TECHNOLOGY

COVERWALLET FOR AGENTS

Technology platform simplifies commercial insurance

By Dave Willis, CPIA

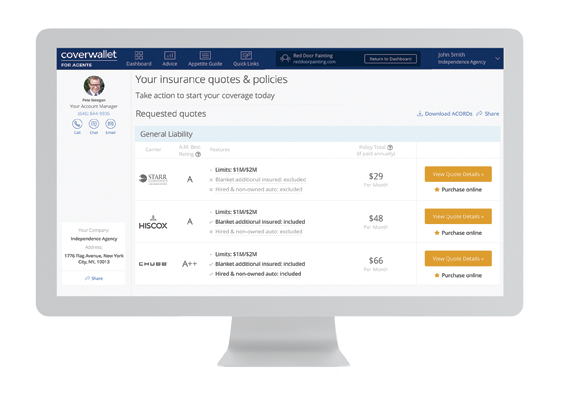

CoverWallet’s mission is pretty straightforward: to simplify commercial insurance through technology. The company offers what it describes as “the easiest way to quote, bind and service small commercial customers, all online.” A single integrated digital application connects to multiple carriers for a number of product lines and delivers multiple, live, bindable quotes.

The firm started as a direct-to-consumer business, but it wasn’t long before opportunities in the independent agent space presented themselves. “From the outset, we found that independent agents saw the promise of technology and the simplicity of doing everything online, and they asked to use the platform,” explains CoverWallet Vice President Michael Konialian. So late in 2018, the company launched CoverWallet for Agents and named Konialian general manager responsible for the endeavor.

“I worked at McKinsey, where I served large financial services companies—insurance companies and banks—and also large technology companies, focusing on helping them identify how to grow their top lines and how to go digital,” he says. “Digital is shaking up virtually every industry across the economy. In financial services, commercial insurance is among the last giant markets to go digital; I believe the big wave is yet to come. What we’re doing is helping accelerate the journey to a truly digital experience for carriers, brokers and insureds.”

-Michael Konialian

Vice President and General Manager

CoverWallet for Agencies

Access and more

Konialian describes CoverWallet for Agents as “a technology platform. We are technologists—engineers, product managers and designers—who help insurance agents do their jobs more effectively and give their insureds a really great experience.” The firm is licensed in all 50 states and has appointments with a number of regional and national carriers and provides market access to independent agents through its platform.

“If you look at the whole journey of placing a commercial customer, an agent might spend hours going through different steps—first taking down information, maybe on ACORD forms, maybe in a different format, then going to multiple carrier portals, perhaps using multiple intermediaries to access and fetch quotes, presenting the quotes to customers, and then going through the manual steps of finding financing if needed—we’ve taken that process, which would takehours and hours, and reduced it dramatically.

“Let’s say an agent wants general liability, workers comp and professional liability,” Konialian explains. With the integrated online application, “they’ll be able to get two to three quotes from A rated carriers like Chubb, CNA, AmTrust, Guard, and so on, and be able to access quote proposal documents, compare quotes, bind and issue the policy, arrange premium financing, set up customers on autopay, get all the documents they need, and then have tools for automated servicing.”

Platform users range from individuals to very large agencies. “There also is a mix of agency types—from very commercial-focused ones to ones that simply want to use it to cross-sell for non-core products,” Konialian says. Main Street risks—retail, service industries, contractors, professionals, healthcare, technology—make up the lion’s share of the insureds served. “It’s business that a lot of carriers are comfortable writing online—a lot of standard risks and all on admitted paper. But it’s very broad from a class perspective. We have hundreds if not thousands of class codes.”

The company has a number of data integrations for property records, registries of businesses at a current address, maps and addresses. “We also do validations for email addresses and phone numbers,” Konialian notes. “These external integrations help to facilitate the process.” CoverWallet for Agents also is talking to agency management system providers to build out integrations with their technology.

The online application carries the agency’s look and feel. “We offer an agency-branded experience, so a customer going through our platform would see it branded as the agency, with agency contact information,” Konialian notes. Agents can place the link or a button to it on their website and generate applications. “Many agency websites have a button that says ‘get a quote,’ and zero percent of the time do they actually get a quote; it’s a contact form. With us, the customer gets one or more quotes, and the agent is notified right away and can follow up to discuss it with them.”

Agent experience

Konialian believes that using the product allows agents to profitably serve clients they might not otherwise be able to serve. “We offer a quick, simple way to handle a larger volume of accounts,” he explains. “Where we make perhaps the greatest difference is on smaller accounts, which an agent will have a hard time writing profitably and may just drop.” He says using CoverWallet for Agents lets agents reduce—not eliminate, of course—the number of touch points required to write the business and helps agencies focused on writing new business expand their reach.

