Who will be the 2024 agency of the year?

One of the agencies featured in a Rough Notes cover story during 2024 will be named Agency of the Year. The winner will be selected based on votes from previous Rough Notes cover agents.

The nominees for this year’s award are described on the following pages. The winning agency will be announced in the February 2025 issue of Rough Notes.

The principals of the winning firm will be presented with the award at a dinner held in their honor this spring.

February

Árachas Group Insurance

Bartlett, Illinois

In 2017, two family agencies in the Chicago metropolitan area—Sullivan & Associates and Bartlett Insurance Group—merged and became Árachas Group. “It is pronounced awe-rock-us and means ‘insurance’ in the Irish language. We like to think that we mean insurance in any language,” says Chief Executive Officer Bill Sullivan.

“There’s an attitude here that’s special,” adds Chief Sales Officer Brian Dolewski. “It’s aggressive but we also have fun. Our ultimate goal is to succeed by helping our clients succeed.”

In July of 2021, Árachas joined Keystone Agency Partners (KAP). “At that time, we were just shy of $10 million in revenue. Two years later, in July of 2023, our revenues were just shy of $24 million,” Bill says.

Thanks to the support of KAP, the agency was able to acquire eight independent agencies. “That is an important part of our acquisition strategy,” Bill adds. “We are looking for partnerships that will add to our expertise and niche offerings. Most agencies experience growing pains every five to ten years. But we’re having growing pains every six months.”

Chief of Staff Bethany Snyder joined the agency from KAP in 2022 to “execute our strategic plan,” she says. “Our extraordinary growth means that we are almost always in some stage of change, which can be tough, but it also presents an enormous opportunity. ‘Don’t Waste the Chaos’ has become my mantra as I explore the best way to maximize this opportunity.”

The agency is also heavily involved in the community, working with—among other charities—Young Hearts for Life, an organization that works to prevent cardiomyopathy.

“We look to double organically every five years through double-digit growth annually. … [M]ost agencies experience growing pains every five to ten years. But we’re having growing pains every six months.”

—William “Bill” Sullivan

Chief Executive Officer

March

Southern States Insurance

Atlanta, Georgia

“Heck no,” was Jim Schubert’s first reply to his dad’s invitation to join him at Southern States Insurance (SSI), the metro Atlanta firm that John Schubert had founded back in 1992. However, having spent some years in shivery New England, warmer temperatures beckoned Jim, and he negotiated a one-year trial. That was in 2001.

What attracted Jim was his father’s innovative entrepreneurial spirit and his across-the-board emphasis on relationships—with everyone from clients and producers

to acquisition prospects and even competitors. Add to that the judicious hiring of Jim’s childhood friend, Iraq veteran Jon Hall, who had learned that the army is based on relationships in the same way that agencies are known to operate.

During the 15 years that Jim and Jon climbed the ladder to CEO and COO respectively, the firm expanded and opened six locations (now 40 employees in nine states). This necessitated linking these offices together. Says Jim, “We were one of the first agencies in the country that Applied worked with to link dispersed offices through a single server.” This process, along with VoIP and instant messaging, worked well for SSI during the pandemic—and to the present day. For example, 65% of SSI’s employees now work remotely full-time.

All of this speaks to the creation of, and the operation according to, Southern Insurance’s five innovative Core Values: Passionate Advocate for Others, Creative Problem Solver, Grow or Die, Get Stuff Done, and Great Attitude.

“What was most surprising was how well my experience in the Army translated

to my work at the agency. Just like in the agency business, relationship building was equally important in the Army.”

—Jon Hall

Chief Operating Officer

April

Sound Pacific Insurance

Tacoma, Washington

Elisha Cavanaugh’s insurance career started at age 16, when she got a part-time job in a local agency. Since 2012, she has led her own firm, and recently was recognized in Safeco/Liberty Mutual’s Agent for the Future program as Outstanding Female Agency Principal.

Among factors driving her success—and leading to the award—are her dedication to creating a positive culture for employees, helping customers understand insurance, and advancing the industry as a whole.

Elisha formulated her agency in a way that would let her, then the mom of a 15-month-old, have time she needed for her son while still providing excellent service to the clients she would attract and the insurance companies she’d represent.

In running her agency, Elisha—a self-described “insurance nerd”—is proud of one trait some find to be elusive: the ability to translate insurance into plain English. “One of the key focus areas in how we deal with clients is the notion of simplifying insurance concepts and trends,” she explains. “We strive to decode coverage and industry jargon with easy-to-digest terms.”

As an agency leader, she values the willingness of competitors to share insight with each other. “I really find value in my collaboration and connection with other agency owners across the country,” she says. She helped create a Facebook group called Insurance Mavericks. “The group hasn’t just given me great friends,” Elisha notes. “It’s become a crucial resource for gaining knowledge and advice.”

