STOLEN CARGO, YES, BUT DOES THAT MEAN IT’S COVERED?

Truck cargo was insured under a Transportation Policy when a theft occurred. The cargo owner expected coverage; however, the insurer disagreed. It held that its policy was not obligated to pay as the loss details did not qualify for coverage. The cargo owner sued for coverage.

Here is how a court addressed whether the situation was an eligible claim.

Editor’s note: We apply the term “Classic” to older court cases that, due to their ongoing relevance, we have republished for your reference.

After a trial court ruled in favor of an insurance company regarding the theft of truck cargo, the property owner appealed. The appeals court considered the question of whether truck cargo protected under a Transportation policy was “in transit” or “in the ordinary course of transportation” when it was stolen.

Two trailers and a truck, owned by the insured, were loaded with the insured’s products at its manufacturing plant and warehouse in southern California. Their destination was northern California where the products were to be delivered to various customers. That evening, three of the insured’s employees drove the vehicles two miles away to a parking lot leased by the insured. The two trailers were disconnected, and the drivers drove home in the tractors, leaving the three locked vehicles for pickup at 2. A.M. They were broken into prior to the return of the drivers, and the cargo was stolen.

One pertinent paragraph in the policy stated: “this policy covers…loss of or damage to lawful goods and merchandise in shipment…occurring while in transit…” Other policy wording read: This policy covers said property from the time of leaving the warehouse, store or factory of shipper and thereafter continuously, in ordinary course of transportation until same is delivered to warehouse, store or factory at destination…”

Citing various authorities and leading cases, the court said that “a temporary stop of brief duration related to the transportation itself does not break the requisite continuity of transportation.” The court found that the stop was not made for the purpose of further work being done on the cargo or of storage. It concluded that any cargo loss “in transit” or ‘in ordinary course of transportation” was covered wherever it occurred and that the facts under review were within the scope of policy coverage.

The court reversed the trial court judgment for the insurance company and rendered judgment in favor of the insured.

Aetna Casualty and Surety Company, Plaintiff-Respondent v. Burbank Generators, Inc., Defendant-Appellant, California Court of Appeal, Second District, Division Three. Civ. No. 58193. Filed July 22, 1981. Reversed CCH 1981 Fire and Casualty Cases 1627.

What is Intended To Be Insured?

What is Intended To Be Insured?

Regardless the type of policy, the language appears early on to share what is the intent of coverage. A key first step in understanding protection often depends on finding out what is meant to be covered. A word of advice: timing is very important. The time to determine whether needed coverage exists is before losses occur. Doing so afterwards, well, that can mean having to confirm for a client that there is a coverage gap. At a minimum, learning of gaps may result in angering and losing a client. Far more important is that gaps can endanger business continuity, so insureds should be encouraged to review what is in the policy they’ve purchased.

Below is an example of how coverage intent is discussed under the CA 00 20-Motor Carrier Coverage Form Analysis.

CA 00 20-Motor Carrier Coverage Form Analysis

A. Coverage

The insurance company pays amounts an insured is legally obligated to pay as damages because of bodily injury or property damage and certain types of pollution events (see definition of covered pollution cost or expense). However, the obligation to pay is triggered only by accidental occurrences involving vehicles covered under the Motor Carrier Coverage Form. An eligible pollution event is covered only if it is connected to a covered bodily injury or property damage loss.

Besides responding to valid claims, the insurance company has an obligation and a right to provide a legal defense related to a claim. The insurance company has sole responsibility as to which claims are denied, settled, investigated, or defended. All defense-related obligations end once an action is resolved by a settlement, a court award, or when the limit of insurance that applies is exhausted. This is true even if additional claims, losses, or suits are filed against the insured.

| Example: Hurryup Transport does not properly maintain its oldest, large tractor-trailer unit. During its latest trip, the brakes failed, causing an accident that involved four vehicles and multiple claimants. The insurance company realized that Hurryup was at fault in the accident and settled out of court with as many of the claimants as the limits allowed. Once the limits were exhausted, the company no longer had to provide Hurryup with a legal defense against the remaining claimants and Hurryup was left to bear the entire cost of the remaining legal expenses by itself. |

- Who Is an Insured

- The named insured is an insured for any covered auto.

- Anyone else who has permission from the named insured to use a covered auto that the named insured owns, hires or borrows is an insured but there are some exceptions. The following persons are not insureds.

(1) The owner of the covered auto and any of the owner’s employees, drivers or agents are not insureds. Any other party from whom the insured hired or borrowed a covered auto is also not an insured.

