Turning structural data into customized

survivability scores enhances guidance,

supports placements and builds resilience

By Maura C. Ciccarelli

A whopping $2.9 trillion—that’s the toll that natural disasters have taken in property damage over the last 45 years, according to the National Oceanic and Atmospheric Administration (NOAA). In 2024 alone, the agency tallied 27 billion-dollar disasters, totaling $182.7 billion in damages, making it the fourth-costliest year on record.

These numbers are shocking but not surprising to industry watchers. And they don’t begin to illustrate the human cost in lost lives, livelihoods and whole communities caused by wildfires, hurricanes, floods, hailstorms and more.

What if there were ways for agents and brokers to directly help homeowners make their properties more resilient in higher-risk zones?

That’s the mission of one company, climate-risk and property analytics startup Faura. Founded in 2023, the firm’s platform harnesses structure-level data for properties to generate survivability scores and mitigation guidance for agents and brokers to share with clients. And it helps with prospecting in risk-prone regions.

“In today’s environment, the question is no longer if a natural disaster will strike—it’s which homes will actually survive,” says Brenden Corr, Faura’s director of sales. “Clients are frustrated, shopping and demanding answers. Renewals are harder to retain and placements harder to get right. And most agents are still quoting with surface-level data that doesn’t tell the full story.

“Renewals—often synonymous with bad news —now become strategic opportunities. Brokers can proactively guide clients with tailored mitigation plans and survivability insights to

improve insurability.”

—Andrew Katz

Senior Vice President,

Business Strategy and Growth

“Fire maps are great, but that doesn’t mean every home in a fire zone is a bad risk. Some homes should be in the open market or getting better rates due to improved structural components and resiliency.”

—Brenden Corr

Director of Sales

Faura

“In most cases, a home is a person’s most valuable asset,” he adds. “Faura allows agents to work directly with homeowners to improve their survivability as natural disasters continue to increase.”

That’s because Faura goes beyond hazard maps and climate models with property-specific data. “Fire maps are great, but that doesn’t mean every home in a fire zone is a bad risk,” Corr explains. “Some homes should be in the open market or getting better rates due to improved structural components and resiliency.”

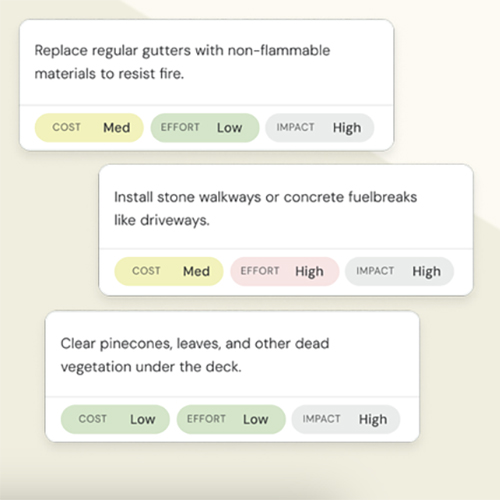

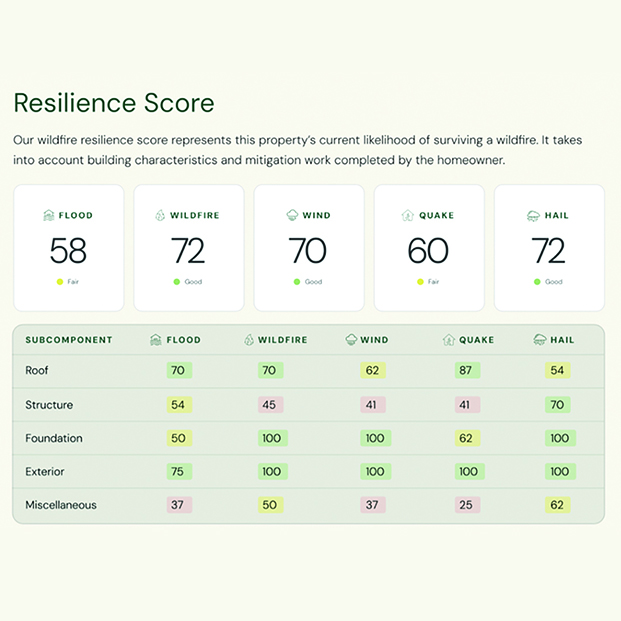

The Faura system evaluates more than 150 factors to produce a 0–100 survivability score across five perils—wildfire, flood, hurricane, hail and earthquake—and pairs the score with a mitigation roadmap for property owners. This shifts agents and brokers from quoting to advising.

Andrew Katz, senior vice president of business strategy and growth at MarshBerry, says Faura creates a connected ecosystem that aligns homeowners, brokers and insurance carriers around risk and survivability. “Renewals—often synonymous with bad news—now become strategic opportunities,” he notes. “Brokers can proactively guide clients with tailored mitigation plans and survivability insights to improve insurability.”

