QUANTIFYING RISK

Assessment tool helps drive risk profile improvement

By Dave Willis, CPIA

More than a decade ago, Scott Addis, CPCU, CRA, CBWA, TRA, had the opportunity to speak at an executive leaders forum about the state of the insurance industry. The audience consisted of 120 or so middle-market chief financial officers from a broad cross-section of business verticals.

Before his presentation, Addis had “pre-asked” attendees to answer two questions. The first question was, “To what degree do you as a chief financial officer have the time and ability to identify the exposures facing your business?” And the second, “To what degree do you believe that insurance agents and brokers have a process to uncover and address these exposures?”

As a former agency principal with a laser focus on risk management, Addis now runs Beyond Insurance, which for years has helped agents and brokers design, build, and deliver processes, tools, and tactics to, as Addis says, “move far beyond the insurance transaction.” He also pens a regular Rough Notes column.

-Scott Addis, CPCU, CRA, CBWA, TRA

CEO

Beyond Insurance

Exposure identification gap

But Addis’s experience and expertise did not prepare him for the response he got that day. “When I collected the response cards, I was shocked,” he recalls. “These highly competent CFOs readily admitted that they did not have the time or ability to properly perform risk identification; they gave themselves, on average, a score of 1.8 out of five.

“As concerning—maybe more so—was the fact that these chief financial officers gave their agents and brokers a lower score: 1.3 out of five. It was their collective opinion that the agent or broker they worked with did not demonstrate or deliver value in the discipline of risk identification.”

That eye-opening experience inspired Addis to write an August 2009 Rough Notes column titled “The World of the CFO.” In it, he shared research that echoed his findings, including a 2006 Los Angeles Times article that stated that fewer than 20% of CEOs believed that their CFO was doing a good job of managing risk.

“C-suite executives are pulled in so many directions today,” Addis explains. “They are starving for an insurance agent or broker who has the desire to go beyond insurance to become their organization’s outsourced risk manager. Doing so requires agents to do a number of things, the first of which is to take the time to truly understand their business and industry.

“Today’s business leaders desperately need help in identifying, prioritizing, measuring, and mitigating risks that confront their organizations,” he adds, “and they covet an agent or broker who has the ability to design strategic risk management solutions to impact their bottom line.”

Addis points out that these C-suite execs by and large detest the traditional insurance bidding process. “They are looking for a more strategic and disciplined approach to insurance and risk management,” he explains. “What they really want is a simplistic and efficient mechanism to quantifiably assess risk issues their business might encounter.”

System for improvement

An outgrowth of Addis’s participation at the CFO forum was the design and development of a systematic way to better understand issues that organizations face. “My goal was to build a quantitative risk assessment tool that would respond to the wish list of C-suite executives,” he explains. The tool is called the “Intelligence Quotient for Risk Management” (IQRM™) and it’s designed to help agents and brokers better support the organizations they serve.

His vision for the quantifiable risk assessment had several elements. “Specifically, I wanted it to empower agents, brokers, carriers, and consumers in a number of facets,” he explains. “First and foremost, I wanted them to become better educated about the risks facing their organizations.” On top of that, he wanted to help them benchmark performance against ideal industry standards and consider best practices to control and mitigate risks.

His vision for the quantifiable risk assessment had several elements. “Specifically, I wanted it to empower agents, brokers, carriers, and consumers in a number of facets,” he explains. “First and foremost, I wanted them to become better educated about the risks facing their organizations.” On top of that, he wanted to help them benchmark performance against ideal industry standards and consider best practices to control and mitigate risks.

Other elements of the tool include the ability to access reference resources to gain further knowledge of the implications of identified risks, and help in designing an action plan to improve performance as gauged by what has been dubbed the IQRM Score. The IQRM scoring system determines risk profile improvement effectiveness through the assessment of policies, procedures, and controls.

The following factors determine effectiveness:

- Activities—tasks and actions that create or implement risk management policies, practices, procedures, and programs

- Behaviors—actions and conduct that affect performance—positively or negatively

- Internal Assessments—risks that have the potential to cause loss, peril, or vulnerability; or that create opportunities for organizational success

- Internal Controls—internal processes, assessments, and framework for ensuring compliance with program goals

- Outcomes—qualitative and quantitative measurements and metrics that assure the achievement of risk management and organizational goals and objectives

Addis says the IQRM tool is designed to help users have a positive impact on business performance by taking an enterprise-wide solutions approach. “More than that, users can leverage the IQRM improvement process to achieve positive results in the broader insurance marketplace,” he explains.

