Firm’s model uses weather and climate data to predict exposures

Maura Ciccarelli

ith carriers exiting the homeowners market in fire-prone states like California, nuanced and sophisticated risk evaluations are making it possible for agents to place coverage for clients whose low-risk properties are misidentified as high exposure by static risk models.

That’s what Delos Insurance Solutions, a San Francisco-based MGA, has been doing since 2017.

Chief Executive Officer Kevin Stein, an aerospace engineer, teamed up with Chief Data Officer Shanna McIntyre, a former Lockheed Martin engineer who’s an expert in predictive risk modeling. Their company includes experts in satellite imaging, data science, artificial intelligence (AI), risk modeling, underwriting, claims and more.

Their interest in helping homeowners with coverage started after witnessing the catastrophic fires around California, including those that affected their families and friends.

“Our passion was being able to use whatever skills we have to adapt society for the oncoming reality and fears about wildfires,” says Stein.

At the heart of their business is a patented fire-risk model that uses satellite imagery, the most recent climate data, and cutting-edge AI to map fire risk in California. It’s been shown to correctly predict fire risk in locations that burned. Plus, the model’s dynamic dataset enables personalized guidance for helping homeowners harden their fire-risk exposure as factors change over time.

“The insurance sector is so powerful,” says Stein, a native Californian like most of his team. “It allows us to reach millions in California and even across the U.S. and incentivize risk protection.

“When we got into the insurance industry, we pretty quickly realized that, in our opinion, any type of property assets in wildfire-affected areas were being approached with a structure that worked very well in a previous static environment, but really no longer works in [today’s more] dynamic, climate-affected environment,” Stein says.

“Wildfires have turned from a generalist peril to a specialist peril.”

—Kevin Stein

Chief Executive Officer

Delos Insurance Solutions

New kinds of wildfire risks

“Climate change is evolving the peril of wildfires at a much faster pace than ever before,” he notes. For example, wind-driven wildfires in both Los Angeles and the Napa Valley in 2017—and in more recent years—have demonstrated a new type of fire behavior that goes beyond forest fires.

“Then, 2018 showed us that this new type of behavior can happen in different geographies and ecologies. 2020 introduced us to the dry lightning ignition event that happened in the Bay Area. The same thing has happened in Colorado, but really hasn’t happened in the Bay Area for 100 years. These new kinds of fire behavior have happened in three out of the last six years,” he notes.

By running the model to see whether actual fires matched up to their predictions (which they did), the team saw an opportunity for a better approach to wildfire risks.

“A general carrier is not a catastrophe expert,” Stein notes. “Their core competency is risk diversification and management, based on multiple years of data. It can take three to five years to develop a fire-risk model for an area using third-party data.”

Unfortunately, wildfire problems are evolving faster than that, putting older modeling systems out of date very quickly.

“Wildfires have turned from a generalist peril to a specialist peril,” he adds.

New, dynamic modeling

Delos’s proprietary model enables nuanced underwriting and pricing approaches. To gather the data needed, the company partners with the Spatial Informatics Group (SIG). The environmental think-tank specializes in characterizing and assessing both urban and wild landscapes. SIG provides the most current climate-related data used in Delos’s model.

The model includes hundreds of parameters pulled from sources like NASA’s Earth-observation imagery and LANDFIRE, a joint wildfire management program run by the U.S. Department of Agriculture Forest Service and U.S. Department of the Interior.

Updated annually and scanning forward one, five, and 10 years, the model tracks drought patterns, vegetation conditions, climate projections, wind activity, temperature, recent fires, and even the government agencies’ cleanup activities in public forests and lands.

The company also fills a needed insurance services void. Stein says that more than half the California homeowners struggling to find coverage have properties that are not at high risk of wildfire in their model. “These millions of homes are miscategorized by the rest of the industry,” he points out.

Guidance developed by the California Department of Forestry and

Fire Protection (Cal Fire).

Fast risk assessment

The MGA provides producers with access to coverage through six specialty carriers and reinsurers. They simply put an address into a broker portal and learn instantly whether

a property passes the low-risk test or not.

“We don’t want our brokers to spend any more time than is necessary to get an answer,” he says.

And, by keeping the model as up-to-date as possible, Delos is able to write risks profitably both from an individual property perspective and a portfolio perspective.

“We’re looking to provide a stable portfolio to reinsurance companies, which is the only way to have a stable solution economically over time,” he says. Delos also hopes to pick up

a commercial property program in the future.

Hardening against fire exposure

To share their insights into fire risk, Delos provides some information back to the homeowners, through producers. In development is an online tool to offer personalized advice based on a property’s risk exposure, Stein says.

Since most homes catch fire from embers and small flames, Delos recommends the following guidance developed by the California Department of Forestry and Fire Protection (Cal Fire), the fire department for the California Natural Resources Agency:

- Keep roofs and gutters clear of leaves and debris.

- Cover all vent openings and chimneys with metal mesh.

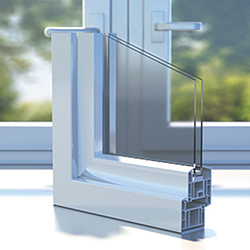

- Install dual-paned windows (with one made of tempered glass) to prevent wildfire heat from breaking glass and letting embers in.

- Keep vegetation at least five feet away from structures and trees, since plants can ignite and create a “fire ladder” that sends flames up the side of the house or into the treetops.

- Keep plants and lawns trimmed and low for at least 30 feet on all sides.

- Prune back 10 feet any branches that overhang or touch the house.

- Clear out dead vegetation from under decks.

- Use fire-resistant patio furniture.

- Keep firewood and propane tanks 30 feet or more away from structures.

Another key factor, he says, is understanding the type of fires a property could be subject to based on the area’s climate, weather patterns, vegetation types, and other factors. For example, fire exposure in the forests of the foggy Mendocino coastal area is different from the dry Southern California chaparral region. Wildfires and urban fires in both areas act differently and so guidance is adapted accordingly.

“We want to be a sustainable solution for the wildfires in the insurance industry,” Stein says. “Having many different partners behind us helps us make sure that we always stay in the market.”

For more information:

Delos Insurance Solutions

The author

Maura Ciccarelli is a freelance journalist originally from Philadelphia who now writes about business and more from the road full-time.