“Using Faura has been amazing in my conversations with clients,” says Emily Wycapelk, CEO of Ground Up Insurance, an agency based in San Antonio, Texas. “Instead of just running numbers, I’ve been able to actually pull up specific homes I was insuring and use the tool as a bridge to talk through potential risks.

“It wasn’t just about quoting a policy,” she adds. “It was about equipping people with knowledge and options so their coverage actually matched the reality of their home.”

Faura’s origins

Faura was co-founded by two technologists whose personal experiences with wildfires shaped the company’s mission.

Chief Executive Officer Valkyrie Holmes grew up in Las Vegas, where smoke from distant wildfires often blanketed the community. She developed data-science skills at NASA’s SEES Institute and engineering experience at SpaceX, then committed to climate mitigation as a 776 Foundation fellow.

Chief Technology Officer Amanda Southworth was raised in Southern California amid repeated wildfire evacuations, and she built safety- and accessibility-focused products in roles at Astra Labs and Vylto.

Together they launched Faura to help insurers, agents and homeowners understand property-level climate risks and take actionable steps toward survivability.

Incentivizing mitigation action through the insurance process became Faura’s key mission. Homeowners get a free self-assessment report by completing a smartphone walk-through of their property. This digital inspection generates a survivability score for each type of risk, as well as a custom mitigation roadmap.

Meanwhile, insurers, agents and brokers pay a subscription for structure-level insights that go beyond hazard scores or ZIP-code data.

“We don’t do internal electrical or plumbing, but we’re looking at structural components—how it’s built, permitted, the roof size and slope, defensible space, and nearby vegetation—the characteristics that define survivability,” says Corr.

Building stronger client relationships

Faura’s analytics help agents and brokers identify prospective customers based on structural survivability, enabling more profitable and better-placed business. For these agents and brokers, the system produces quick prospecting reports and deeper manual assessments with survivability scores and roadmaps for each peril.

“Instead of just running numbers, I’ve been able to actually pull up specific homes I was insuring and use the tool as a bridge to talk through potential risks.”

—Emily Wycapelk

Chief Executive Officer

Ground Up Insurance

MarshBerry

Through Faura, carriers now get access to first-party verified data and can set risk thresholds—for example, not underwriting below a Faura score of 65—while agents guide customers toward improvements that raise scores and restore eligibility for preferred carriers if they originally had to be in the E&S market.

Agencies can also run their book through Faura to flag rising-risk properties and deliver mitigation steps before renewal, which improves both retention and margins.

Faura team members Brenden Corr,

Director of Sales; Amanda Southworth,

Chief Technology Officer; and Valkyrie Holmes,

Chief Executive Officer, at the 2025 ITC Vegas event.

Updated survivability data leads to making properties easier to place and less likely to be dropped, Corr says. “Instead of saying, ‘Your premium went up 30%,’ you can say, ‘Your risk score dropped after clearing defensible space. Take these two steps and I can now present a complete and improved risk profile to your carrier.’”

Price competition is common, but few agencies help protect assets, he adds. Faura equips teams to act as educators, advocates and risk managers.

Prospecting becomes more efficient. “If I have 100 homes in a ZIP code and put all 100 into Faura, I know which are best to prospect,” Corr notes. “Typical quote-to-bind is around 10% to 12%. If an agent can now pre-select the top 20 properties based on the survivability, they have instantly improved their efficiency and quote-to-bind ratio by bringing top properties to their tier-one carriers.”

Reports quantify the cost and difficulty of mitigation steps (e.g., trim limbs yourself vs. hire an arborist) and show how each step improves the survivability score. This first-hand, verifiable data gives insurers confidence at renewal.

“Much like a credit score, we want carriers, agents and homeowners using the same data, risk profiles and survivability signals,” Corr says. “That way, you know which properties to bring to preferred insurers—and which to send to the secondary market—and what to do to move back.”

For insurers, the homeowner’s digital inspection gives better underwriting data to deliver the best premium that can include mitigation-earned discounts. “Agents and brokers can prepare and qualify risks so that, at renewal, they have a better story to tell the carrier,” Corr adds.

The result: a positive feedback loop of trust, transparency and partnership between the carriers, agents and homeowners.

Faura’s goal is to help agencies prospect smarter and more efficiently, improve quote-to-bind ratios, retain clients with proactive renewal strategies and communicate clearly about the steps homeowners can take to strengthen survivability and insurability—helping communities prepare for the disasters everyone knows will come, even if they don’t know when.

“For agencies navigating shrinking markets and rising client demands, the future of growth isn’t quoting faster—it’s becoming a true, trusted risk advisor,” Corr concludes. “Faura helps you do exactly that.”

The author

Maura C. Ciccarelli is a longtime freelance journalist originally from Philadelphia. She writes about business and more from an adobe home in southern New Mexico, after spending nine years living on the road full time with her husband in their Airstream trailer.