Who will be the 2023 agency of the year?

One of the agencies featured in a Rough Notes cover story during 2023 will be named Agency of the Year. The winner will be selected based on votes from previous Rough Notes cover agents.

Principals of the winning firm will be presented with the award at a dinner held in their honor this spring.

The nominees for this year’s award are described on the following pages. The winning agency will be announced in the February 2024 issue of Rough Notes.

FEBRUARY

Snellings Walters Insurance Agency

Atlanta, Georgia

Founded in 1952, this firm jump-started its growth trajectory in 2007 when it expanded ownership beyond family. That year, revenue totaled around $3 million. Today, it’s in the $20 million range. The Assurex Global broker won the MarshBerry National MAX Performer Award in 2022 and 2023.

Helping drive success is “our ongoing effort to align our people with our core values of being engaged, accountable, curious and authentic,” says William (Billy) J. Potter, agency CEO. Using EOS® (Entrepreneurial Operating System, a business management framework/model), the firm has created an environment of accountability—tracking what matters and having a metric on everything it does. Another success driver was implementation of a culture index, where each employee completes a survey identifying their

“[My brother] Bill and I decided that it was

better to own part of a healthy, growing agency than to own all of something smaller.”

—J. Clayton (Clay) Snellings, CPCU

Chairman

behavioral traits and strengths, which lets the agency put them “in the right seat.” Once the right people are in the right seats, agency leaders say, productivity increases and there are better outcomes for employees, families, and clients.

To stay on track, the agency surveys employees three times a year to determine employee engagement and areas of possible improvement for the organization. “Also, each employee has a quarterly conversation with leadership to ensure core value alignment and identify what’s working and what’s not,” says President and COO Jennifer Goodwyn.

“When it all comes down to it,” she notes, “there are three things that people want from their jobs: a better boss, a brighter future, and a bigger vision—in other words, they want to be part of something bigger than themselves.

March

The J. Morey Company

Cypress, California

The Morey family immigrated to the United States from Japan in 1897 and started a general store in the Little Tokyo neighborhood of Los Angeles. Years later, John, Jack and James Morey started the J. Morey insurance agency in nearby Cerritos.

John’s son, Josh, initially had no desire to work in insurance, but that changed after he returned from a trip to Japan with a greater understanding of the importance of insurance to the Japanese community. John made Josh a commission-only P-C producer and later had him open a branch office with its own P&L balance sheet. Josh paid homage to his great-grandparents by re-opening the branch in Little Tokyo, near where their store was until it was shut down when they were placed in a World War II internment camp.

He was joined at the branch by Kevin Fukuyama. The agency has grown from 18 employees when Josh (now president) and Kevin (now CEO)

“I stand on the shoulders of my ancestors. … [Insurance] is a product that everyone needs, and by providing it I am able to work with and help the businesses and people in our community.”

—Joshua Morey

President

took over, to 170 employees today, but it still maintains an open and transparent family atmosphere.

Amid organic and acquisition-driven growth, Josh and Kevin saw a need in the independent agency ranks for better ways to perpetuate than selling to the highest bidder. To remedy that, they formed Ori-gen, a platform that helps smaller agencies perpetuate without selling to the bigger firms and then seeing their agency identity disappear.

Beyond insurance, The J. Morey team is dedicated to advancing diverse communities, and that involves engaging with a wide variety of community organizations—ranging from the Japanese American National Museum, Center for the Pacific Asian Family, and Asian American Drug Abuse Program to the Little Tokyo Community Council, U.S.-Japan Council, and more.

April

Harmon Dennis Bradshaw

Montgomery, Alabama

The road to success of the Harmon Dennis Bradshaw Agency is built on three basic tenets: integrity, honesty, and exceptional service. The proof? According to President David Dennis, “When I joined the firm in 1996, we had nine people working [here] and wrote around $20 million in premium. Today, we have about 50 employees and around $140 million in premiums.”

It took a bit of figuring out, but HDB has settled on reducing the emphasis on money and focusing on “providing services to customers that were so valuable that money, while still important, was not the sole factor,” says Dennis. The next step: deciding on what HDB’s brand should be. The solution became “mitigating risk while providing unique boutique commercial coverages and services.

“We have worked hard to keep the family atmosphere and we have created multiple ways for our employees to succeed. Thanks to that, we’ve put together a team that includes seasoned veterans and young people looking for a place to call home.”

—David Dennis, CPIA

President

” Careful to stay away from areas where they lack the knowledge to provide risk management solutions, HDB targets clients in forestry products, social services, construction, difficult-to-place property, and manufacturing.

