Fifteen years of public policy education and

engagement with agents and brokers, customers, and the public

By Maura C. Ciccarelli

Standing at the engagement point between the insurance industry and public policy since 2009, the Travelers Institute has reached more than 435,000 people at over 1,100 in-person events, through its Wednesdays with Woodward® webinar series, and via its newly launched Travelers Institute Risk & Resilience podcast. Nearly 100,000 independent agents and brokers follow the Institute for online and in-person events. The Institute also sparks conversations at holiday dinner tables through its annual distracted driving virtual media tour, which reaches millions of people across the country around Thanksgiving time.

“It feels like we’re just getting started,” says Joan Woodward, president of the Travelers Institute and executive vice president of Public Policy at Travelers.

The conversations among some 600 speakers from academia, government, and the industry over the years have sparked ideas and surfaced actionable solutions through widely accessible programming, Woodward says. Recent topics have included the industry outlook for independent agencies and brokers, cybersecurity, the everyday risks facing ordinary people and businesses, disaster preparedness and challenges, and more.

“Four years ago, I never would have thought, we should have a webinar every Wednesday,” she says. “In just this past six months, we launched a podcast because people like to get their content through podcasting instead of sitting at a webinar looking at a screen.

“I want people to have access to us when they’re skiing, when they’re gardening, when they’re golfing. And we’re action oriented. We want you to learn. We want you to tune in to the next podcast. We want to give our viewers or listeners a reason to come back.”

The beginning

Woodward says that 15 years ago, the idea for creating a thought leadership, educational and public policy platform for Travelers originated with then-Vice Chairman Alan Schnitzer, now Travelers’ CEO. “Since we are in a heavily regulated industry, Alan wanted to share our deep risk management expertise and for Travelers to educate, inform, and make policymakers and regulators aware of how our industry works,” says Woodward.

“I want you to be able to tune in and learn and think

about the subject material. And, second, I want the

webinar to be impactful and actionable.”

—Joan Woodward

President

The Institute’s audiences also include independent agents and brokers, and programs have reached out to businesses and the general public as well.

Before joining Travelers, Woodward founded and led the Goldman Sachs Global Markets Institute, the firm’s international public policy and institutional investor educational platform. She also served on Capitol Hill for a dozen years as deputy chief of staff for the U.S. Senate Finance Committee under Chairman Bill Roth, where she was instrumental in creating the Roth IRA. Prior to that, she was chief economist for the Senate Governmental Affairs Committee and the U.S. House Budget Committee under Chairman John Kasich.

Tackling tough topics

Woodward says recent programs like the Every Second Matters® platform, which raises safety awareness around distracted driving, have been very well received. In particular, its “Unfinished Stories” videos talk about lives that ended abruptly and unnecessarily because of a distraction.

“We’ve gone to over 100 colleges and universities to talk to students about the importance of calling out your friend who might be distracted by things like talking on the phone,” Woodward notes. The program also targets other audiences, ranging from teenagers or adult drivers to commercial truck drivers.

In the cybersecurity realm, the Institute has partnered with the Department of Homeland Security, the FBI, the U.S. Small Business Administration, and other organizations in awareness campaigns to share knowledge about public and commercial organizations that oversee waterways, electrical grids, school systems, and businesses, so they can be prepared for a cyberattack.

A new program in 2025 will focus on Workforce Risk, a kind of “risk and insurance” take on employee well-being. It’s designed to improve employee engagement and mental health to reduce the risk of workers comp accidents. It tackles why it’s important for day-to-day safety to get enough sleep, regular exercise, and good nutrition.

“Engagement is difficult in these times of uncertainty—not just here but also globally,” Woodward says. “People are worried about their future, their children, and what’s going to happen in their country.”

These issues, she adds, really struck a nerve with Institute followers, so there are plans to delve deeper into the topic in the coming years—particularly since 70% of employees’ waking hours are spent at work.

“Your manager’s influence on your mental and physical well-being has a much greater influence on how you’re going to feel about yourself,” she says. “If you’re feeling good about yourself today, that feeling is coming from your manager, not your doctor. We employers have to recognize that, which is another reason to do this workforce risk platform.”

Looking out for the future, the Institute has also focused on attracting younger talent to the industry through partnerships with risk management degree programs at institutions such as the University of Southern California, St. John’s University, and the University of Texas’s Darden School.

To serve the industry’s increasingly diverse customer base, the Institute also partners on diversity recruiting programming with organizations such as the National African American Insurance Association (NAAIA).

