Everybody’s talking about AI!

But what about EI and CI?

By Olga Collins

Artificial Intelligence (AI) is a global phenomenon transforming every aspect of our lives and work, regardless of our location or profession. The insurance industry, traditionally slow and resistant to change, is now experiencing a dynamic digital revolution.

This is an exciting time for independent agents and brokers, as AI enables us to work smarter and faster, freeing up valuable time to focus on consultative rather than transactional tasks. However, we must ensure that neither we nor our industry lose our human touch as a result.

Risk and relationships must go hand in hand for us to achieve continued success. We cannot overlook the other two “I’s,” which I believe are the most powerful yet underestimated qualities in global risk management.

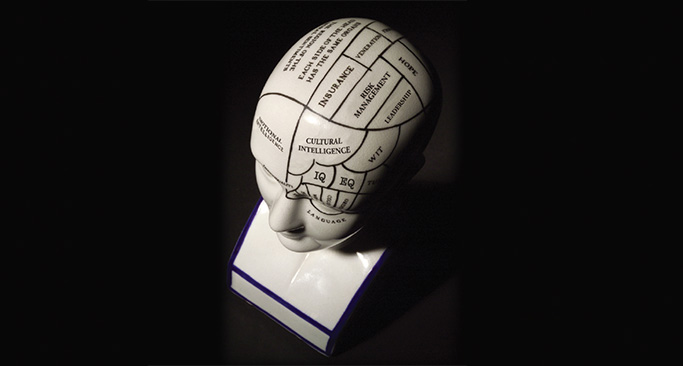

Intelligence is crucial to our success, but it must go beyond being artificial or academic. This is where Emotional Intelligence (EI) and Cultural Intelligence (CI) come into play. These qualities can never be replaced by machine learning and, when truly embraced, can provide a significant competitive edge.

Emotional intelligence

The term “emotional intelligence” has been around for a long time but was popularized by psychologist Daniel Goleman, who highlighted its importance in leadership. He told the Harvard Business Review that “the most effective leaders are all alike in one crucial way: They all have a high degree of what has come to be known as emotional intelligence. It’s not that IQ and technical skills are irrelevant. They do matter, but they are the entry-level requirements for executive positions.”

You can have the highest IQ and all the technical skills in the world, but without EI, we can’t implement these effectively. IQ may get you the job, but EQ helps you excel at it. IQ tells you what you can do, but EQ tells you how to do it.

Having emotional intelligence is like having good “emotional hygiene.” It’s about being able to recognize your emotions and how they influence your behavior, channelling them accordingly, and adapting to change.

[Emotional Intelligence (EI) and

Cultural Intelligence (CI)] can never

be replaced by machine learning and,

when truly embraced, can provide

a significant competitive edge.

Despite misconceptions, insurance is first and foremost a people business, so empathy and understanding are crucial to our success.

Cultural intelligence

I believe that the other secret weapon for insurance professionals is cultural intelligence, especially as we see increased globalization in the workplace. By that, I mean having the cultural understanding to embrace the differences that come with working with people across multiple borders, all facing different geopolitical, cultural, and regulatory pressures.

At Worldwide Broker Network (WBN), we work with 150 members across over 100 countries and six continents, and we have seen first-hand how differences within teams have proved to be our greatest strength and competitive advantage. Our quality partners in each country can connect and collaborate to strengthen their footprint and serve bigger customers, no matter where in the world they are. This would not work without a culture of care and the belief that our differences make us stronger together.

People, not robots, are at the center of our business

You just need to imagine for a minute what life without EI and CI would be like.

There are so many situations where we need to rely on EI—from addressing customer inquiries and handling complaints sensitively, to closing a deal and being sensitive to the distress that claimants may be experiencing.

Brokers with high emotional intelligence are more likely to stay calm under pressure and resolve conflict effectively and empathetically, creating a distinct advantage for their firm.

[H]ealthy employees

make organizations stronger and able to

withstand some of the macro pressures facing the insurance market today.

Recruiting and retaining talent is already one of our biggest challenges; imagine a robot trying to develop a rapport with a colleague or make a good first impression in an interview. For our industry to thrive, we need to hire emotionally intelligent individuals and create work environments that foster this.

Equally, we cannot build trust and form meaningful relationships with our clients, whose needs are constantly changing, if we do not understand and empathize with their concerns and motivations. WBN created a client advisory council—a thought leadership group, as a strategic, multi-continental forum to do exactly this and ensure that clients remain front and center.

Inspiring “intelligence” from the top

There is no doubt that leaders set the tone of their organization. Sadly, there are many leaders today lacking in emotional intelligence, often with extreme consequences. As independents, we have more freedom when it comes to shaping our corporate culture, so can make sure we instill EI and CI within our respective businesses to future-proof the industry.

As a network, we stay engaged with our members through our new technology platform to make sure their needs are being understood and addressed. We also provide mental health support for employees of members and members’ clients through our Wellbeing Zone, an ecosystem of hand-picked, global partner organizations across the five wellbeing pillars: mental, physical, financial, social and digital.

Users can access their services to benefit from a more holistic approach to their health and work life balance, whether they are needing bereavement support, fitness programs or personal finance advice. This offering is inspired by our belief that happy, healthy employees make organizations stronger and able to withstand some of the macro pressures facing the insurance market today.

Despite misconceptions,

insurance is first and foremost

a people business, so empathy

and understanding are crucial to our success.

Better together

While we should seize all the opportunities that artificial intelligence offers, let’s not allow the digital hype to cloud our vision of what is important, which in our case is a focus on people and relationships.

Without emotional intelligence, you cannot truly understand and meet the needs of customers and, therefore, cannot deliver exceptional service. Without cultural intelligence, you cannot effectively work globally and think locally. Achieving this three-way balance between artificial, emotional and cultural intelligence is not always easy, but the benefits of getting it right can prove invaluable to any organization.

If we can positively leverage AI, while simultaneously nurturing a people-centric environment, we will go a long way in positioning risk management as an appealing, dynamic, and lucrative career of choice for Generation Z.

The author

Olga Collins is CEO of Worldwide Broker Network—the world’s largest independent network and one of the top five global entities, with a combined brokerage revenue of over $14 billion and 150 members across 100 countries. The group (wbnglobal.com) works with some of the largest businesses in the world—from independents to Fortune 50s—but size and stature is not their primary ambition. For more information, visit wbnglobal.com.