Focusing on those needs allows the firm to concentrate on creating risk management solutions on an individual client basis. For example, a sub-niche within the manufacturing group is the Korean auto business, with two bilingual Korean professionals concentrating on communication. Other agency experts work in the same manner in other niches.

HDB’s three offices (including branches in Birmingham and Troy) maintain a sense of camaraderie through INFOBOARDS monitors in office kitchens that broadcast varieties of personal and business news. Great benefit and retirement programs, work-from-home opportunities, flexible hours, and the firm’s own training program for CSRs round out what creates a family atmosphere.

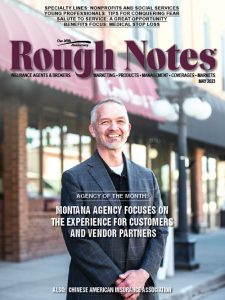

May

Paradox Insurance Agency

Kalispell, Montana

A strong desire to balance work with family life has taken R. Dean Giem, president of Paradox Insurance Agency, on a circuitous journey from retail sales to a large direct writer and, finally, to opening his own independent agency.

An insurance agency named Paradox? That seems to be a paradox in itself; however, in Dean’s mind it’s anything but. “[We] adopted a name that really described how our customers and our people felt about the product that we offered,” he explains. They hate paying the premium but love the security of knowing that they needn’t fear a life-changing loss. Settling in the small town of Kalispell, Montana—population 25,000—Dean has parlayed family interests into a variety of niches, including: collectors of classic cars and other collectibles, youth athletics/sports facilities, as well as auto garage and dealerships, contractors, and manufacturers.

“We have a very lean team, but it is enhanced by our ability to utilize technology effectively and by focusing on niche markets where we have a particular expertise.”

—R. Dean Giem

President

“Our expertise in the classic car insurance arena has resulted in strong growth in that niche, as customers recommend us to other collectors, and our slow-drip marketing also helps develop warm leads for us,” Dean points out.

As to drip marketing, Dean shares that “we continue to use cold-calling … but our type of cold-calling would be better described as lukewarm calling, as we often get the leads through our drip email system or from client recommendations.”

The firm’s thrust in customer education through risk management, coupled with efficient use of technology, has led to close relationships with clients they have never met in person and policies in 11 states.

June

Florida Risk Partners

Valrico, Florida

A curious mixture of disillusionment and a wife’s sage advice became the making of today’s up-and-coming Florida Risk Partners of Valrico, Florida. Having experienced a difficult time in the insurance industry, David R. Carothers began seeking and being offered employment in some Fortune 500 companies. However, his wife, Andrea, sensed that he loved the insurance industry and cautioned him not to leave because of one bad experience. Her suggestion? Start his own agency and run it his way.

David opened his office just a few years ago with middle market commercial being the firm’s primary focus, and with becoming risk partners being the ultimate goal.

He has looked to youth and their knowledge of insurtech to move the firm into the future. David’s team of employees has created a tech stack that allows both the agency and its clients to build an individual website in the cloud, so that clients

“Our technology has

allowed us to be a player at all levels. We can compete for large commercial businesses and we can handle small businesses efficiently and profitably. Clients all get a level of service that is best-in-class.”

—Kyle Houck

can follow their own progress in reducing risk. In addition, because much information is in public domain (particularly workers compensation), Florida Risk Partners can utilize software to share with prospects and current clients ways to reduce risks and, thus, costs.

That technology has enabled the agency to be able to compete for large commercial businesses, while maintaining best-in-class service to small entities.

Florida Risk Partners is approaching $4 million in revenue, has 18 employees (some in Pakistan) and is poised to grow exponentially. And David is happy to announce that “we’ve reached a point where I can dedicate parts of the agency to the team and start giving them equity.”

July

Hitchings Insurance Agency

Findlay, Ohio

Even though Hitchings Insurance Agency is over 50 years old, “we are just getting started,” notes third-generation owner Ryan Pessell. “Our goal is to grow by 18% a year and we fully expect to do so.”

The agency’s foundation continues to be promoted in its logo, where the four vertical lines represent community, customer, dedicated team, and extended family—a commitment to placing people ahead of

policies. “That’s what my grandparents believed and worked toward every day, and we continue to hold that precept as the essence of what we think sets us apart from our competition,”

“We don’t look at

our customers and prospects as insurance

clients, but as people, and we spend time to get to know them and help them in any way that we can.”