(2) The named insured’s employees or agents are not insureds if the employees, agents or members of their households own the auto.

Note: If an employee borrows her son’s car to pick a client up at the airport, that employee is not an insured.

(3) When the covered auto is being worked on, the individual doing the work is not an insured if he or she is in the business of selling, servicing, repairing, parking, or storing autos. However, those individuals are insureds if the named insured owns the business.

(4) Anyone moving property to or from a covered auto is not an insured but there are exceptions. The named insured’s partners, employees, and members of a limited liability company are covered, as well as lessees and borrowers of autos, including their employees.

| Example: Bill allows Jack, one of his friends, to use one of Hurryup’s trucks to move his household property. Jack is not an insured when he loses control of his piano and it strikes his new neighbor. |

(5) The named insured’s partners or members are not insureds for a covered private passenger auto they or members of their households own.

- The owner of a trailer that the named insured hires or borrow is an insured. Others from whom the named insured hires or borrows trailers are also insureds. However, this status for the owner and for the others applies only while such trailers are attached to a covered power unit or, if not attached, are used exclusively in the named insured’s business.

- Any party that is leasing a non-trailer covered auto to the named insured is an insured only if all of the following apply:

- There is a written agreement

- The written agreement does not require the lessor to hold the named insured harmless

- The leased auto is used in the named insured carrier-for-hire business

Employees, agents or drivers of the lessor are insured if the party leasing the auto to the named insured is considered an insured.

- Parties liable for the conduct of any insured described above are also insureds to the extent of their liability.

The following are not insureds:

(1) Other than the named insured and its employees, any carrier-for-hire and its agents or employees that is:

(a) Subject to motor carrier insurance requirements and does not use auto liability insurance to meet them

(b) Not covered for primary hired autos liability that insures the parties that own the autos and their employees and agents while the hired autos are used exclusively in that party’s business.

This (1) does not apply when the named insured uses a written agreement to lease an auto to the carrier for hire when that lease holds that carrier harmless.

(2) When a trailer is detached from a covered auto and is being transported, the rail, water, or air carriers providing the transport are not insureds. This applies only when the covered auto is being loaded, transported, or unloaded by the carrier.

Related Court Case: 220_C141, Told You So: Insurer Disclaims Coverage

Note: One of the important differences in Who Is an Insured in this coverage form compared to the old Truckers Coverage Form is the section dealing with the named insured’s business operations. The Truckers Coverage Form specifically referred to the named insured’s business as a trucker and to the operating rights granted by a public authority. The Motor Carrier Coverage Form does not.

It Takes A Lot To Protect A Business

It Takes A Lot To Protect A Business

A historical problem with insurance and with the issue of risk management is that those who own businesses are fully engaged with daily tasks and challenges that have to be met to maintain their operations. Even more time and energy are dedicated to get a business to grow profitably.

Yes, insurance professionals are stewards, charged with creating heightened awareness of the essential role played by the products and services that are designed to protect business. The fact is that, too often, businessowners see our offerings as expensive distractions. Still, persistence in the effort to educate those we serve is necessary, else we are not doing OUR jobs. Coverages Applicable is a tremendous resource for, initially, providing a snapshot of the universe of coverage that should considered.

Here is some information provided by the section on Trucking and Transit found in Coverages Applicable in Advantage Plus.

TRUCKING AND TRANSIT

INCLUDING: Ambulance Services • Armored Car Services • Bus Lines–City Service • Bus Lines–Interstate and Charter • Ferries • Freight Forwarder and Freight Agencies • Furniture Movers • Garbage Collection • Truckers

The business operations in this chapter are among the most heavily regulated in the country. All are subject to multiple types of regulation including municipal, state and federal. The regulations are necessary because potential for severe property damage and/or bodily injury is extremely high.

All carry cargo that if not handled appropriately could have serious consequences to the cargo owner and/or the public at large. Those that carry people must prove that they keep their equipment in good condition and that employees operate in a safe, sober manner.

PACKAGE POLICIES

Package policies are the most convenient way to combine two or more coverage parts into a single policy. Package policies may include automobile, but most businesses in this category place their automobile separately from the rest of its coverage. The Businessowners Policy is not an option for businesses within this category.

Commercial Package Policy (CPP)

PROPERTY COVERAGES

Terminals represent the major property exposure for a trucking concern and usually consist of office and dispatch equipment, goods and merchandise of others in transit and garage repair operations. Time element coverage issues include not only business income for direct damage at the terminal but also the extra expenses needed to support vehicles on the road after a loss. They also include loss of income because of a covered direct damage loss at a major customer or a parts and equipment supplier.