Agency team members are driving the firm’s success. Elisha says they “work hard to keep customers happy, and that is proven by the fact that we have more than 300 positive Google reviews—and counting.”

“What I like best about the (independent agency) channel is that we can all do it differently and still succeed in whatever manner we deem to be most important.”

—Elisha Cavanaugh

Founder and President

May

Iron Insurance Partners

Salina, Kansas

When Kansas agencies Keller Leopold and Assurance Partners (formerly Insurance & Investors, Inc.) merged, they broke the mold of “like” acquiring or merging with “like.” And yet, their seemingly different methods of focus and operation, when coupled with similar values of integrity and service, resulted in the creation of Iron Insurance Partners, which is now one of the largest providers of risk management and risk transfer services in the Midwest.

Because Keller focused primarily on smaller clients, it looked to acquire like-minded agencies, while Assurance looked for prospective agencies that focused on large commercial accounts. When both groups engaged the services of BroadStreet Partners to help them in the acquisition process, BroadStreet came up with what might have seemed to be a strange suggestion: a merger of the two firms, despite their differences.

CEO Shawn Myers (formerly of Keller) says, “In short, we realized that we would be stronger together,” with President Mark Skidmore (formerly of Assurance Partners) bringing his sales talents to complement Shawn’s managerial skills. In addition, both firms agreed that they would be employee centric, community centric, and client centric—rather than money centric.

The agency’s Producer Pathway to Ownership offers bonuses that can be turned into ownership. Individual offices have individual team members who support philanthropic activities, and all levels of the 80-plus-year-old agency are client-centric.

“While both entities have primarily stayed in their respective lanes, the larger size has provided us with growth in areas that were unreachable before.”

—Jim Wilson

Executive Chairman

June

Associated Insurance Services

Boise, Idaho

Associated Insurance Services, which was formed to drive marketing and customer service for a non-assessable workers comp reciprocal exchange for loggers in Idaho, now delivers a range of other products and services in more than a dozen states. Over the last 15 years, the agency deepened its logging specialization while making a name for itself as a generalist, bringing on key carrier partners and entering new segments, including employee benefits and personal lines.

In 2022, the team created Axe Insurance Group to provide general liability, commercial auto, equipment, and excess liability for loggers and log truckers in the Northwest. A big part of the program’s success is that it’s offered by an agency owned by loggers who truly understand what loggers go through every day.

“[B]ecause our people truly are part of their industry, they won’t have to deal with typical insurance crap,” says Bryan Graham, forest products director. “We promise to … handle [their] insurance needs like we would handle the needs of a family member. Like our slogan says, ‘You cut the logs; we’ll cut the crap.’”

To drive a clear risk management focus, the agency offers what it calls Peak360 as its promise to clients. It’s a “five-step approach to develop a risk management program: identify, design, execute, procure, and monitor,” says Commercial Risk Director Clint Paskewitz.

Team member development is another key success driver. “One of our major efforts as the leadership team over the last eight years has been to be an employer that we would want to work for,” says Emily Koleno, director of operations. “We encourage [our people] to learn and we pay for and encourage them to get designations.”

“We recently set up Associated Cares to provide support for people in need and several nonprofits in Idaho. We encourage our people to get involved in their communities

by providing them with paid time to volunteer.”

—Emily Koleno

Director of Operations

CEO Jack Wingate

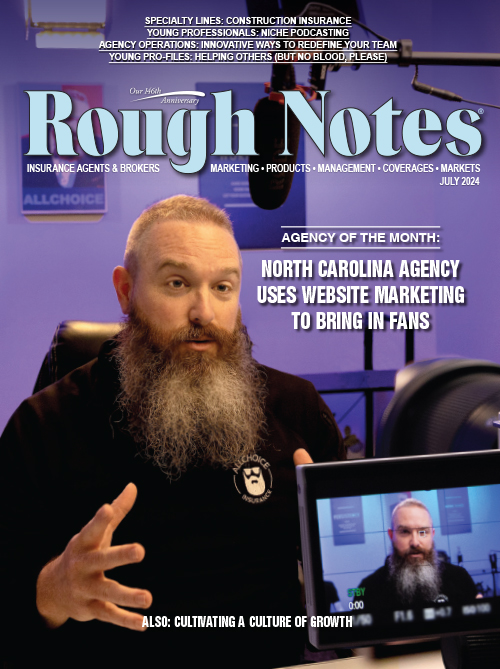

July

ALLCHOICE Insurance

Greensboro, North Carolina

Current major changes in today’s business world, and particularly in the change-sensitive insurance industry, were tailor-made for a techie guy and computer salesman Jack Wingate. While consulting about auto insurance with a fraternity friend some 20 years ago, Jack received a challenge to give insurance a try. And that’s how ALLCHOICE Insurance of Greensboro, North Carolina, came into being.