—Ryan Pessell

Owner and President

Ryan says, noting that the agency’s retention ratio is 96.4%

“We spend a great deal of time with our team members making certain that they understand and buy in to our approach,” adds Kari Colman, vice president, brand manager and operations manager. “We’re always looking to get better … .”

When Ryan joined in 2008, he started encouraging the agency to invest in two areas: commercial insurance and technology. “We weren’t looking at [technology] as a replacement for people but rather as a way to enhance our ability to service and communicate with clients.”

Hitchings dedicates 5% of its revenue to new technologies, and by turning its focus on commercial lines, the agency’s total revenue is now benefits (34.1%), commercial lines (31.3%) and personal lines (34.5%).

This year, the agency started its Hitchings Gives Back program. “[It] includes not just financial support but marketing support and volunteering. Our people are given two free hours per month to help out at any charity,” Kari says.

August

Aspire Insurance Group

Hudson, Wisconsin

While working at a captive agency, Beth DeLaForest became a founding director of A Rotta Love Plus, a nonprofit that rescues Pit Bulls and Rottweilers. While there, she created a dog bite prevention program.

Then serendipity struck. A volunteer at the rescue was working at an independent agency. “We talked and I was convinced that being an independent agent would let me use my experience and still give me a chance to be helpful,” Beth recalls.Beth built up a book of personal and commercial business and started Aspire Insurance (Hudson, Wisconsin) from scratch in 2014 as a remote agency. “I did this so I would have the freedom and flexibility to be with my family when I needed to and still develop the relationships

“Protecting the culture is especially important here because our clients are part of that culture. We vet our clients and prospects based on how they fit into our culture rather than by class.”

—Beth DeLaForest

President

needed to bring in business to a growing insurance agency,” Beth says.

As a dog lover, Beth established doggoneinsurance.com, which finds homeowners insurance that doesn’t breed discriminate, insurance after an animal liability claim, and business insurance for animal-related businesses—including rescue facilities.

Meanwhile, an agency in Gilbert, Minnesota—Aspire Insurance Agency—started receiving some of Beth’s mail. This led to Beth acquiring the other Aspire in 2020.

“I feel very valued with Beth,” Kaitlyn Jensen, agency manager who joined from the Gilbert Aspire says, adding that, “having Beth and Adam (Beth’s husband and agency chief financial officer) as such supportive leaders has been extremely self-affirming. The flexibility of our hybrid model … has allowed me to work from home when I need to be there.”

Even with a remote team spread out across two continents—Aspire has two virtual assistants located in The Philippines—“our EBITDA is 45% and our retention rate is always in the high 90s,” Beth says.

September

Rathbun Insurance

Lansing, Michigan

From its inception in 1956, Lansing, Michigan-based Rathbun Insurance has successfully melded community interests, education, and the challenge of diversity.

Two years ago, at the “ripe” young age of 28, current President Ben Rathbun unexpectedly had to take over the agency’s helm after the death of his father, Paul, who was one of the firm’s founders.

Well-schooled by Paul, Ben had already shown his mettle by replacing all of the agency’s advertising and marketing with direct donations to nonprofits through its “Quotes for a Cause.” Ben says, “The initiative has done more than help support diverse charitable organizations,” many of which function in the field of education or mentoring.

“We believe in the power of education and its potential to transform lives, and we actively support initiatives that aim to improve educational resources and access for all communities.”

—Ben Rathbun

President

A business outcome has been the creation of a niche that serves the insurance and risk management needs of nonprofit organizations. For example, Rathbun is directly involved in the operation of one of its insureds, the Allen Neighborhood Center (ANC), whose purpose is to improve the health, well-being, and economic opportunities of Lansing Eastside citizens.

“They’re teaching people how to run a business,” Ben says, and the center’s Rathbun Accelerator Kitchen allows “graduates” access to shared equipment, a store-front, and a small public dining room.

Last year, Ben helped local educators form the Insurance BFF Mentorship Program, in which 19 high school seniors were paired with an insurance professional. Most plan to study risk management or insurance in college.

And in the area of diversity efforts, Rathbun is copyrighting its onboarding process under the name of “The Internship Passport” in order to share with others in the industry.

October

Reliance Group of Companies

Burnaby, British Columbia

Jim Ball started as an agent in 1982 with a desk, a phone book, and an entrepreneurial spirit he apparently passed to his son. That son, Chris, now leads the agency and affiliates serving clients across Canada.