Types of Property

Building

Business Personal Property

Personal Property of Others

Improvements and Betterments

Property Coverage Forms

Building and Personal Property Coverage Forms

Commercial Output Policies

Equipment Breakdown Protection Coverage

Legal Liability Coverage

Perils Insured/Causes of Loss Forms

Basic

Broad

Special

Earthquake

Flood Coverage

Mine Subsidence

Property Coverage Options to Consider

Debris Removal Coverage

Ordinance or Law Coverage

Outdoor Trees, Shrubs and Plants Coverage

Spoilage Coverage

Utility Services–Direct Damage Coverage

Valuation Options

Functional Replacement Cost

Replacement Cost

Time Element Coverages

Business Income with Extra Expense Coverage

Business Income without Extra Expense Coverage

Extra Expense Coverage

Leasehold Interest Coverage

Time Element Coverage Options to Consider

Business Income from Dependent Properties Coverage

Ordinance or Law Increased Period of Restoration Coverage

Utility Services–Time Element Coverage

Seek More Resources and Ideas

Seek More Resources and Ideas

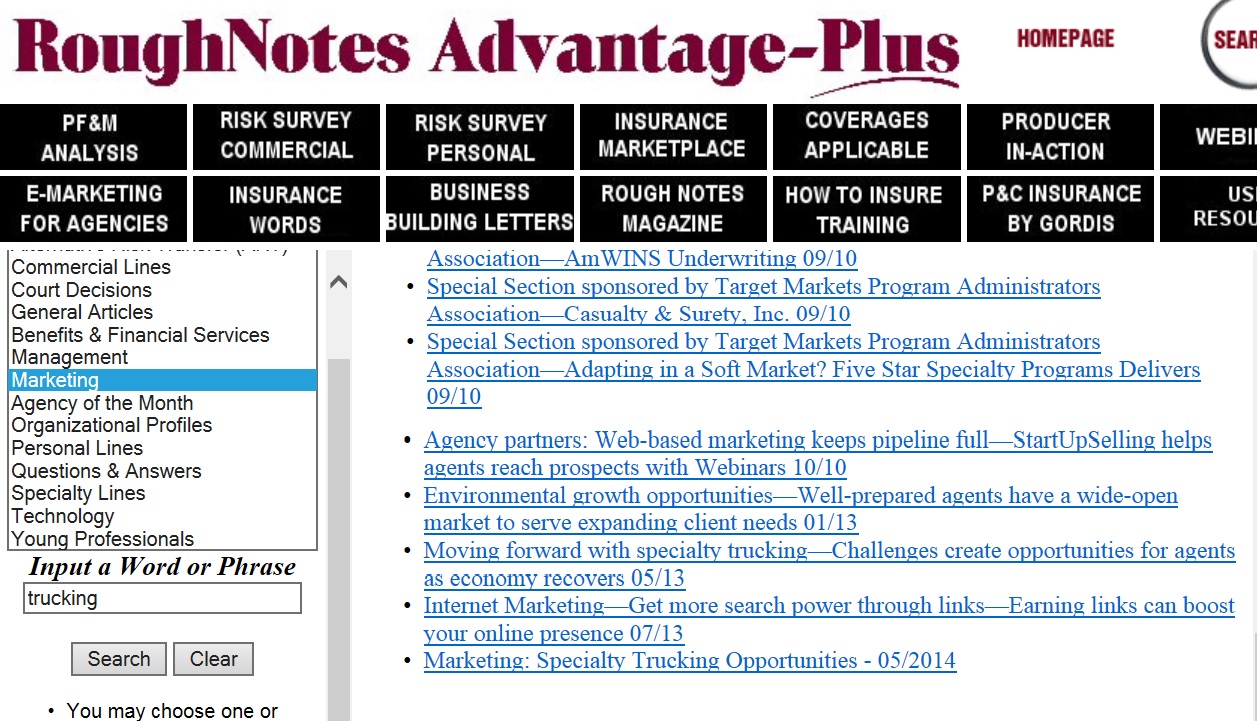

Advantage Plus touches upon various insurance issues in a variety of ways that may be easy to overlook. A goal of providing advice to others is often hampered by tunnel vision, so angles and perspectives may be missed. Here’s an idea: search for more information. Using our search feature could open you up to a more comprehensive approach in dealing with coverage issues.

Here is an example of how you might perform a search in different products that could provide ideas and solutions.