The agency’s name itself reflects Jack’s two goals: to give clients a choice through education and to do it through the use of technology—namely 10- to 12-minute educational videos. “I recognized that I needed to create a system that could get the job done quickly, with quality and repeatable processes, so technology would play a part,” Jack points out, adding that education leads to client trust, satisfaction, and retention.

These videos are a sort of client “meeting” that explains coverages, anticipates questions, and finally offers a quote. In addition, current clients also receive a video that explains current market problems, thus establishing more trust. Proof? Seventy percent of the agency’s business comes from its website.

Beside’s Jack, ALLCHOICE’s team consists of a marketing director, an operations director, a director of client experience, and a number of outside producers. It also includes three virtual assistants through Agency VA.

Jack’s staff enjoys unlimited time off and has never abused that benefit. “In fact,” laughs Jack, “the only problem I’ve ever had in that regard was when I had to tell one member of the staff to take some time off.”

“We have a ticketing system to make certain that we respond quickly. … [W]e let them know that they will receive a video within 24 to 48 hours … that will explain the coverages we recommend, and that we will offer a number of solutions along with the costs for each.”

—Jack Wingate

Founder

August

Apple Valley Insurance

Greenville, Rhode Island

In 2004, The brother and sister team of David Brush and Nancy Mendizabal purchased their father’s agency with his namesake, rebranding it as Apple Valley Insurance.

“David and I complement each other so well with different strengths but very important commonalities including a similar risk tolerance where we are both willing to try new things and delight in the successes, while learning from the failures,” Nancy says.

“Another important value that Nancy and I share,” David adds, “is our love of learning. We are learners and teachers for life. That is one of our core values.”

During the pandemic in 2020, “five agency employees went home with laptops—and haven’t come back since. Now we have 11 people working remotely, and that number will grow. We learned how to hire remotely, and we even successfully completed two acquisitions during COVID,” Nancy says.

The results speak for themselves. From January 2019 to December 2023, the agency tripled in size.

With a remote team, the agency hosts Monday morning Q&A sessions and Tuesday team meetings. “Then, twice a week, we have shoot-the-breeze meetings, where we get to know each other. We don’t talk work,” Nancy says.

As for the agency, “for the first half of 2024, we worked on internal efficiency, team talent allocation, retention and rounding,” Nancy says. “We are transitioning our focus to growth in the second half of 2024 and then make another acquisition in 2025.

“Our goal is to end 2027 at $15 million in premium,” she adds. “We will continue to invest in and empower our team; we see this as the leading indicator of our success and our greatest asset.”

“[W]e are learners and teachers for life. That is one of our core values. … We used to focus on a person’s skills when making a hiring decision. Now, all decisions are based on how well the individual fits with our core values and culture. The result of this change has been dramatic.”

—David Brush, CIC

Agency Principal

September

Tower Street Insurance &

Risk Management

Dallas, Texas

Despite the pandemic in 2020, Tower Street Insurance & Risk Management, which opened its doors that May, started with a growth spurt that saw revenues quadruple to reach an expected $15 million this year. At the same time, the number of employees grew to 70 from 12.

“We actually found that the pandemic, as horrible as it was, helped us in some ways,” Founder Ashleigh C. Trent recalls. “People were definitely focused on risk … [and] were happy to spend time on the phone with us and, since our approach centers on partnering with clients rather than selling insurance, it played right into our strength.”

“Our primary goal is loss prevention and preparation,” Chris Peterie, agency founder, explains. “We work proactively with our clients to head off potential losses, leading with education, and we provide help with safety, continuity planning, and OSHA, DOT, and EPA regulations and requirements.

“All of this is based on an extensive enterprise risk management assessment that includes a full coverage gap analysis of a company’s current insurance coverage program, their internal risk management, and loss prevention program,” he adds.

Recently, Tower Street entered the employee benefits field, providing everything from health insurance, vision, group life and AD&D, to short- and long-term disability, HSAs, FSAs, and supplemental insurance.

To support the communities it serves, Tower Street created a foundation and sets aside a percentage of its revenue to support local organizations and charities. These acts have contributed to the agency consistently earning top grades on Glassdoor, as well as being named “best places to work” in the Dallas Business Journal and Dallas Morning News.

“Our goal in starting Tower Street was to create an agency that provided the best experience for its employees, customers, and carriers. And that all starts with a culture of service.”