Chris worked at the agency briefly in the 1990s before leaving to gain experience handling insurance and risk management needs of Fortune 1000 accounts, working with big brokers in New York; San Francisco; and Vancouver, British Columbia. He rejoined his dad in 2005, bringing expertise in large, complex risks.

When he first returned, Chris says, he “wasn’t sure this (arrangement) would work. Dad and I are different in many ways.” But they’re the same where it counts: wanting their firms to succeed so their 100-plus employees can, as he says, “come to a place where they

“We ask staff what we should keep doing, what we should stop doing. We even tell interviewees that if they want

micromanagement, they’ve come to the wrong place, but if they want autonomy, come on in.”

—Chris Ball

CEO

enjoy what they are doing and are proud to work for a company that takes care of its customers and its community.

“Now,” Chris admits, “I don’t know what I would do if Dad wasn’t here. He is 82 and he still comes in every day; he is a grounding presence to the culture of the organization. … We have built our agency by listening to people and he has led that effort.” Those people have helped Reliance reach $20 million in revenue, a number they aim to double in five years.

Besides supporting employees and customers, Reliance gives back to the community—as leaders of The Insurance Brokers Association of British Columbia, and through a range of programs, from housing construction in Nicaragua to PALS Adult Services Society, which provides daily programs and independent housing for adults with autism spectrum disorder.

November

The Dunn Group

Towanda, Pennsylvania

The Dunn Insurance Agency was founded during the Great Depression. Today, the third generation of Dunns, brothers Hank and Bryant, help operate seven locations—now under The Dunn Group, after acquiring Swan Morss, a New York-based agency.

“I think more than anything, the natural fit was our commitment to our teams and being family oriented,” says Josh Palmer, president of Swan Morss.

“Our employees are part of our family and we’re willing to bend on their various needs that they may need to attend to,” adds Hank Dunn, president of The Dunn Group.

“We wouldn’t be here 90 or 170 years without the time and energy our past and present team members have put in; 100% of the credit is given to them, because they’ve been pivotal to our growth.”

—Bryant Dunn

Chief Operating Officer, The Dunn Group

On an agency development level, vision boards are used. One employee idea driven from this process led to the creation of the agency’s education center, Dunn U. “It’s an onboarding process, where we educate clients on technology we provide or extended services (HR, benefits, risk management and more) we offer,” Josh says.

Considered to be generalists, The Dunn Group offers a wide range of products from personal and commercial lines, financial services, real estate services and employee benefits.

“Benefits is a fast-growing area for us; we offer captive products, self-insured administration, ICHRAs, executive benefits, voluntary, individual products and more,” says Hank. The agency also has niches in landscapers, manufacturing, and Bitcoin mining insurance.

Known in the community for volunteer work, team members spend significant time supporting schools, nonprofits, hospitals, community groups, and youth sports.

“Our pillars have always been our clients, our colleagues and our community,” says Bryant Dunn, chief operating officer. “A consultant recently looked at [our giving records] and said we gave 80% more than a typical agency our size. We’re proud of that.”

December

First Citizens Insurance Services

Raleigh, North Carolina

To “meet customer needs through a broad array of financial offerings,” First Citizens Bank formed First Citizens Insurance Services in 1999 after purchasing a 100-year-old agency. Within two years, four additional agencies were acquired.

“Our value-add to the bank’s customers is our ability to protect their growth through risk management and risk mitigation,” says Bill Fryer, manager-insurance services.

To provide its clients with the best protection for their businesses, the agency established its four-step Beacon Program, which, “determine[s] the best risk management approach for each customer or prospect,” says Tim Hrehor, manager-commercial insurance sales.

“Our value-add to the bank’s customers is our ability to protect their growth through risk management and risk mitigation.”

—Bill Fryer

Manager-Insurance Services

“Thanks to the information about each client that we develop through our Beacon Program, we have been able to put together teams of experts that can handle the risk management needs and services of a growing list of niche areas.”

Some of these include medical, manufacturing, construction, and property management.

Julia Benfield, manager-commercial insurance service, works alongside Tim to develop effective high-performance teams. “We take a proactive approach with our clients, including sending out our own risk manager to help them mitigate potential losses.”

“None of us looks to quote business,” adds Commercial Risk Advisor Kristen Charles. “We are instead focused on providing the best risk management solutions. If people are looking for quotes, they’ve come to the wrong place.”

First Citizens also offers a variety of concierge-level services, including loss control, claims management, ongoing risk strategy meetings, workers comp experience mod review, cyber risk review, and technology tools that provide a client self-service capability to add a vehicle or obtain certificates.