Wednesdays with Woodward

Before 2020, the Institute hosted about 20 symposiums a year in areas where Travelers had a lot of business and relationships with independent agents and brokers. The goal was for these professionals to meet with government officials, so many events were held in state capitols and at regional Federal Reserve Banks.

“A lot of our symposiums were done with the [Federal Reserve]—and then the pandemic hit,” Woodward says. “We were all sitting home, thinking, how can we deliver high quality content to our agents and brokers?”

As a result, the Institute has webcasted 130 Wednesdays with Woodward webinars in the last four years. The viewing audiences has been between 3,000 and 6,000 people each time.

“I want you to be able to tune in and learn and think about the subject material. And, second, I want the webinar to be impactful and actionable,” she says. “We found that making them not only interesting but [also] actionable was the key to success.”

Commitment to independent agencies and brokers

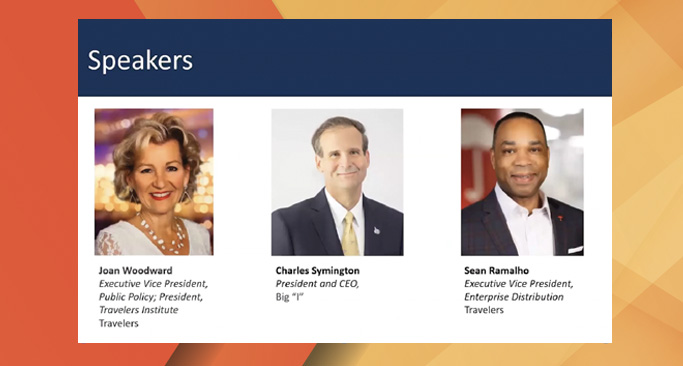

A recent Wednesdays with Woodward webinar called “Mastering Market Shifts: What Independent Insurance Professionals Need to Know” featured Woodward as moderator along with Charles Symington, president and CEO of the Independent Insurance Agents & Brokers of America (the Big “I”), and Sean Ramalho, executive vice president, Enterprise Distribution at Travelers.

They discussed insights from the Agency Universe Study by Future One, a collaboration of the Big “I” and leading independent agency companies including Travelers, which provides a deeply comprehensive look at the independent agency system.

“Customer expectations and customer demands have really changed. There’s a level of transparency and awareness that any customer expects in any purchase.”

—Sean Ramalho

Executive Vice President,

Enterprise Distribution

Travelers

The biennial study shows there are 39,000 independent agencies in the United States—the same number as 20 years ago—though there are fewer mid-sized agencies and more small and large agencies. Also, more than three in four agencies saw revenues rise from 2022 to 2023, with an average increase of 26%.

The topic was a natural one, Ramalho says, because independent agencies (IAs) and brokers are Travelers’ primary distribution channels and the research results tie into what he calls the “go-to-market strategy” for this critical audience.

Less than a decade ago, he says, there was a lot of industry commentary around disruption.

“There was a lot of rhetoric from technology firms or new entrants into the insurance space around how they [could] disrupt the insurance space, whether through a different diffusion model or just deployment of capital,” he says. “As we sit here today, all of the discussion and efforts are being directed to how can we enhance, how can we reinforce, and how can we make it a little bit easier to transact business [and] support the current IA channel and the deployment of capital.”

An important development, he adds, is how organizations are utilizing third-party data to improve quotes and proposals. “That makes the transition more frictionless,” he says.

Data sources include public property records that reveal square footage, year and type of construction, and other details that make it easier to accurately assess the property’s risk. Now, agencies and brokers can get real, credible information, which brings a bit of standardization to how different companies look at the same type of risk, making the underwriting process more streamlined, Ramalho says.

“Customer expectations and customer demands have really changed,” Ramalho says. “There’s a level of transparency and awareness that any customer expects in any purchase. [That’s] also driving the insurance industry to do the same because customers expect it.”

Woodward reflects that while the Institute has done so much already, there’s still more it can do to spread how the insurance industry vitally intersects with public policy issues.

“I’m just so grateful that Alan, our CEO, had the vision that the industry needed something like this to showcase the good we do for society. The insurance industry is tremendous in partnering to help society and the GDP to grow. I’m just grateful to be able to be a part of it,” she says.

For more information:

Travelers Institute

travelers.com/travelers-institute

The author

Maura C. Ciccarelli is a longtime freelance journalist originally from Philadelphia. She writes about business and more from an adobe home in southern New Mexico, after spending nine years living on the road fulltime with her husband in their Airstream trailer.