—Chris Peterie

Founder

October

Camargo Insurance

Cincinnati, Ohio

When suburban Camargo Insurance moved into downtown Cincinnati in 2019, third-generation owner Jay Mueller recognized that the agency needed to “reboot” into Camargo Version 2.0. What did that entail?

First it would retain its name, which was based on the street on which it had been located for 60 years. Second, says Jay, it would take advantage of the presence of nearby universities “where it could create the energy needed to attract and retain the great people we needed to take the agency to the next level.

” Third, it would need to move into the technological age to meet “the next generation of customers where they wanted to be.” How to do all of that?

In order to create a new type of team, Camargo looked for talented people outside of the industry, whom they could teach insurance. Then, they introduced the Entrepreneurial Operating System (EOS), which helped their leadership team manage and fuel growth. Next, Premier Strategy Box provided coaching in setting up key performance indices (KPIs) and bringing technology up to date.

Jay then looked for guidance from leaders both inside and outside the insurance industry and created an advisory board to serve as mentors.

Despite its rapid growth, operational changes, and team-building efforts, Camargo has managed to maintain a policy of community outreach through its Camargo Cares-Pay It Forward program, which supports nonprofits by donating a percentage of revenue to that community. In addition, team members support nonprofits through Camargo’s community service days.

“Because I was looking for guidance from leaders both inside and outside the insurance industry, I set up an advisory board … . I was able to find a bench of professionals … to choose from, many of whom were executives in the second stage of their careers who were passionate about helping entrepreneurs grow their business.”

—Jay Mueller

Chief Executive Officer

November

Jaffery Insurance

Omaha, Nebraska

In 2002, a woman emigrated from Afghanistan with her five children, including 14-year-old Cyrus, who admits he “didn’t speak English very well.” But he was willing to work hard, desired to help people, loved learning, and boasted an engaging personality. His brother Ahmad says, “He’s great at meeting people and becoming their friend in that first meeting.”

These traits led Cyrus to excel as a captive agent. But he felt he could help more people as an independent, so in 2019 he launched Jaffery Insurance. He, Ahmad, and their brother, Bobby, lead the Nebraska-based firm, which has 1099-based agents around the country.

Phones are answered in a way that differentiates the agency from the competition: “We’re having a great day at Jaffery Insurance. How can I help you have a great experience?” During calls, agents determine not just the insurance needs of clients and prospects, but how they want to communicate with the agency and how often.

The agency created technology that incorporates these preferences and, more than that, delivers quotes within 60 seconds from multiple companies. Agency leaders drive sales accountability through twice-daily “Circle of Trust” meetings where metrics are reviewed. “I borrowed this idea from my workout group,” Cyrus says humbly. “Everything I do comes from something I’ve heard or seen.”

Social media plays a key role in the agency’s marketing. The agency hosts a library of short videos explaining various aspects of insurance and offering positive stories about how insurance helped people. The firm also uses video to thank people who provide reviews of the agency, something Bobby says has a “greater impact than a written thank you.”

“My ultimate goal in life is to have a positive impact on at least one million people. As an agency, we’ve been able to provide jobs to people and opportunities for agents struggling to establish themselves.”

—Cyrus Jaffery

Founder and CEO

December

Rate Insurance

Schaumburg, Illinois

Thirteen years after being founded by a mortgage lender to help its customers secure homeowners insurance, the growth at Rate Insurance proved so successful that it became a stand-alone entity in 2021.

Today, the agency has roughly 200 employees in 40 states and works with 100-plus carriers. “[We] have more than $184 million in premium placed,” says Jeff Wingate, executive vice president and general manager of insurance. “At this point, roughly 96% of that is coming from personal lines.”

With a deep understanding of the mortgage process, the agency continues to grow its outside leads sources with companies that do business with home buyers, like home alarm, home services, home inspection, and moving companies.

“We are always looking for ways to get better and to speed up our process and ensure that the policy is in place quickly so the loan can close on time,” says John Deichl, executive vice president of business development.

The agency’s growth through its investments in technology and other accomplishments contributed to its being honored as the 2023 Agent for the Future by Liberty Mutual/Safeco.

“Using the [tech-driven platform we built] ensures that the information we provide to customers is up-to-date and consistent with what is happening in the marketplace,” Jeff adds.

“Our automation and augmentation efforts are measured against their impact on the agency’s revenue per employee and, I’m proud to say, that has risen significantly,” adds Ryan Haggard, senior vice president of Product and Technology.

Even though the agency is 100% remote, “we spend a great deal of time building a positive culture,” Jeff says. This is achieved with cultural and charitable virtual and in-person events.

“Our goal is to be a top 50 national insurance broker … with the commitment that the more

we grow, the more good we will do. That is our ultimate goal.”

—Jeff Wingate

Executive Vice President and

General Manager of Insurance