Strategies to safeguard a

Strategies to safeguard a

business from submerged threats

[T]he key to success is not just weathering the storm but avoiding it altogether.

By Randy Boss, CRM, MWCA, SHRM-SCP

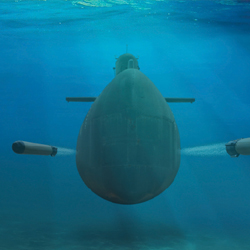

A business managing risks can be compared to navigating treacherous waters on a Navy ship. Just as sea captains must guide their vessels from one point to another without succumbing to the perils of the sea, business owners and leaders must protect their enterprises from potential threats. As risk advisors, it is our responsibility to help clients understand the dangers that lurk beneath the surface, those that can deal a devastating blow below the waterline.

There is one thing that Navy sailors fear more than sharks: a torpedo. Modern torpedoes don’t impact a ship’s hull. They explode under the centerline of the ship, its backbone, and remove the water below it so it falls into the hole left by water, turning to steam and breaking its back. Then, the upward pressure of the explosion causes the ship to break in two and sink very quickly.

The modern Navy uses the process of risk management that every business can learn from to avoid a hit below the waterline.

The five-step approach to risk management

Risk management follows a structured five-step process, guiding organizations through the tumultuous waters of uncertainty. These steps include risk identification, data analysis, risk control, risk financing, and results measurement.

- Identify risks. The first step in managing risk is identifying potential business threats. Just as a ship’s crew must be vigilant for dangers in the open sea like a missile strike that could cause damage or, even worse, a torpedo hitting below the waterline, causing a total loss of the ship and sailors on board, business owners must recognize the risks that could undermine their success. By identifying these risks, they can begin to address them proactively.

- Analyze data. Analyzing data is like charting the course for a business. It involves thoroughly examining available information to understand the nature and scope of potential risks. Data-driven insights help make informed decisions and devise strategies to mitigate risks effectively.

- Control risk. Controlling risks involves implementing measures to minimize the impact of identified risks, similar to steering the ship away from treacherous waters and dangers. Modern warships are equipped with countermeasures to confuse oncoming torpedo guidance systems, and captains are trained to turn the ship away and parallel to an incoming torpedo to make the target harder to hit.

Just as a skilled captain adjusts the ship’s course to avoid dangerous currents, organizations can take action to reduce their exposure to potential threats. - Finance risk. While some risks can be controlled, others must be financially managed. As a ship owner might carry insurance to cover losses in the event of an accident, businesses need to secure appropriate insurance to cope with unforeseen challenges.

- Measure results. The final step in this journey is to measure results. Leaders must regularly assess the effectiveness of their risk management strategies. This includes evaluating whether the chosen action has protected the business and its employees from harm.

Below-the-waterline risks: the most dangerous threats

When it comes to risk, not all dangers are equal. Some risks can be considered torpedoes that strike a ship below the waterline, causing catastrophic damage. These “below-the-waterline” risks pose the highest threat, as they can quickly lead to a business’s downfall.

One tragic real-world example of a below-the-waterline risk occurred on February 7, 2008, at the Imperial Sugar refinery northwest of Savannah, Georgia. A massive explosion and fire resulted in 14 fatalities and 38 injuries, 14 of which were severe burns. This disaster was fueled by the accumulation of combustible sugar dust within the packaging building.

The Occupational Safety and Health Administration (OSHA) swiftly intervened, issuing citations and proposing penalties totaling $8,777,500 against Imperial Sugar for violations at its facilities. Notably, this proposed fine is the third largest in OSHA’s history.

Inspectors discovered significant accumulations of combustible sugar dust in work areas, on electrical equipment, and on machinery. Alarmingly, company officials were aware of these hazardous conditions but failed to take appropriate actions to mitigate the risks.

It’s important to note that better housekeeping practices and a critical sugar dust collection system in one production line that was enclosed for sanitation reasons could have prevented the loss of life in this tragic incident. All it took was an overheated bearing in a motor to trigger an explosion.

The first explosion is called the primary explosion, and the force created by a primary explosion can unsettle even more sugar dust, causing a secondary explosion. The two can happen quickly, and the second blast is often the more powerful. It’s kind of like “boom-KABOOM!”

There had been no emergency evacuation drills in the past, so many workers were trapped, not knowing how to escape.

The role of risk management in avoiding catastrophe

Deploying the five-step risk management process can make a significant difference in avoiding below-the-waterline hits like the one experienced by Imperial Sugar.

- Identifying Risks. Imperial Sugar’s failure to recognize the severe risk of a sugar dust explosion was a critical oversight. Investigators found that they were aware but complacent because there had not been an explosion in the past. Identifying this danger in advance and taking it seriously would have allowed them to take proactive measures.

- Analyzing Data. Analysis of historical data could have revealed a series of smaller fires at Imperial Sugar resulting from dust accumulation, serving as warning signs of the impending catastrophe. As it turns out, there’s nothing unusual about sugar that makes it flammable. Have you ever roasted a marshmallow and suddenly have it burst in to flames? In fact, according to the Chemical Safety Board, before the Imperial Sugar refinery disaster, there were 281 volatile dust explosions in the United States between 1980 and 2005, costing 119 lives. These explosions were caused by dust from grains, wood, and other materials.

- Controlling Risk. Implementing improved dust collection systems and stringent housekeeping measures would have significantly controlled the risk of a catastrophic explosion. The removal of accumulated sugar dust could have reduced the severity of any secondary blast. Training employees on how to evacuate in an emergency might have saved some from entrapment.

- Financing Risk. While insurance plays a crucial role in covering property damage and workers’ injuries, it’s essential to understand that insurance cannot reverse the injury and loss of human lives, pay for OSHA, or prevent harm to reputation. Companies that are effective in the first three steps get rewarded with lower costs in financing risk and avoiding the cost of risk that is not covered by insurance.

- Measuring Results. In the case of Imperial Sugar, the results could have been so much better. Effective risk management should improve safety and operational performance, ultimately protecting people and the business.

Conclusion

Navigating the complex waters of risk management is essential for safeguarding businesses from submerged threats. Just as vigilant captains steer their ship from dangerous waters, business leaders, with the help of their trusted risk and insurance advisor, must adopt proactive risk management strategies to protect their enterprises.

By identifying risks, analyzing data, controlling risks, financing risks, and measuring results, businesses can reduce the likelihood of below-the-waterline hits and ensure smoother sailing in the unpredictable sea of commerce. Remember, the key to success is not just weathering the storm but avoiding it altogether.

The author

Randy Boss is a Certified Risk Manager at Ottawa Kent in Jenison, Michigan. As a Risk Manager, he designs, builds, and implements risk management and insurance plans for middle market companies in the areas of safety, work comp, human resources, property/casualty and benefits. He is the co-founder of emergeapps.com, web apps for insurance agents to share with employers. Randy can be reached at rboss@ottawakent.com.