What every insurance principal must

know about premium trust accounts

By Patti Smith

Running a successful independent insurance agency requires more than insurance acumen. While attention is often focused on carrier appointments, talent acquisition, client retention, and customer experience technology, a foundational but often overlooked area is the agency’s banking structure—specifically, the critical role of premium trust accounts (PTAs).

Without a strong financial backbone, even the best-run agency can run into compliance issues, cash flow challenges or worse. Just as a car engine will not run well with the wrong oil or loose parts, your agency can sputter if you have not “looked under the hood” of your cash-handling systems.

Unlike other small businesses that might operate with a single general operating account, insurance agencies, especially those handling P&C lines, require more specialized banking arrangements.

This is largely because of the dual nature of how premiums are handled:

- Direct bill. The carrier bills the client directly. The agency earns a commission but does not collect or hold premium funds.

- Agency bill. The agency bills the client, collects the premium and then remits the carrier’s share, making the agency a fiduciary holding client funds temporarily. When agency billing is used, the agency assumes significant financial responsibility, which is where premium trust accounts come in.

What PTAs are and why they matter

A PTA is a segregated bank account used to hold client premium funds until they are remitted to the insurance carrier. This account legally and ethically separates client money from the agency’s operating funds.

Think of a PTA as a holding tank, not a profit center. These funds do not belong to the agency and should not be used to cover payroll, rent or any other operational costs. Commingling PTA and operational funds is not only poor practice but also, in many states, illegal. A one-to-one ratio between premium trust funds and obligations reinforces financial stability and regulatory security.

State regulations often require strict fund segregation. Some states like California and Texas impose steep penalties for commingling funds, while others such as New York and Illinois impose geographic restrictions on where PTAs can be held.

Segregating funds:

- Prevents misuse or misallocation of client money

- Provides a clear audit trail

- Builds trust with clients and carriers

- Keeps the agency in good standing with state regulators

Even in jurisdictions where commingling is not explicitly prohibited, maintaining separate accounts is widely viewed as a best practice.

Banking relationships: Choose with caution

Not all banks are equally equipped to serve the insurance agency business model. Agency principals should seek banking partners that understand industry-specific compliance requirements, including:

- Proper account titling (PTAs)

- Daily sweep functionality (if used)

- Multistate regulatory variations

Banks unfamiliar with these nuances may inadvertently set up accounts that expose the agency to unnecessary audit risk.

Key elements of PTA oversight

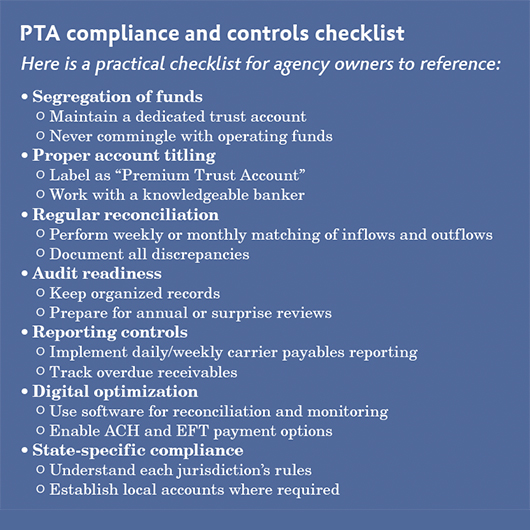

Properly managing PTAs involves more than opening an account and depositing checks. Ongoing diligence is required in the following key areas:

Without a strong financial backbone, even the best-run

agency can run into compliance issues, cash flow challenges or worse.

- Routine reconciliation. Monthly (or even weekly) reconciliation ensures that the funds in the PTA match the amounts billed and owed. This protects against internal fraud, accounting errors and missed carrier payments.

- Accurate naming conventions. Each PTA should be clearly labeled in both the bank’s system and the agency’s general ledger. Avoid vague terms like “Operating 2”; instead, use “XYZ Agency Premium Trust Account.”

- Recordkeeping and retention. Maintain meticulous records of all deposits, disbursements and bank statements. Regulators often require PTAs to be reconciled and fully documented for at least five years.

- Controls for disbursement. Access to PTA funds should be limited to a few authorized individuals. Implement dual control protocols where possible, especially for large disbursements or EFTs (electronic funds transfers).

Financial reporting and regulatory considerations

Every agency should have a system in place to tie its premium payments and returns to individual client transactions, not just to bulk carrier payments. Reports should include:

- Carrier premium remittance logs

- Outstanding receivables

- Claims payment tracking (if applicable)

Some states also require agencies to submit annual or periodic PTA reports. Falling behind in your reporting can cause trouble in an audit.

Agencies operating across multiple states must be even more vigilant. State laws differ not only on segregation but on how and where funds can be held. For example, in New York, PTAs must be held in banks chartered in New York or with branches in the state. Because of the variations, agencies should review their state’s PTA requirements if they are operating in multiple jurisdictions to discover whether they need to establish local PTAs to remain compliant. Legal and accounting support is critical in such cases.

Mergers and acquisitions: Do not overlook the PTA

When acquiring an agency, one of the most sensitive areas to evaluate is the integrity of the seller’s PTAs. Failing to conduct proper due diligence can result in acquiring liabilities or regulatory issues.

Best practices include:

- Requiring 12 to 24 months of PTA reconciliation history

- Conducting a forensic accounting review

- Understanding the seller’s method of trust fund allocation (manual vs. automated)

Buyers should factor in any underfunding or misallocated funds into the deal terms and indemnification clauses.

Final thoughts: Managing risk, not just money

The manual handling of PTAs is both risky and inefficient. Fortunately, modern banking and accounting platforms now offer agency-centric solutions to streamline PTA oversight.

Some bank partners offer agency-specific platforms designed to integrate with agency management systems, creating seamless workflows and audit trails.

Managing your PTA properly is not just about accounting; it is about protecting your agency’s reputation, your customer’s money, and your own license.

Too often, agency owners leave their financial systems as an afterthought until they face an audit, a merger or a legal dispute. Proactive management of your trust accounts ensures smoother operations, better financial insight and full regulatory compliance.

In summary, think of your agency’s banking structure as the engine of a finely tuned machine. It may not be visible to clients or even staff, but if it fails, the whole business grinds to a halt. Proactively managing your PTAs is a core part of running a financially sound and legally compliant independent agency.

The author

Patricia Smith is vice president and director of cash management services at InsurBanc, a division of Connecticut Community Bank, N.A. InsurBanc is a community-focused commercial bank specializing in products and services for independent insurance agencies.