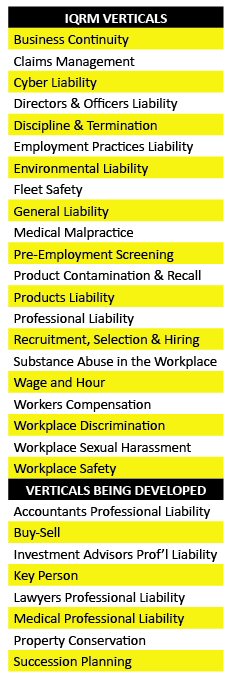

In an effort to add intellectual depth and increased credibility to the tool, Addis identified subject matter experts (SMEs) to stand behind each of the nearly two dozen IQRM risk verticals, ranging from business continuity, claims management, and cyber liability to workers comp, workplace discrimination, and workplace sexual harassment (see chart). More than a half-dozen other verticals are under development.

“The subject matter experts played a vital role as they crafted an explanation of the risk issues in laymen’s terms, introduced best practices for risk mitigation, created response rationales, and offered additional resources to advance the business leader’s understanding of risk,” Addis explains. Team members at Addis’ firm supplemented SME efforts with the creation of an IQRM template, which included the scoring system that is supported by a risk profile improvement action plan.

-Brandon Smyrl

President

Highpoint Insurance Group

IQRM use and impact

The IQRM tool was introduced in 2011 to members of the Beyond Insurance Global Network (BIGN), a peer-to-peer group of high-performing independent agency principals whom Addis and his team members work with who take a diagnostic, consultative, risk advisor-based approach to client service. “The IQRMs are now part of the DNA of all 70 or so members as well as their chosen clients,” Addis explains. “While the IQRM is a potent business development tool, it also is a vital component of pre-renewal meetings, carrier negotiations, risk management service plans, and stewardship reviews.”

Randy Boss, CRA, CBWA, principal at Jenison, Michigan-based Ottawa Kent, has seen the tool’s value first-hand. “I had a meeting with a large lumber company recently,” he recalls. “The firm was within the 90-day renewal cycle, so I suggested that they renew with their current broker and we would start the IQRM process after renewal. To my surprise, they called me in a panic 45 days before they were set to renew, letting me know that they received a non-renewal notice.

“I recommended that they meet directly with the underwriter, and I should be invited to the meeting,” Boss explains. “They agreed. At the meeting, it was obvious that fleet safety was the carrier’s biggest concern, so I grabbed my iPad and showed the underwriter the Fleet Safety IQRM we had just completed. He was so impressed that he agreed to renew as long as we were the agent and the IQRM process was in place.”

Other carriers echo what Boss heard from that underwriter. “That’s because IQRM documents an understanding of risks and activities that improve an organization’s risk profile,” Addis explains, “and that reduces claim frequency and severity. We continually get positive reviews from carrier staff members. One underwriter said the tool helps them make informed decisions on risk selection and pricing more quickly and offers the insured the most favorable terms and conditions. Another said it greatly clarifies their risk acceptance and pricing decisions and allows for more flexibility in program design.

“Importantly,” Addis adds, “IQRMs also are shifting the consumer focusfrom product to process. It is interest-ing to note that buyers embrace the scoring system in support of risk profile improvement.”

“Importantly,” Addis adds, “IQRMs also are shifting the consumer focusfrom product to process. It is interest-ing to note that buyers embrace the scoring system in support of risk profile improvement.”

Brandon Smyrl, president of Highpoint Insurance Group in Friendswood, Texas, recently saw that happen. “We had a situation where a large global broker came in and did a dog-and-pony show for a mid-sized client of ours,” he explains. “As part of their presentation, they explained how they have 20-plus staff members who make up their risk control team.

“As the broker had a long-standing relationship on the surety portion of the account, I sensed they felt it was a given that this ‘team of safety/loss control experts’ as they called it would win the rest of the business,” Smyrl adds. “But I knew the IQRM was unique and potent, and I was confident it would give the global broker a run for its money. Once the customer saw the IQRM and the capabilities of the subject matter experts, they were sold! We received a BOR the next day.”

The IQRM not only empowers business leaders to become better educated about risks, but also includes an action plan to improve the IQRM score; that delivered value to the American Management Association, a firm that provides skills, knowledge, and tools for individuals and organizations worldwide. Greg Adams, the organization’s CFO, says, “The Intelligence Quotient for Risk Management made a lot of sense to us. We chose to use 13 different IQRM modules to assess our risk management and quality assurance protocols. We found the process efficient, insightful, and refreshing.”

Addis expects continued positive results for agents who use the IQRM tool. “It’s a practical and common-sense way for agents, carriers, and clients to measure exposures and determine the general effectiveness of strategies to manage risk,” he says, “and in the end, that’s the approach that will allow agents to deliver the greatest possible value to clients and carriers alike.”