel.”

Sitkins’ course provides eight live, virtual sessions over eight weeks to producers, reinforced through monthly sales meetings. Account managers do four weekly sessions, along with the monthly sales meetings. Agency leaders participate in the sales and service programs, based on their responsibilities, along with C-level leadership programs, including chief revenue officer programs.

“The big difference for First Main-Street is their ongoing commitment to team member development,” Sitkins says. “They see their team members as a valuable asset, not an expense. Getting all team members following the same ‘playbook’ is crucial.”

Many agencies, one community

Bridges notes that, while each agency retains its own identity, members of FMSI share a common goal: providing service to clients. “At the heart of what we do is that we want to be able to care about people as people and as individuals, versus putting them into a big corporate structure,” she says.

In addition to helping agencies maintain their local presence, grow if they want to, and avoid being bogged down by operational responsibilities related to tech, HR, finance, etc., Bridges says it’s the personal connections and relationships that speak to her about the true value of the First MainStreet model.

“I spent an hour on the phone today with a woman whose dad is in hospice. She knows I’ve had that experience, so she wanted to call and talk to me about it and what should she expect,” Bridges says. “That makes my heart feel good on what we’ve built, because that tells us that we’re still small-community focused. That’s what resonates with me. And I believe when you can capture that, the rest just follows behind and success comes along with that.”

The author

Maura C. Ciccarelli is a freelance journalist originally from Philadelphia who now writes about business and more from the road full-time.