Roberto Lasa, owner of Lasa Links Insurance in Coral Gables, Florida, is one such agent. A golf industry veteran, Lasa started his own P-C agency a few years ago. “I started my agency reaching out to contacts I made while I was in the golf business,” he explains, “and since then, it’s taken off from referrals. In addition to personal lines, we specialize in small business, which is an underserved market here.” The “we” includes Lasa and two part-time CSRs—one handling personal lines, the other commercial.

This year has been a transformative one for the agency. He recently switched to a new agency management system, launched a new website, and began to focus on SEO. He also signed on with CoverWallet for Agents. He had seen the original direct-to-consumer offering referenced online some time ago, “and I was actually upset. I thought, ‘This is what I’ve been looking for. Why can’t I have it? If I could get this for my small business clients and prospects, it would make a world of difference. It would save time and increase profit.’”

Lasa reached out to the company around the time the agent offering was ramping up. “I started with the platform in the spring,” he explains. “It’s such an easy way to submit business. If something doesn’t fit their appetite, I have all the information that’s in there already and I can submit it to other markets. It’s a no-brainer.”

CoverWallet for Agents creates a unique link for each agency. “Whenever I get a referral, I introduce myself and direct the prospect to that link, which I describe as ‘our super-easy questionnaire,’” Lasa explains. “The prospect goes through it, and within five minutes or so I get an email telling me I have a new application. I contact the prospect right away and discuss their needs in detail.

“Sometimes I need to edit the application based on our discussion, but still, the whole process has been streamlined,” he notes. “In the past, I would have not only needed to have a conversation, but then send a PDF, which could take anywhere from a day to a week or more to get back.

“It makes things a lot easier for the customer, and it also is easier for us and it makes the transaction more profitable,” Lasa adds. “If you can improve customer experience and agency profitability, that’s a slam dunk.”

Occasionally a customer will be less than eager to complete an online application. “It’s not that often, but if it does happen, that’s not a problem,” he notes. “I’ll just go through the online application with them on the phone, and they’re fine with that.”

The platform plays right into Lasa’s motto: Service First. “I want to make the customer’s experience as easy as possible, because for many people insurance is a pain,” he explains. “I’m constantly looking at how I can improve. The way for me to succeed is to provide the best service possible—to streamline and automate as much as possible, but at the same time maintain the human contact. People who come to me want an agent—they want someone to talk to.”

CoverWallet for Agents and other technology and tools he’s investing in today are laying the groundwork for ongoing growth. “I’m putting all the systems in place—the foundation—and I see 2020 as the year when I will start to bring on producers to go out there and crush it!”

One new platform feature is helping the agency increase its footprint this year. Konialian explains: “We have a number of people come to the CoverWallet consumer platform whom we cannot place, so we’re offering those leads to agents.” Lasa is making use of these. “I’m trying to grow my business in Texas, so I’m choosing leads there and reaching out,” he says. “It’s a great added benefit.”

-Roberto Lasa

Owner

Lasa Links Insurance

Going forward

CoverWallet for Agents technology is built on the same technology as the direct-to-consumer offering, so while the agent product has not seen customer renewals, the firm knows the drill. “We have quite a bit of renewal experience,” Konialian explains. “All of our policies are auto pay and auto renew. We’ll send a renewal quote to the agent a month or two before the expiration and ask if there have been any material changes to business operations, rating or underwriting. If not, the policy renews. It’s very easy; basically ‘set it and forget it.’”

Konialian points out that agents own their customers. “We don’t contact the customer independently, he explains. “And agents can take the customer wherever they want. That’s something we feel very strongly about.”

Agent engagement continues to grow. “More and more agents are signing up,” he explains. “It’s free and easy to join. Registration is automated; it’s possible to register and start quoting the same day. We only require that agencies have E&O insurance and that agents be licensed in the states where they do business. Then they’re able to access those markets through us.”

Product and carrier integration also will expand. “Now we have integrated general liability, business owners policies, workers comp, professional liability/E&O, cyber liability and special events; we’re actively working with carriers to build a commercial auto offering,” Konialian says. “We’re also looking to expand the number of carriers on our platform.

“In addition, we’re growing our appetites and our limits with the carriers we have,” he adds. “For instance, with Chubb, we’re increasing our revenue threshold by five times in terms of what we’re able to write online. And we’re also building some more added-value features for agents.

“One of our core beliefs is that we want technology to do what technology does best—inputting data and accessing information—and have humans do what humans do best,” Konialian explains. “Insurance agents are trusted advisors; they need to build a relationship with customers, help them evaluate options, and recommend through their experience and understanding of the business operations what the best coverages are.

“And then they need to be able to manage the account—to help customers through changes or endorsements or claims that arise,” he adds. “They can do that work a lot more effectively if they’re able to place business relatively quickly, without a lot of friction and without a lot of data reentry.”

For more information:

CoverWallet for Agents

agents.coverwallet.com