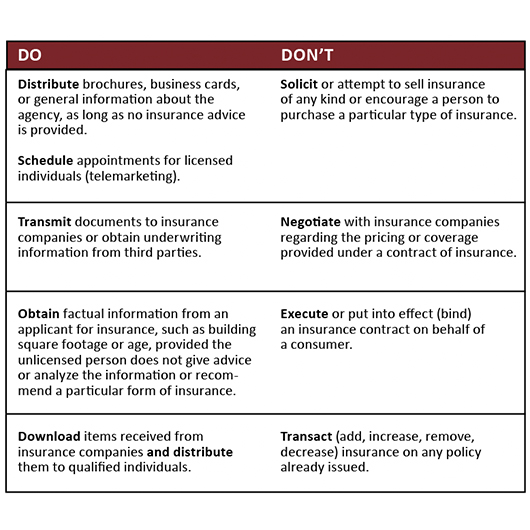

The do’s and don’ts when assigning tasks between licensees and non-licensees

When in doubt, require every client-facing position

to hold an appropriate license and always check with an attorney … for guidance.

By Cheryl Koch, CPCU, ARM, AAI, ACSR, AFIS, and Mary Belka, CPCU, ARM, ARe, RPLU, CIC

A participant in a recent class asked if we had a checklist of the types of transactions that could (or could not be) performed in an agency without the individual possessing a property and casualty license. Her concern was that some individuals in the agency processing items on behalf of the account managers were not, for whatever reason, currently licensed.

The unfortunate answer is that we would have to have 51 such checklists because of the variation in state laws and regulations. The National Association of Insurance Commissioners (NAIC) developed model laws and regulations years ago in an attempt to make licensing requirements more uniform. That’s when they created the NIPR (National Insurance Producer Registry) and we all got to memorize a new number—our NPN—or National Producer Number.

The idea was to establish more uniformity and make it easier for an agent to obtain and maintain non-resident licenses. Unfortunately, the NAIC has no ability to change state law, thus the use of the term “model law.” They can only encourage their members to return to their state and convince a legislator to sponsor a change.

However, there are some things that are almost universally true when looking at the various state rules—from New York, which has some of the strictest, to California, which tends to grant a wider berth. Selling any type of insurance contract or analyzing, recommending or giving advice about insurance policies without a license is prohibited in virtually every jurisdiction. Many states, however, will allow a non-licensed person to set appointments for agents, obtain expiration dates, or seek permission to have a licensee contact a prospective agency client.

Where things get tricky is when we come to the so-called “clerical” tasks. Keep in mind that many state laws pre-date the high levels of automation we see in today’s independent agencies.

Back in the “Stone Age,” when we first got into the business, there was little use of the term “account manager.” Agencies preferred to use the title CSR (Customer Service Representative) thinking that this was a way to avoid having people licensed. After all, they were just doing “clerical” tasks like typing forms and sending requests to insurance companies.

One’s job title is not mentioned in any state licensing law of which we are aware. Licensing rules are governed by the type of tasks performed and even those “clerical” functions generally require that the unlicensed person be working under the direct supervision of a licensee. With automation, the number of “merely clerical” tasks is reduced almost to non-existence, thereby transforming the account manager job to one that clearly requires a license.

To understand this better, it is helpful to consider what licensing laws attempt to accomplish, whether that’s in the insurance industry, the medical profession, or at your local spa or hair salon. Licensing generally sets forth a minimum level of knowledge that consumers can expect a provider to possess.

The mission of most state departments of insurance is to protect insurance consumers. Licensing (and required continuing education) is intended to set a minimum level of knowledge that is acceptable for interacting with potential buyers of insurance. The public should be able to rely on the fact that a person offering insurance products for sale has taken and passed an examination to receive a license. Granted, it’s not exactly rocket science to obtain a license in any state, but it’s better than nothing. Licensing is only the starting point on the lifetime journey of risk management and insurance education.

So, what general conclusions can we draw from a review of the various state requirements for licensure? In the chart below are some do’s and don’ts that may provide guidance when assigning tasks between licensees and non-licensees:

Some of the “thornier” issues where it is difficult to talk in absolutes would be:

Claims. In some states it is permissible for a person to take a first report of a loss from an insured and pass it along to the company claims department or an internal claims handler in the agency.

Auto ID cards. Some states specifically prohibit an unlicensed person from issuing an ID card and, by extension, may also prohibit one from issuing certificates or other evidence of coverage.

Payments. Many states expressly prohibit unlicensed individuals from collecting premium payments from consumers except for agency-billed items. (We’ve been cautioning you about this for years!)

Also, keep in mind that insurance carrier contracts (agency agreements) may also restrict or prohibit certain types of transactions being delegated to unlicensed individuals, regardless of whether or not the law in that state permits it.

Unfortunately, a very fine and imprecise line exists between what is considered “clerical” and what may or may not be construed as giving advice, making recommendations, or putting coverage into effect. When in doubt, require every client-facing position to hold an appropriate license and always check with an attorney who is familiar with licensing laws and/or your state department of insurance for guidance. n

The authors

Cheryl Koch is the owner of Agency Management Resource Group, a California firm providing training, education and consulting to producers, account managers and owners of independent agencies. She has a BA in Economics from UCLA and an MBA from Sacramento State University. She has also earned several insurance professional designations: CPCU, CIC, ARM, AAI, AAI-M, API, AIS, AAM, AIM, ARP, AINS, ACSR, AFIS, and MLIS.

Mary M. Belka is owner and CEO of Eisenhart Consulting Group, Inc., providing management and operations consulting to the insurance industry. She also is an endorsed agency E&O auditor for Swiss Re/Westport. A graduate of the University of Nebraska, Mary holds the CPCU, ARM, ARe, RPLU, CIC, and CPIW designations.